Leading crypto analyst and strategist Kevin Svenson has claimed that Bitcoin (BTC) is nearing the end of its current correction. The analyst predicts another upward trend in the near future.

Anticipates a Short-Term Rally Exceeding $76,000

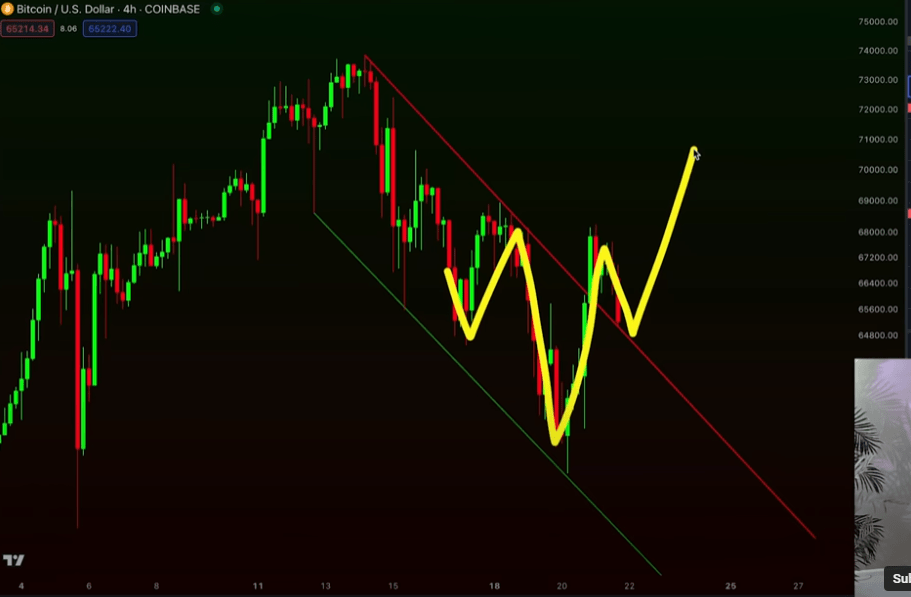

In his latest video analysis shared with his YouTube subscribers, Svenson pointed out a bullish formation on the four-hour chart for Bitcoin, signaling a change in momentum. According to the analyst, investors are currently tracking the potential formation of an “Inverse Head and Shoulders” (IHS) pattern, which is generally considered a significant signal for the reversal of a downtrend.

Svenson believes that Bitcoin’s price is preparing to form a higher low around $64,800, which could potentially indicate a reversal in momentum and a strong short-term bullish trend. This assessment coincides with expectations of increased demand and a shift in market sentiment. The successful retest of the falling resistance trend line as support further strengthens Svenson’s expectation of a rally exceeding $76,000 for Bitcoin.

In addition to the bullish outlook, Svenson also highlighted the Moving Average Convergence Divergence (MACD) indicator, which is showing signs of a bullish signal. With the return of positive momentum, the analyst added that Bitcoin’s recent daily close above the resistance trend line has reinforced the bullish sentiment in the market.

Predicts $90,000 Target

Previously, Svenson had predicted a parabolic rally for Bitcoin, anticipating a rise to as much as $90,000. The analyst also expected volatility to increase as Bitcoin approached this price target. Svenson’s expectations have garnered significant interest in the crypto world, with many investors eagerly awaiting developments in line with his predictions.

With the latest data, BTC has seen a 3.46% increase over the last 24 hours, trading at $66,852, and the data indicates a 4.93% decline over the past week. The positive price movement from last weekend is being fueled by technical indicators and analyst predictions, following a potential uptrend in optimism for the largest cryptocurrency.

Türkçe

Türkçe Español

Español