Bitcoin price has been anchored in the $65,000 region for a while, and the rally ended early due to weak ETF inflows. After BTC surpassed $68,000, we saw a pullback due to the weakness of the US stock markets and spot Bitcoin ETFs. This situation also caused the double-digit gains in altcoins to fade. What are the current predictions for BONK, SHIB, and LUNC Coin?

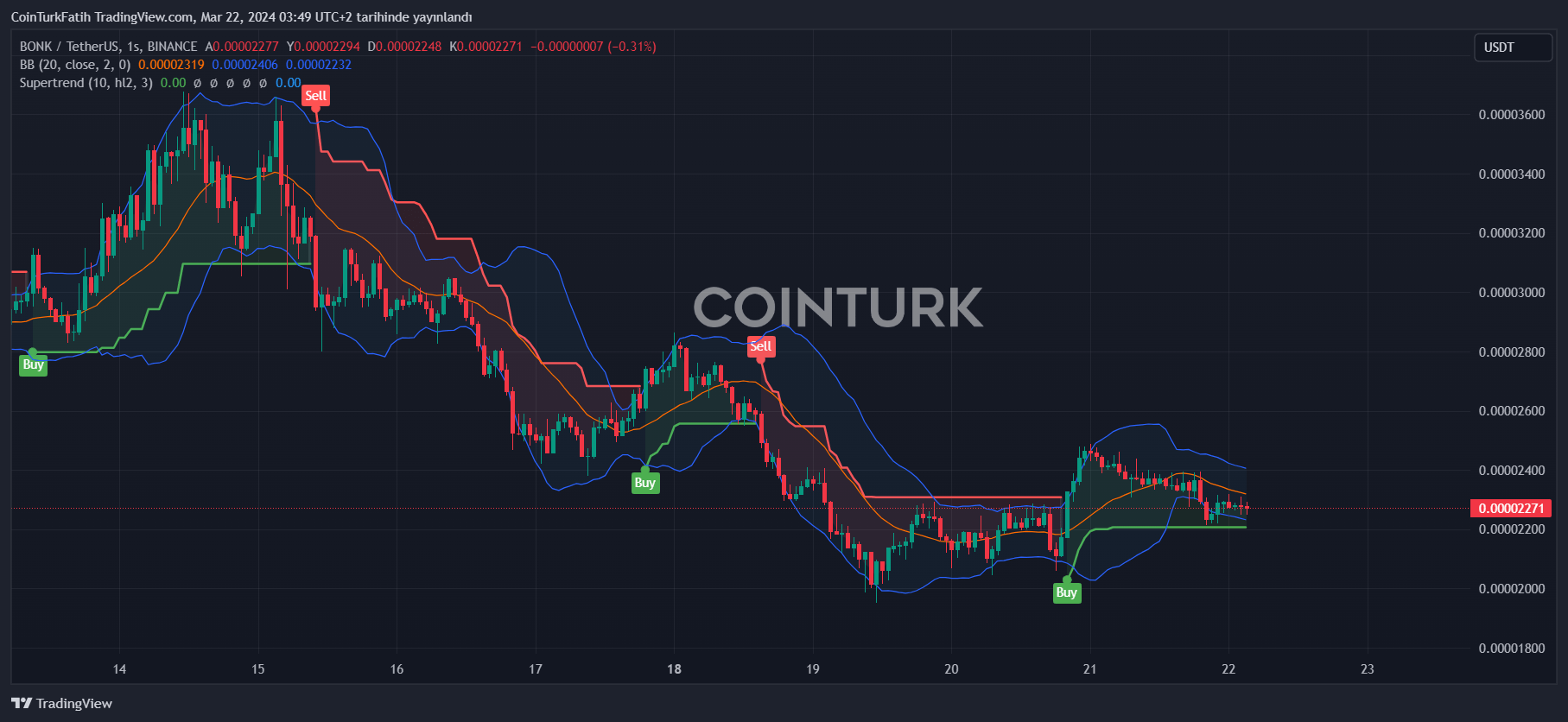

BONK Coin Commentary

Since the beginning of 2023, BONK Coin has been in the spotlight as the first major meme coin to shine in the Solana ecosystem. On its mission to reduce community losses, airdrops were conducted for many NFTs and protocols on the Solana network. Investors waiting for 2024 have made significant gains and have recouped some of their losses.

