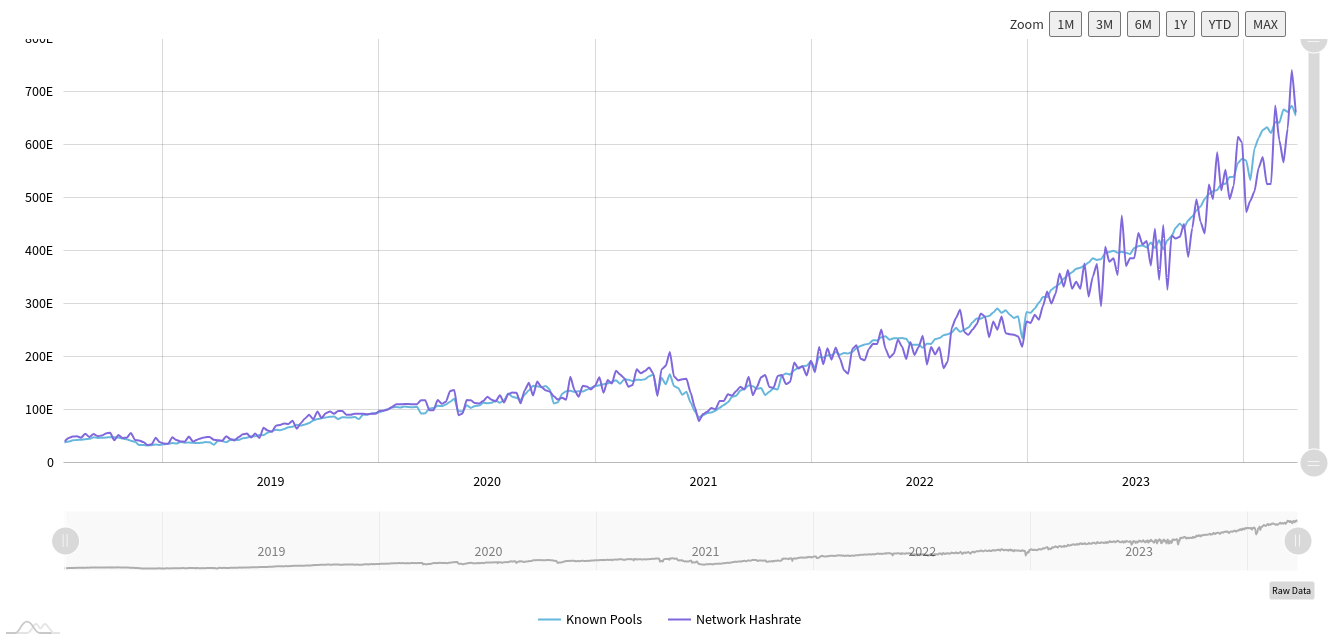

Despite the recent downward volatility in Bitcoin prices, the fundamentals of the Bitcoin network are preparing to continue their upward trend. According to the latest forecasts from data monitoring source BTC com, mining difficulty is holding steady in this week’s automatic readjustment. This keeps the difficulty around or near the all-time high level of 95 trillion, while the hash rate paints a similar picture.

Countdown to Halving Continues

Raw data from MiningPoolStats shows that a new record was broken on March 24th with 741 exahash (EH/s) per second. Miners continue to prepare for the block subsidy halving on April 20th, which will reduce the emission of newly mined Bitcoin by 50% to 3.125 Bitcoins per block.

However, investor Mike Alfred, who analyzes the halving effect, anticipates a massive restructuring as miners adapt to the new subsidy regime. Alfred used the following expressions last week:

“After the halving, we will see a significant correction in the global hashrate. There are many old pieces of equipment that want to make one last profit before heading to the dustbin of history. All the big public miners are getting new equipment. Super profits are coming very soon.”

