Crypto currency markets had a good last 24 hours, with BTC gaining momentum at the opening of the US market. Investors in altcoins are beginning to erase their losses and are preparing for a peaceful sleep. So how do experts interpret the recent rise in Bitcoin prices? What are the current market predictions?

Bitcoin (BTC)

As this article was being prepared, the price of Bitcoin was at $70,470, experiencing a notable rise after opening at $67,212 on March 25th. The daily peak was set at $71,150. According to the latest report by CoinShares, a 7-week cycle has ended. The rapid increases seen last week disrupted the series.

After a total of $12.3 billion in inflows, we saw the first week of outflows. The cumulative value of crypto funds continues to hover above the previous cycle peak at $88 billion.

“We believe the recent price correction has caused hesitation among investors and led to significantly lower inflows for new ETF issuers in the US. The $1.1 billion in inflows significantly balanced out the $2 billion outflow from GBTC.”

The outflows triggered by the liquidation of bankruptcy assets should now be balanced this week, and net inflows need to resume.

James Seyffart

When it comes to spot Bitcoin ETFs, we should listen to James Seyffart, who has been working on this issue for a long time. According to him, the large outflows witnessed by spot Bitcoin ETFs last week were likely due to the bankrupt lending institution Genesis selling its GBTC shares.

When clear confirmations come in, we can expect a positive impact on the sentiment of crypto investors.

ChiefRat Crypto Commentary

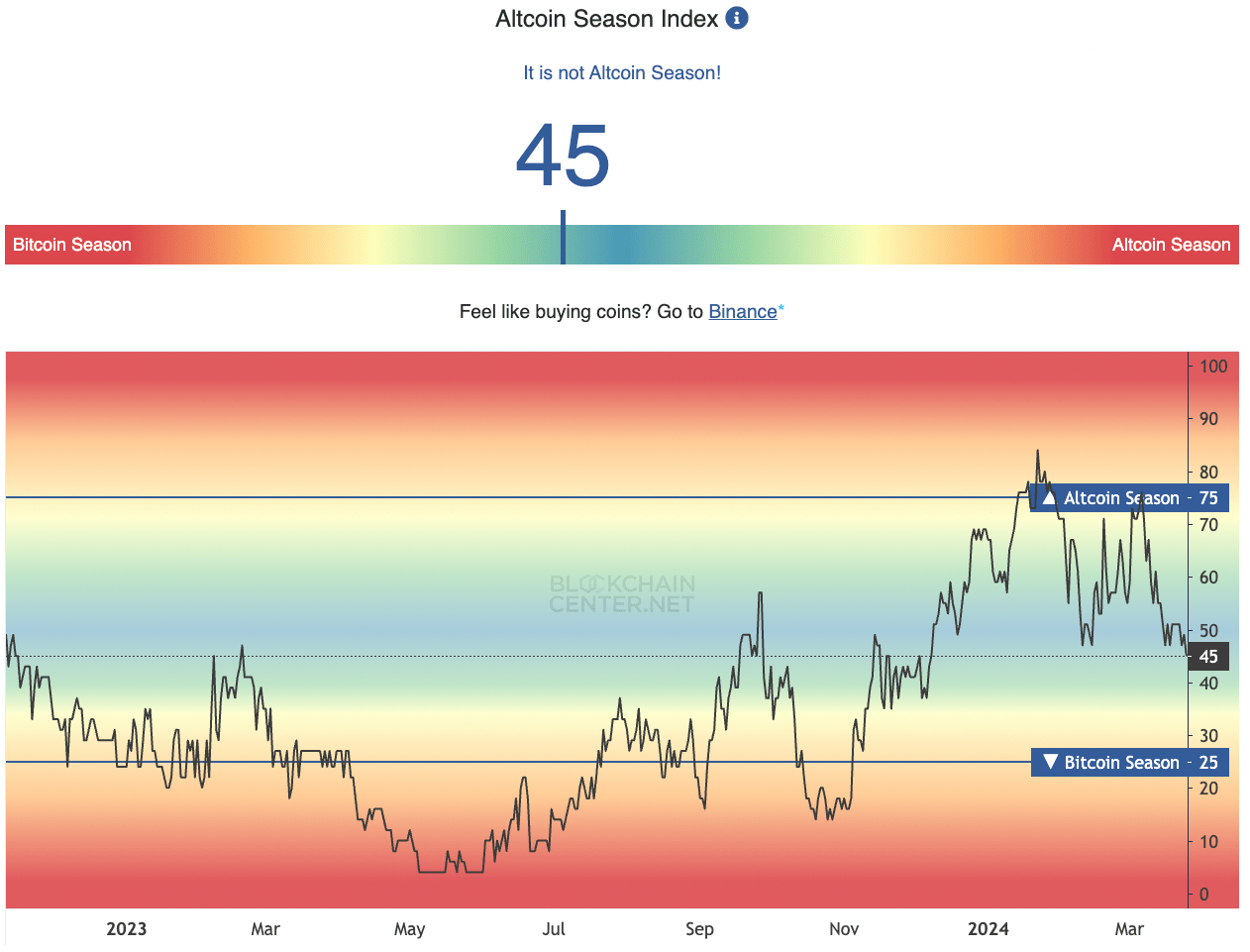

Crypto commentator ChiefRat issued important warnings for altcoin investors. Despite the demand for altcoins through ETFs, he says we might see a price correction this year even if the cumulative value hits new highs.

“For now, we are moving in the mid-range. Resistance at 1.25T, support at 960 billion dollars. Even though I expect a new ATH in 2024, testing of support is likely.”

Sheldon The Sniper Bitcoin Commentary

Popular crypto analyst Sheldon The Sniper thinks that Bitcoin’s dominance may start to weaken. According to him, as Bitcoin Market Dominance weakens, the foundations for the much-anticipated mega rally in altcoins will be laid. BTCD is still around 51.7%.

Türkçe

Türkçe Español

Español