Some brands stand for quality and leadership, and in the tech world, Apple is one of those brands. A prominent figure in the crypto world made a bold statement. It’s normal for him to view the altcoin he co-founded as the Apple of crypto, but this view should be approached with caution. However, we can question why he thinks this way.

The Apple of Cryptocurrencies

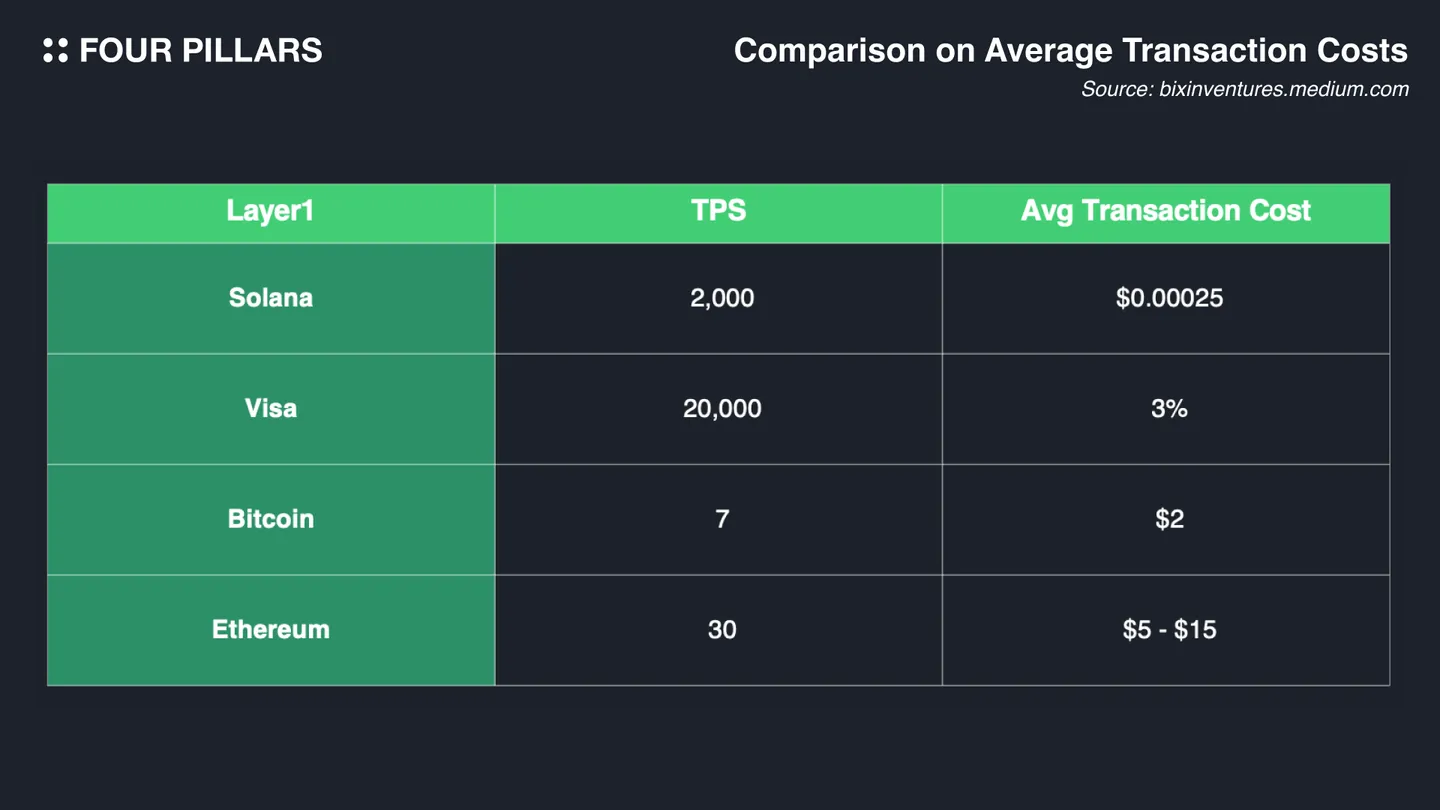

It’s a bold statement, but Solana co-founder Raj Gokal often refers to Solana’s vision as “the Apple of crypto.” According to researchers at Four Pillars, Solana could be one of the best crypto networks, fundamentally capable of parallel transactions with multi-threading.

This network, which is low-cost and fast (and unfortunately goes offline for a few hours each year), has quickly attracted developers in areas like DeFi and NFT. It has reached a large number of users, even seeing close to 800,000 daily users recently. Four Pillars’ assessment is as follows;

“Solana has the capacity to process thousands of transactions per second, and block times are recorded at 400-500 ms. This performance is significantly higher than current blockchains. Ultimately, Solana’s adoption of this technical approach aims to achieve two missions: a scalable platform that can handle high usage and interoperability between applications.”

Cathie Wood, CEO of Ark Invest, also had this to say about Solana;

“Solana is really doing a good job. If you look at Ethereum, it was faster and cheaper than Bitcoin at the time. Solana is faster and more cost-effective than Ethereum.”

Solana and Low-Cost Transactions

Technical issues on the network lead to hours-long outages. Even though it was claimed that this problem was completely eliminated before the last outage, the same thing happened again. This is a serious image loss for Solana because blockchains are not something that should experience a few hours of downtime each year.

On the other hand, being cheap and fast is turning a large part of the crypto community into potential customers for Solana. People don’t want to pay even a few cents for each transaction. Indeed, in Turkey, 1 cent equals 32 kuruş, and people can buy a loaf of bread for 0.25 cent. Considering that cryptocurrencies are of interest in less developed and developing countries, not just in terms of monetary value but also in terms of user numbers, it should be understandable that people do not want to spend the money they would use to buy bread on transaction fees.

All this shows that the transaction fees on the Solana network being imperceptible even for investors in weak economies is a significant advantage. This also reveals the potential for a lasting high user base in the future.

Türkçe

Türkçe Español

Español