Bitcoin’s decreasing issuance rate is leading investors to explore alternative options in other blockchain ecosystems. Bitcoin‘s halving periods, partly due to its deflationary nature, are prompting investors who traditionally see Bitcoin as a profitable investment to reassess the dynamics of risk and reward. As the rate of new Bitcoin mining decreases due to halving events, the increasing scarcity strengthens its appeal as digital gold.

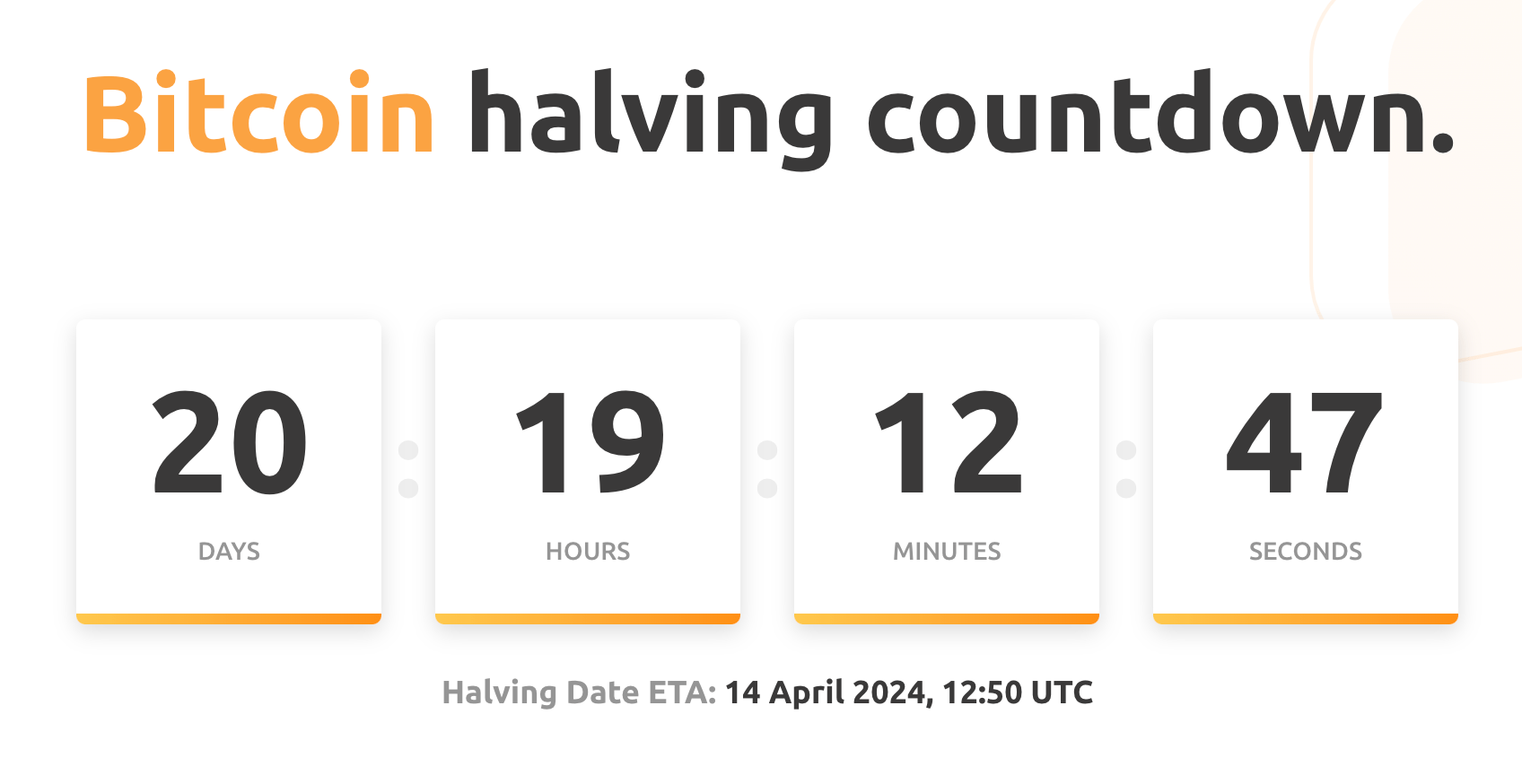

Bitcoin and the Halving Effect

The dynamics of investment in the cryptocurrency space are complex and multifaceted. Investors seeking portfolio diversification and risk reduction often explore alternative blockchain projects that offer different characteristics, benefits, or potential returns. This search for alternative options among investors necessitates the development of interoperability among various blockchain projects as they attempt to invest in and fluidly transfer value and assets between these platforms.

Interoperable multi-chain ecosystems are becoming increasingly important as they enable seamless transactions and interactions between different blockchain ecosystems, thereby expanding the scope for investment strategies and risk management. The interaction between Bitcoin’s issuance rate and investor behavior underscores a broader trend towards decentralization and creates an environment for the maturation of the cryptocurrency market.

The Halving Process and the Blockchain Space

Inter-chain interoperability solutions add significance to Bitcoin’s halving periods by improving market efficiency and capital allocation. These solutions are crucial in transforming the cryptocurrency environment by addressing fragmentation and increasing liquidity across blockchain ecosystems. The Bitcoin halving event process adds particular importance to the role these solutions play in enhancing market efficiency.

Inter-chain interoperability solutions can contribute to reducing arbitrage opportunities that arise due to price discrepancies between different blockchain ecosystems. As assets move seamlessly between interconnected networks, price differences for the same asset on different chains narrow, increasing market efficiency. This is particularly true during periods of high volatility, such as Bitcoin halving events, where price discrepancies can be more pronounced.

Bitcoin halving events contribute to increased market volatility and cryptocurrency trading activities as investors respond to changing supply dynamics. During such periods, efficient capital allocation becomes crucial to optimize returns and manage risks. Inter-chain interoperability solutions facilitate this process by enabling assets to move smoothly between various blockchain ecosystems.

Türkçe

Türkçe Español

Español