At the time of writing, BONK Coin’s price is finding buyers at $0.00002264. The price, which fell to $0.00001952 on March 19, is currently maintaining $0.0000220 as support. In the event of a renewed rise, the barrier of $0.0000249 must be overcome with closures above $0.0000239. Then, peaks of $0.0000286 and $0.0000365 can be targeted.

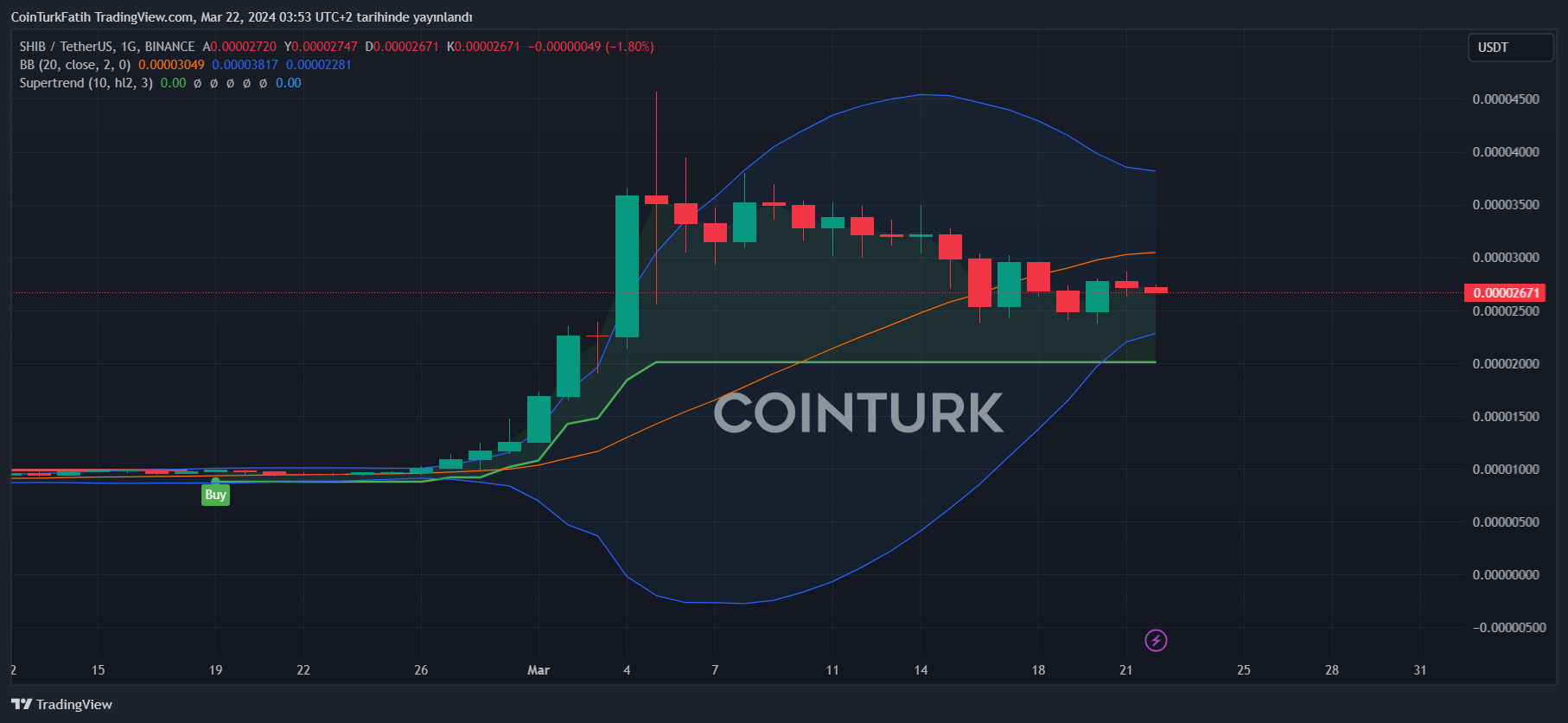

SHIB Price Prediction

Sales at the peak of $0.0000456 brought the SHIBA Coin price down to $0.0000236. Now, the price aims to surpass $0.0000288 while maintaining this bottom. If the BTC price returns to $68,000 and stays there, overcoming the $0.0000350 resistance could lead Shiba Coin’s price back to its peak.

