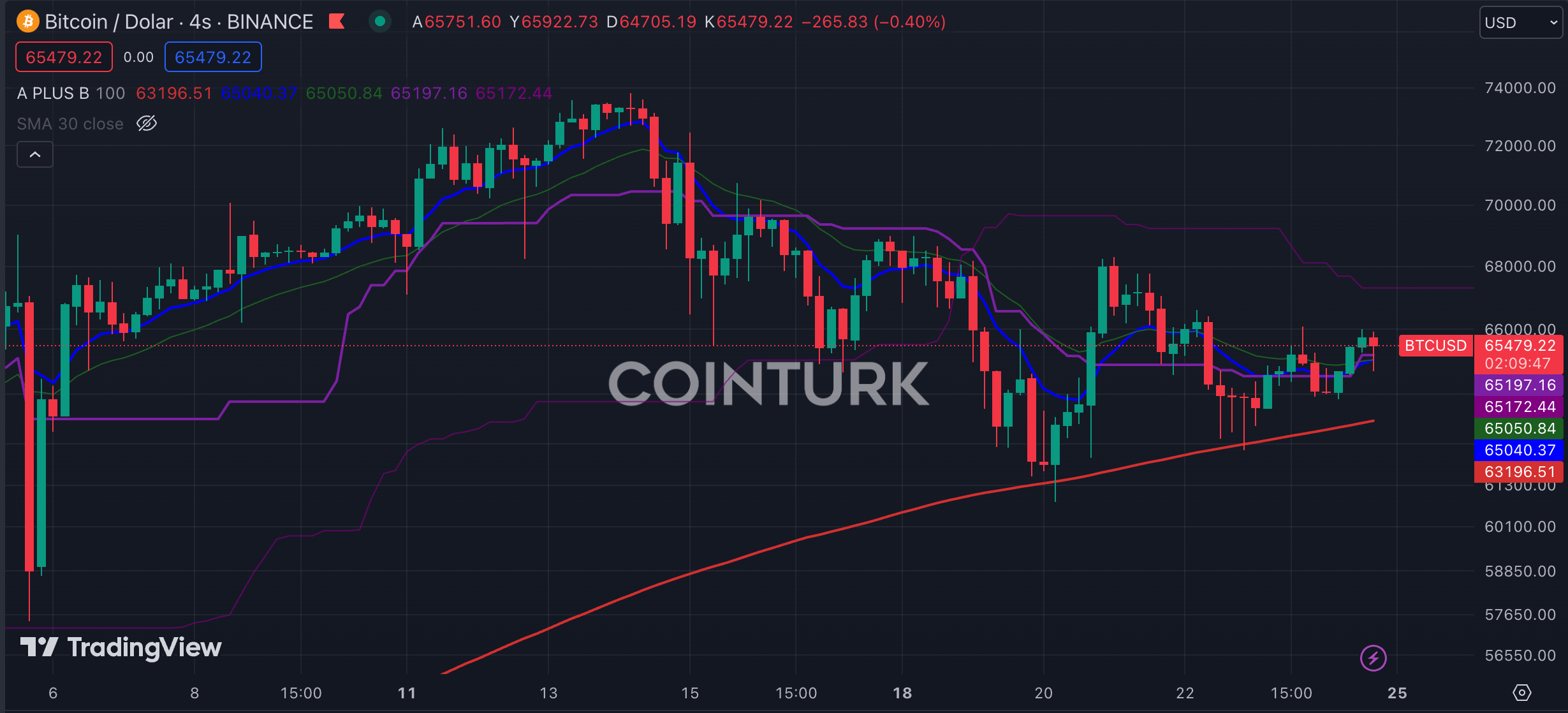

From a long-term perspective, as indicated by the low levels of new investment flows, Bitcoin has not yet touched the peak of its bull cycle. After Bitcoin reached its all-time high of $73,700, it entered a price correction phase. Miners, whales, and other large investors, including other market participants, began selling their Bitcoins to realize profits.

What’s Happening on the Bitcoin Front?

Blockchain data analysis platform CryptoQuant analysts believe that Bitcoin is far from the end of its bull cycle, based on price valuation data and the fact that it is far from the levels seen in past market peaks. The Bull-Bear Market Cycle Indicator pointed to an overheated bull phase last week when Bitcoin dropped from $73,700 to $60,700. The decline triggered asset sales by investors looking to realize high profit margins.

CryptoQuant has detected that unrealized profit margins have risen to 69%, the highest level since March 2021 when Bitcoin was trading around $60,000. Even though investors are selling their assets, unrealized profit margins are still at high levels of 47%.

Large Bitcoin holders also started to liquidate their assets when prices rose above $70,000. When the crypto asset reached its all-time high on March 12, 567,000 Bitcoins were moved, representing 35% of the total transfers on the Bitcoin network.

CryptoQuant stated that some of the large holders were Bitcoin miners. Miners achieved record high daily revenues due to Bitcoin’s recent rally, and there was a significant increase in Bitcoin transfers in the OTC market as the crypto asset exceeded $70,000.

Bitcoin and the Bull Cycle

Bitcoin’s demand in the United States decreased shortly after reaching $73,000, as evidenced by the negative turn of the Coinbase Premium index. Analysts suggest that if the correction continues, Bitcoin could fall to the cost basis of its large short-term holders, which is between $58,000 and $60,000.

Looking at a longer-term perspective, Bitcoin has not yet touched the peak of this bull cycle, as shown by the low levels of new investment flows. Currently, about 48% of Bitcoin investments come from short-term holders, while historically, bull cycles typically end with 84-92% of investments coming from this group of investors.

Türkçe

Türkçe Español

Español