The cryptocurrency market kicked off the week on a positive note, showing a slight but optimistic trend. The total market cap of cryptocurrencies today increased by 3.5%, reaching $2.56 trillion. In the last 24 hours, there has also been a rise in the Total Value Locked (TVL) across the market. On the other hand, a notable 15% surge in the market’s overall trading volume was another significant indicator. While the trading volume of cryptocurrencies rose to $81.2 billion, DeFi volumes saw a 9% increase within the same period, reaching $8.05 billion.

Cryptocurrencies on the Rise

Bitcoin (BTC) has seemingly erased the losses of the past week with a close to 3% increase in the last 24 hours. The total decline over the past 7 days was only 0.04%.

Bitcoin‘s 24-hour trading volume today increased by 28%, surpassing $30 billion once again. Meanwhile, its market cap also saw a 3% increase, leaving the $1.3 trillion mark behind. Bitcoin has broken out of its recent stagnant phase and started trading at the $67,500 level.

Last week saw major developments on the Bitcoin front. Global macroeconomic factors and broader cryptocurrency market downturns led to a decrease in investor confidence, resulting in significant sell-offs.

Ethereum experienced a 2.38% increase, reducing the losses of the past week to 2.35%. During this period, its 30-day gain was also 13.79%. Last week, there were several developments related to both the Ethereum Foundation and the SEC’s demands.

During this period, the rise in BNB and Solana continued unabated, marking March with respective increases of 4.1% and 7%, indicating their role in leading the market’s recovery.

On the other hand, Dogecoin saw a 1% increase, while Shiba Inu experienced a slight daily decrease of 1.23%, highlighting the waning interest in meme coins.

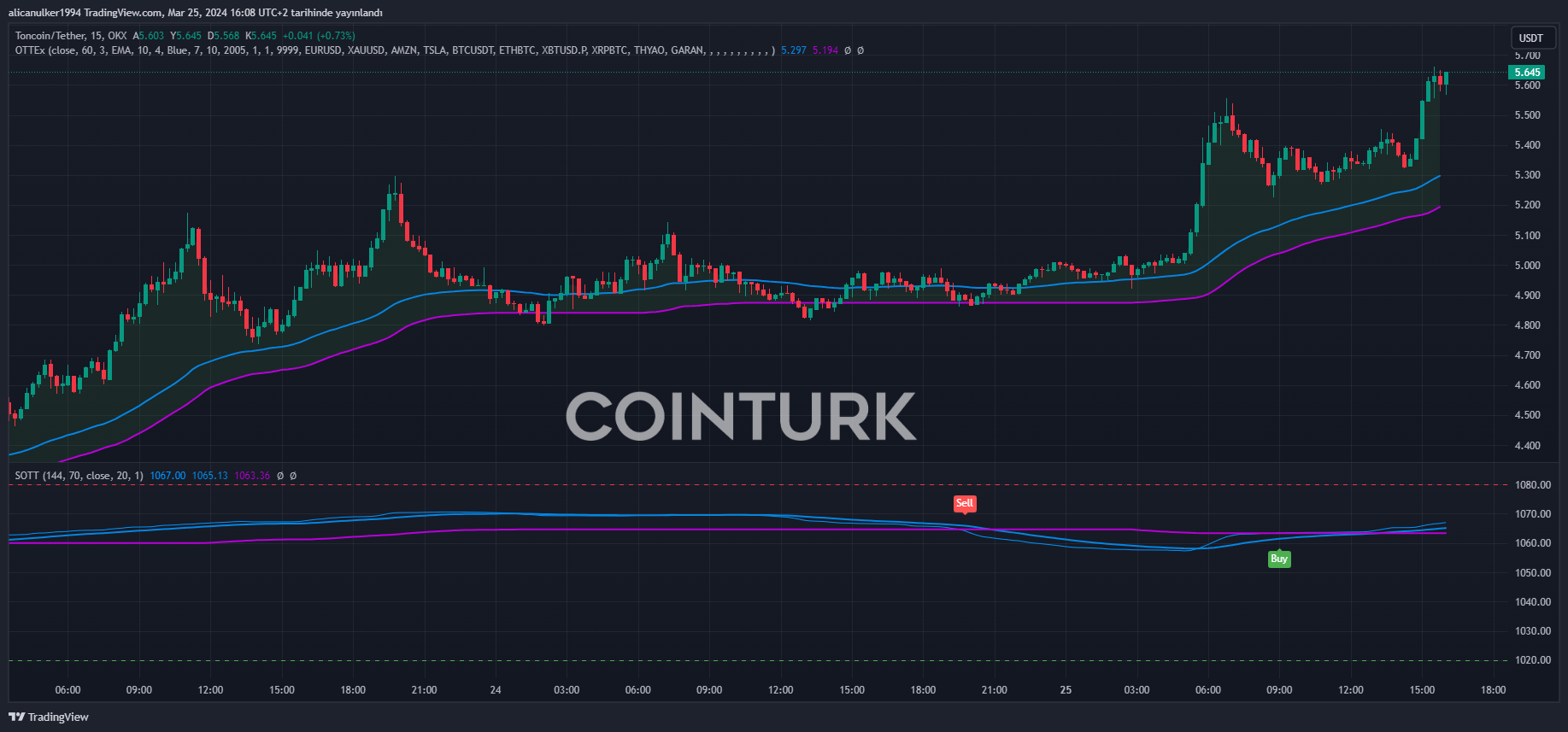

The most notable among the top 15 were AVAX and TON coins. AVAX is currently ranked 10th in market cap, while TON is at the 11th spot. Following a 165% increase in the last month, TON continues to attract investor attention and seems to be eyeing a spot in the top 10.

Current State of the Cryptocurrency Market

Analysts find a reason for the recent surge. The upcoming halving event is said to be one of the causes.

Before the halving, it was observed that miners and institutions were moving their Bitcoins and increasing their equipment to boost mining capacity. Experts also noted a recovery following last week’s correction.

The correction that led to the sell-offs seems to have slowed down when looking at the market outlook after the Federal Open Market Committee’s (FOMC) meeting. A steady decision on interest rates and hints of future cuts could turn the market favorable.

Türkçe

Türkçe Español

Español