Short-term Bitcoin (STH) holders have started to join the market following the development of the bull market. Experts suggest that these holders, driven by a desire for quick profits, do not keep their tokens for a long period. However, if the Bitcoin price corrects as it did in the past week, short-term holders could quickly lose ground. Nevertheless, their behaviors and tokens are very important for the sustainability of a healthy bull market.

Behavior of Short-Term Bitcoin Investors

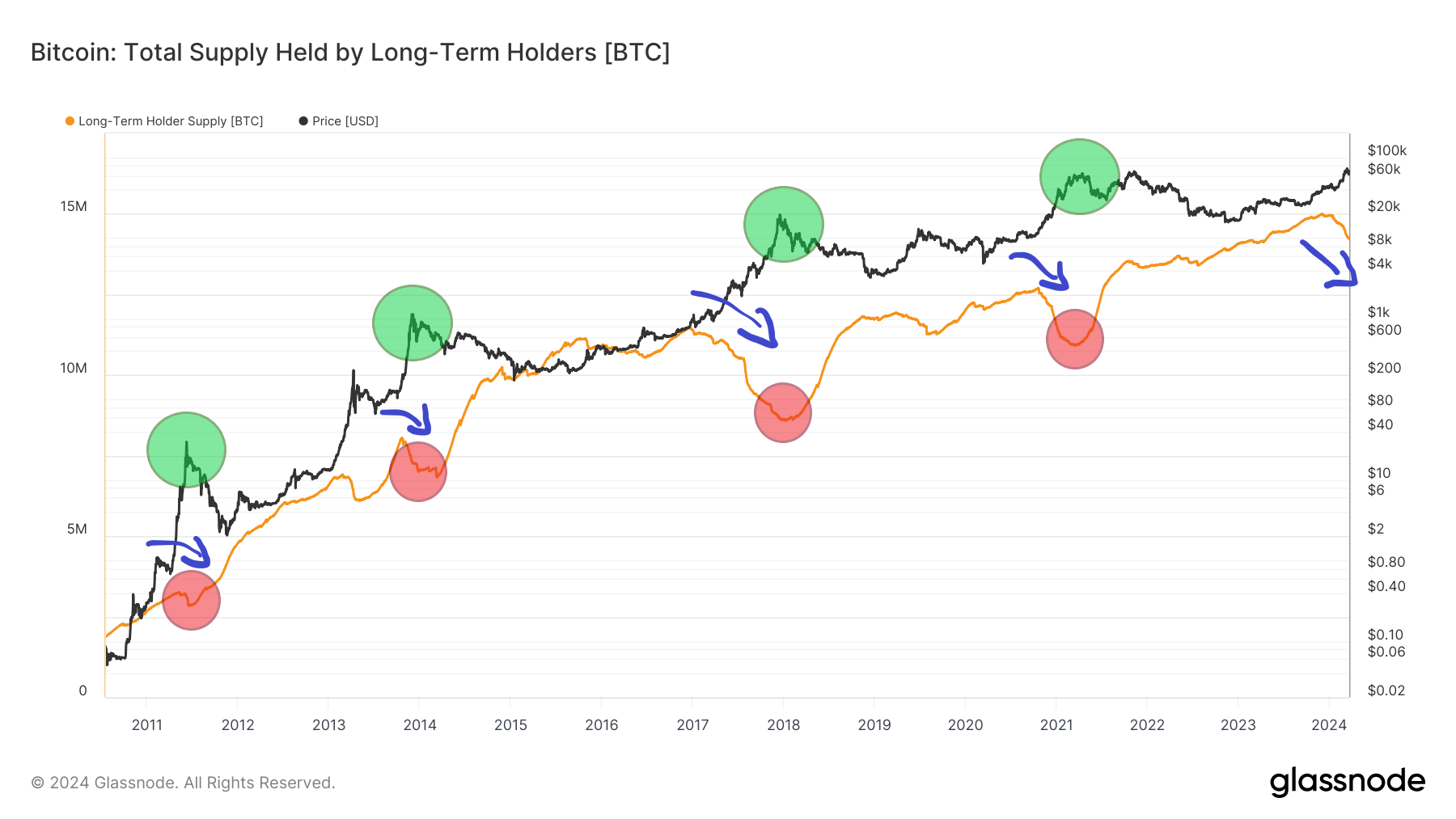

Observing the behavior of short-term Bitcoin holders is significant due to historical correlations with the BTC price. The STH category may include addresses that hold their BTC for less than 155 days. After surpassing this limit, addresses can transition to long-term hodlers (LTH). They tend to hold their tokens for the long term and are not inclined to sell based on emotion. The increase in the percentage of BTC supply held by STHs is inversely proportional to the percentage held by LTHs. The graph of the long-term supply held by LTH is also inversely proportional to the Bitcoin price. This can be particularly noticeable at the peak points of consecutive cycles.

Experts believe that the more Bitcoin is sold by long-term holders, the higher the BTC price will be. Therefore, the supply held by STHs is usually directly proportional to the BTC price. Experts continue to believe that the cryptocurrency will keep rising since it has already started to do so. This situation could fuel a growing community of new investors and analysts still eager to join the momentum of the bull market.

Expert Views on Bitcoin

Therefore, the importance of tracking what short-term holders are doing on-chain becomes evident. A recent report by the analyst firm CryptoQuant, highlighted that approximately 50% of Bitcoin’s realized capital is held by short-term holders. This indicator particularly shows a significant increase in the excitement and speed of STH purchases over the last 30 days. The analyst then suggests that if Bitcoin’s ongoing correction leads back to the STH price area, Bitcoin could reach the $55,000 area. Measured against the current all-time high of $73,777 (ATH), this could be an approximate 25% drop.

Türkçe

Türkçe Español

Español