Ripple has experienced a new development in its ongoing legal struggle with the United States Securities and Exchange Commission (SEC). Judge Analisa Torres has approved a joint request to seal confidential documents submitted by both parties. This request was granted on March 20, 2024.

Focus on Settlement Approaches in the Case

The court’s decision includes information related to proposed settlement approaches in the case. These details may encompass Ripple‘s financial statements and specifics following the SEC’s lawsuit against XRP sales in December 2020. Ripple and the SEC have defended the partial sealing of these documents to protect sensitive financial information.

Judge Torres’s decision allows for a revised schedule and redaction process for the settlement briefing. This will enable the disclosure of the core arguments from both sides to the public, barring commercially sensitive details.

Moreover, a decision has been made that necessitates a negotiation period to determine specific content to be redacted from public files among Ripple, the SEC, and potentially involved third parties.

New Deadlines and Potential Settlement

The revised schedule sets new deadlines for the submission of summaries and responses. The SEC will present its opening summary on March 22, followed by a negotiation period on redactions. The SEC is expected to release redacted versions of the summaries to the public on March 26, and Ripple on April 22.

The deadline for response summaries and motions to seal information is set for May 20. This extended timeframe allows for a thorough review of settlement arguments and the possibility of resolving the dispute. Legal experts anticipate that a settlement agreement between Ripple and the SEC could be reached before the case goes to trial.

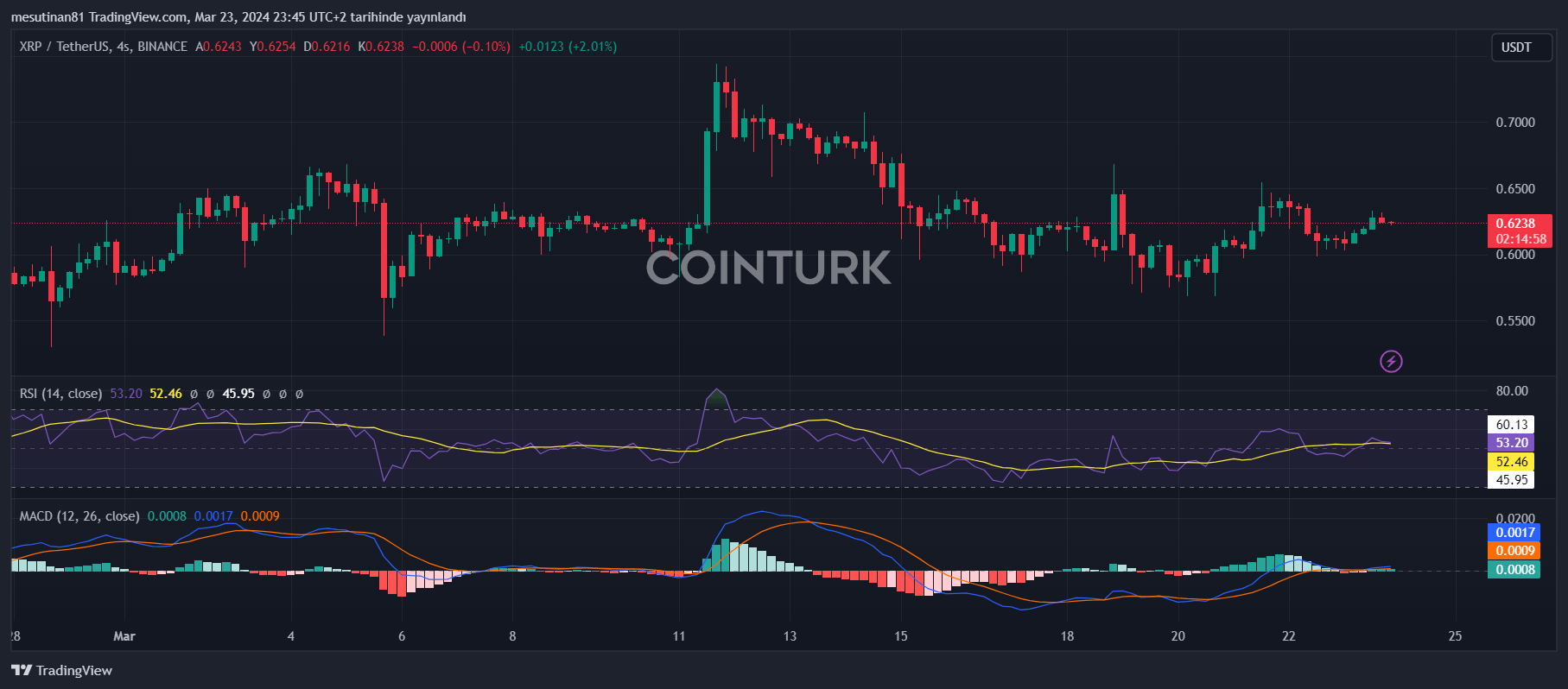

Impact on XRP Price and Timeline

The ongoing lawsuit has had a significant impact on the price of XRP. Recent news in the past 24 hours has led to a 4.43% increase in XRP’s value, with it currently trading at $0.62. However, the long-term outcomes remain uncertain. The SEC’s focus on XRP sales is emerging as a significant factor in determining the outcome for Ripple and potential penalties.

Judge Torres’s previous decision in July 2023, which stated that XRP is not a security under US laws, was considered a positive development for Ripple. However, the outcome of the case could still affect XRP’s price depending on the final decision. As the judge’s final decision is not expected until 2025, this could mean XRP remains less effective in a potential bull market.