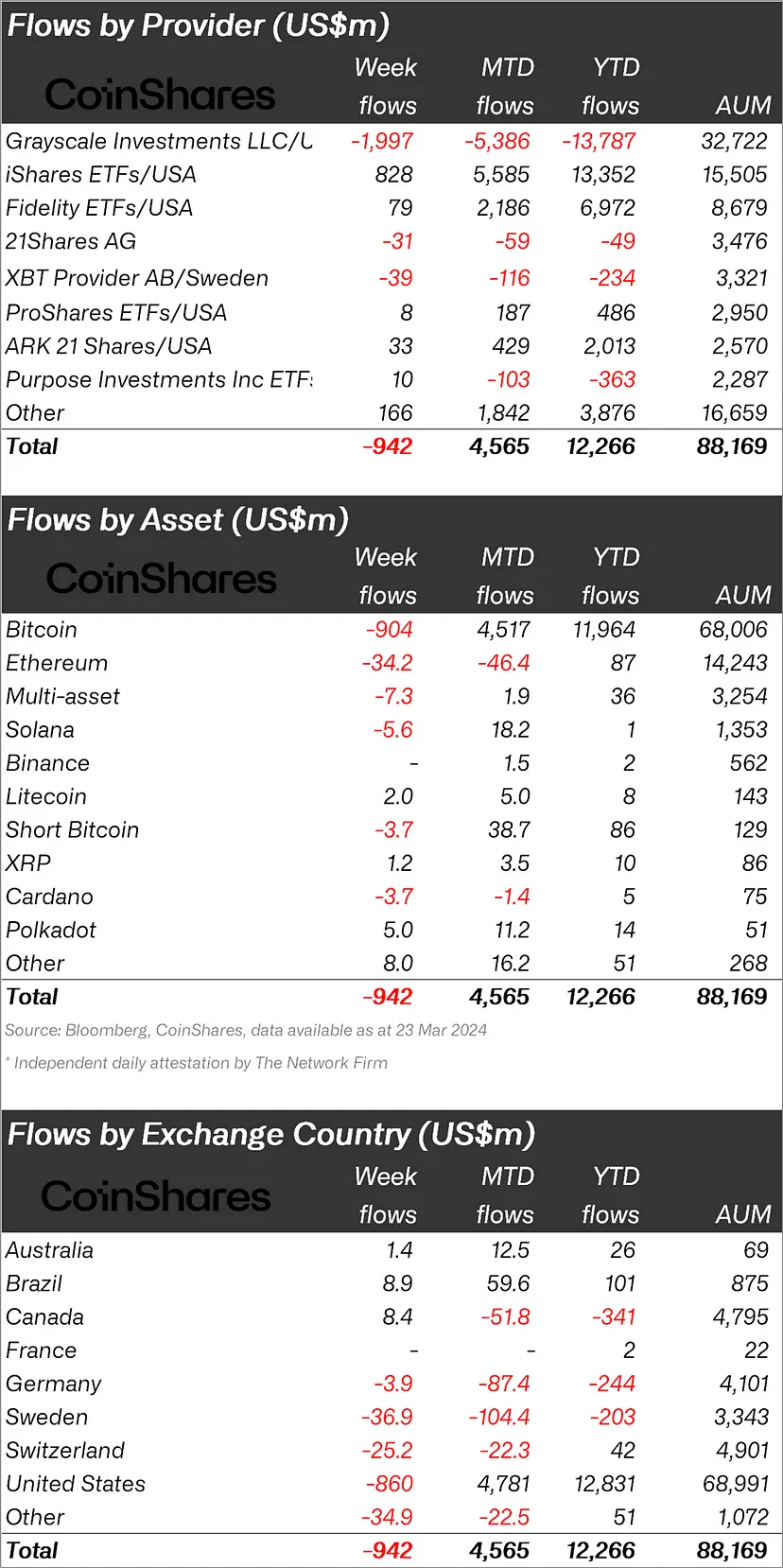

Crypto asset investment products, after a record seven-week inflow totaling $12.3 billion, experienced an outflow of $942 million last week. This outflow figure is also a record. New ETF issuers in the USA saw an inflow of $1.1 billion. However, this partially offset the significant $2 billion outflow from Grayscale last week. Let’s look at the details.

Altcoin-Focused Crypto Investment Products

The rest of the altcoin space performed well, witnessing a net inflow of $16 million. The products with the highest inflows in this area were Polkadot with $5 million, Avalanche (AVAX) with $2.9 million, and Litecoin with $2 million.

Trading volumes in ETPs, although high at $28 billion weekly, were about two-thirds of the previous week. The recent price correction wiped $10 billion from the total assets under management (AuM), but it remained above the previous cycle’s peak at $88 billion.

The outflows were not limited to the US. Sweden, Switzerland, Hong Kong, and Germany also saw outflows of $37 million, $25 million, $35 million, and $4 million, respectively. However, Brazil and Canada saw inflows of $9 million and $8.4 million, respectively.

Majority of Outflows in Bitcoin

Bitcoin constituted 96% of the outflows, with $904 million leaving the market, while short-focused Bitcoin products also saw small outflows totaling $3.7 million.

Ethereum, Solana, and Cardano also experienced outflows of $34 million, $5.6 million, and $3.7 million, respectively.

Türkçe

Türkçe Español

Español