Bitcoin advocate Samson Mow, known for his million-dollar price prediction, commented on recent outflows from Bitcoin ETFs. Jan3 CEO Samson Mow alerted the crypto community about events he expects to reverse in the future.

Spot Bitcoin ETFs Face Major Outflows

Lately, there has been a noticeable increase in outflows from spot-based Bitcoin exchange-traded funds. This week alone, outflows amounted to an impressive $742 million. Experts believe these outflows are largely due to the SEC‘s recent approval of the conversion of GBTC to a spot ETF and the launch of ten new spot Bitcoin ETFs on January 11, which has been followed by consistent withdrawals from Grayscale Bitcoin Trust (GBTC).

One of the main reasons investors are exiting Grayscale is the company’s higher fees compared to ETF market competitors. It appears that investors are now turning to alternatives offering similar services at lower costs.

As for the largest Bitcoin ETF, BlackRock’s IBIT, which was once the market leader and saw an inflow of $1 billion in a single day, has seen its daily inflow drop to $49.3 million. This figure is the lowest in the last 18 trading days. These developments may indicate a shift in market balances and a change in investor preferences.

Samson Mow’s Warnings on Bitcoin and Ethereum ETFs

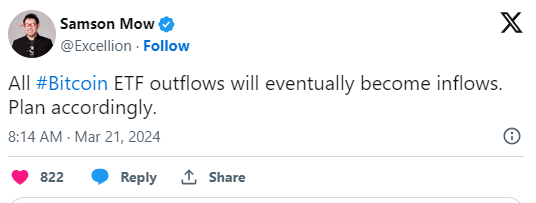

Samson Mow, a bold and influential voice in the crypto world, has issued important warnings about Bitcoin ETFs and the overall market situation. Maintaining his optimistic stance on Bitcoin’s future, Mow urged the Bitcoin community in his latest tweet to be cautious and plan accordingly.

One key point Mow emphasized was the uncertainty in the overall market sentiment for Bitcoin. In responses to multiple accounts, he expressed concerns that Bitcoin could fall in the short term. However, Mow highlighted Bitcoin’s true strength as “ultimate scarcity and unlimited demand,” suggesting sentiment is insignificant.

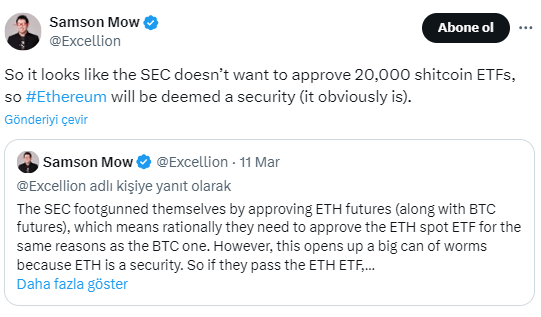

Mow also mentioned Ethereum‘s recent spotlight due to the potential approval of ETFs based on spot trading prices, stating his belief that Ethereum is a security and that the SEC will eventually accept this fact.

However, Mow’s concerns are not limited to Ethereum ETFs. According to him, the approval of an ETH ETF could be a significant mistake by the SEC, as it might pave the way for similar ETFs for other crypto assets like Solana and XRP.

Türkçe

Türkçe Español

Español