After weeks of relentless climbing, Bitcoin (BTC) has fallen below the $61,000 level, undergoing the correction many analysts expected before the block reward halving. This correction led to significant losses in the cryptocurrency market, impacting altcoins like Solana (SOL), Dogecoin (DOGE), and Ripple (XRP), and resulting in over $250 billion being wiped from the market in just two days. Market sentiment shifted in the hours following the March 20th meeting of the US Federal Open Market Committee (FOMC), with cryptocurrencies beginning to rise again.

Focus Shifts to Post-Halving Expectations

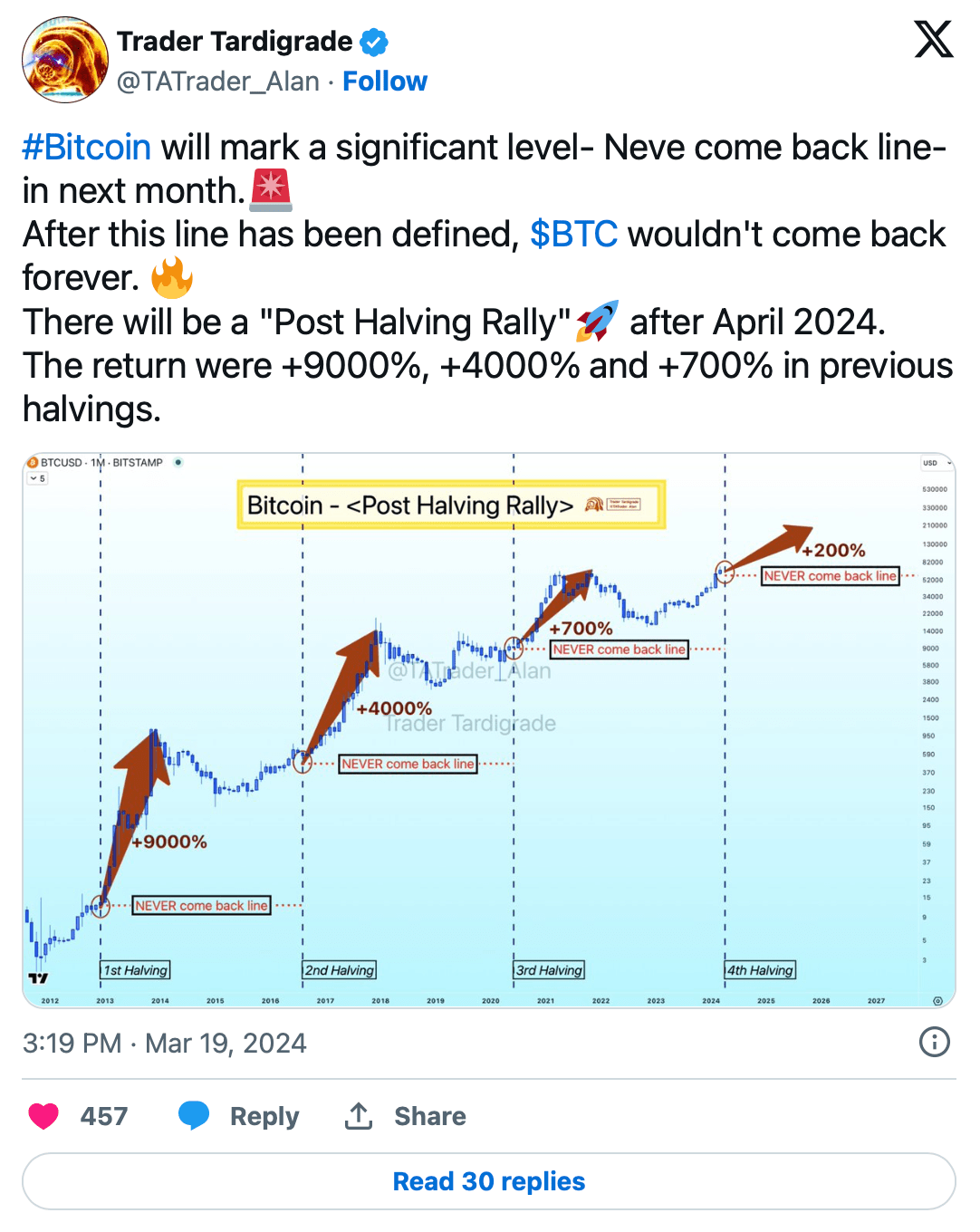

Analysts are now focusing on the potential returns after the 4th Bitcoin block reward halving, expected around April 21st, while some warn that the largest cryptocurrency might be entering the “Danger Zone,” a period typically characterized by deep pullbacks before a halving. Despite short-term fluctuations, analysts remain optimistic about a rally that could propel Bitcoin to new price peaks after the halving.

Technical analyst Trader Tardigrade highlighted historical instances of post-halving surges of 9,000%, 4,000%, and 700%. The analyst predicts a potential 200% increase in BTC’s price, theoretically reaching around $200,000 as the fourth block reward halving approaches.

Potential Peak Timeline Revealed

Even though Bitcoin and altcoins have recovered most of their recent losses, there is a cautious anticipation of further corrections in the crypto world. Some skeptics speculate that the bull run might be over, but analysts advise investors to remain calm during periods of volatility and correction.

Another analyst, CryptoCon, emphasized that Bitcoin’s current resistance level is at $69,000. Following the Relative Vigor Index (RVI) on the monthly timeframe, the analyst noted that surpassing a value of 0.21 historically indicates a cycle peak occurring approximately ten months later, potentially pointing to a peak this December.

Türkçe

Türkçe Español

Español