Noteworthy Data for Bitcoin

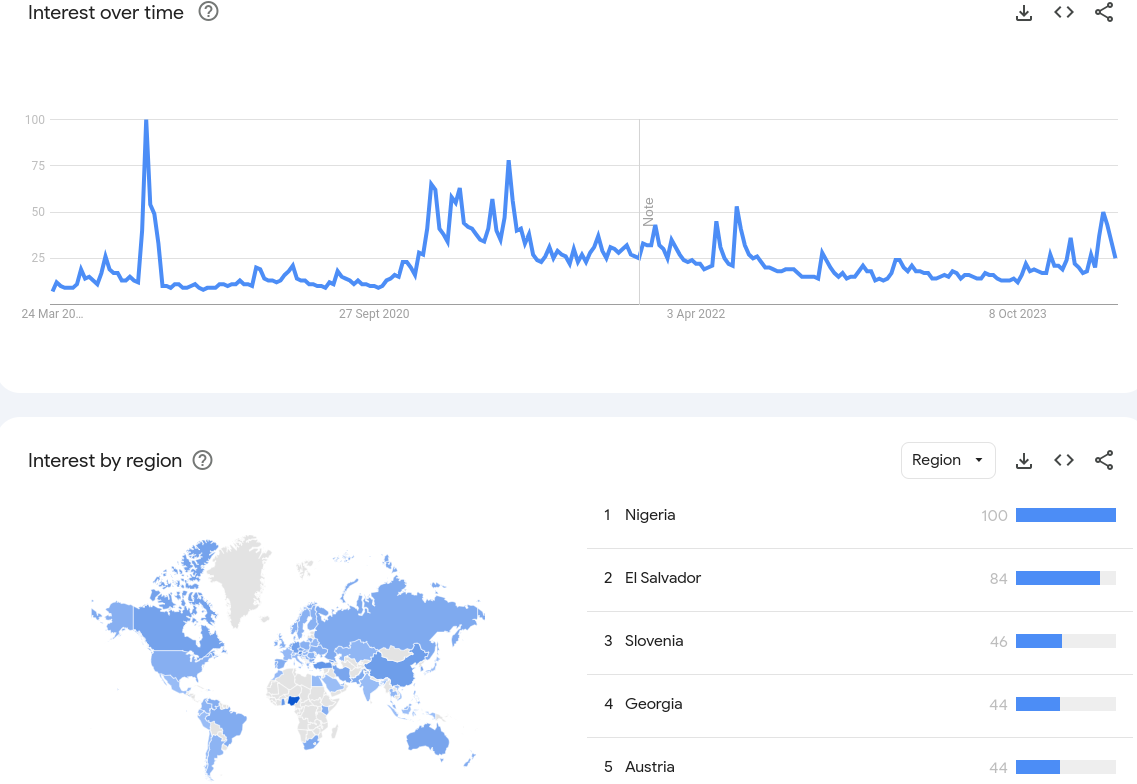

The overall sentiment in the crypto market may still be greedy, but mainstream interest seems to be waning already. The latest data from Google Trends shows that after a modest increase during the last journey to all-time high levels for the BTC/USD pair, the search intensity for Bitcoin has returned. The figures show that the average Google user is only reaching a fraction of the search volume at its highest level in 2021 with a shrug to Bitcoin’s return to form.

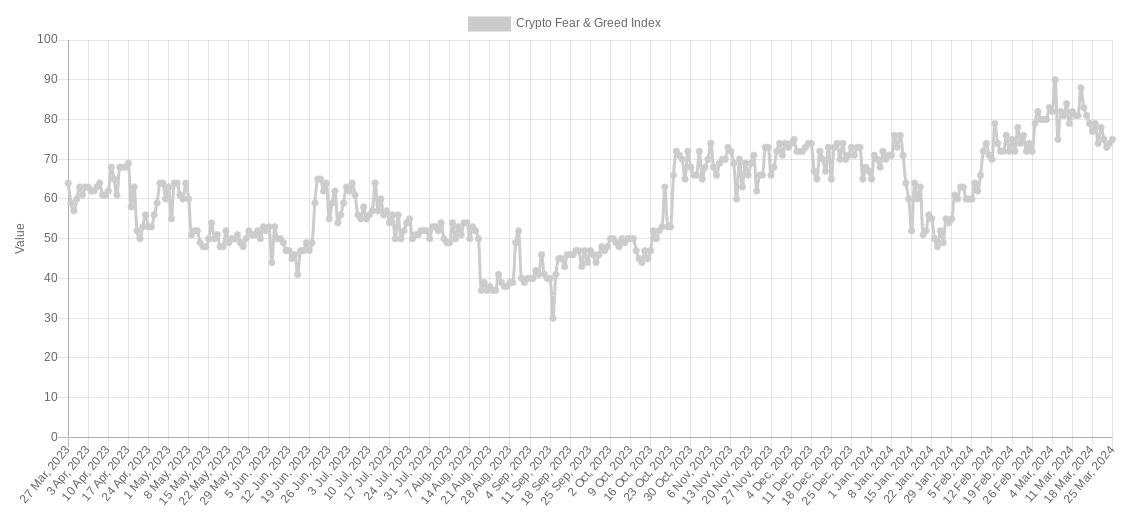

Meanwhile, the Crypto Fear and Greed Index is hovering just below the extreme greed zone at 75/100.

According to statistician Willy Woo, the creator of the data source Woobull, the strength of the Bitcoin bull market should no longer be underestimated. Last week, comparing Bitcoin to the S&P 500, Woo made a clear distinction between market behavior in TradFi and Bitcoin:

“In TradFi, bear markets are steep, people panic. In Bitcoin, bull markets are steep, people FOMO.”

Türkçe

Türkçe Español

Español