However, closures below $0.0000199 would indicate that the uptrend has reversed, bringing targets of $0.00001261 and $0.00000995 into play. The “secret weapons, projects” announcement by the Shiba team did not have a significant impact on the price. Perhaps it’s time for the team to announce a new “big project, idea, partnership” after more than a year since Shibarium.

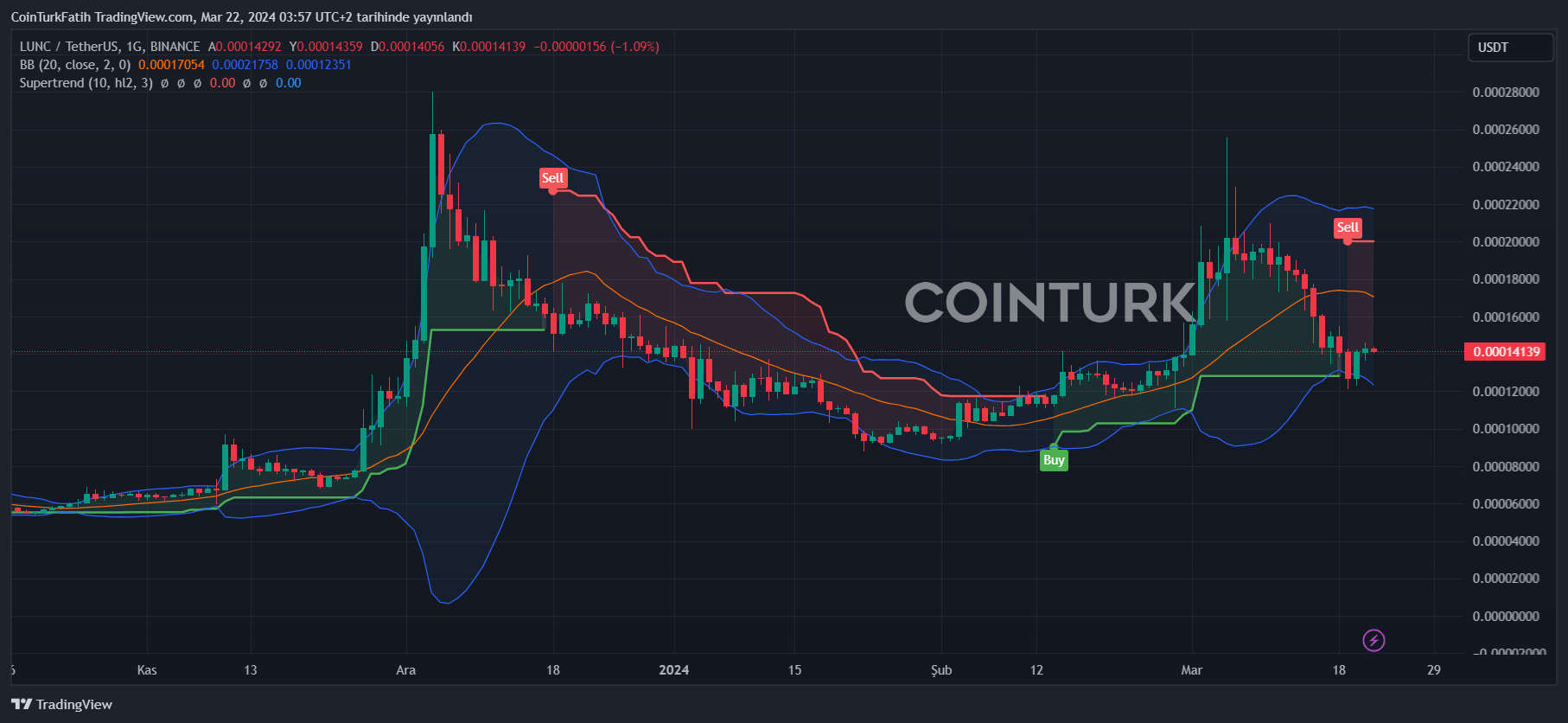

LUNC Coin Price Prediction

LUNC Coin price managed to recover from $0.000126. This presents a good opportunity to reverse the downtrend that has been ongoing since March 12. If LUNC is to start a speculative rise, with the support of BTC price, a target of $0.0001868 could be in sight.

In the case of an abnormal rise, sales may accelerate as the price approaches $0.000229. Conversely, closures below $0.0001291 could lead to a target of $0.0000875.

Türkçe

Türkçe Español

Español