Spot Ethereum ETF announcements for final decisions will begin in May, and the current sentiment is negative. According to comments from Bloomberg ETF experts, investors’ hope has diminished, which is clearly reflected in the price of Ether. However, Craig from Grayscale does not share this view.

Will Spot ETH ETFs Be Approved?

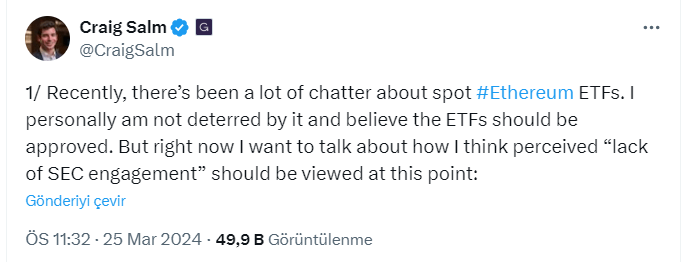

After the transition to PoS, SEC Chairman Gensler’s attitude towards the largest altcoin by market value changed. However, Grayscale Chief Legal Officer Craig Salm doesn’t quite agree. He wrote the following in an assessment published about 1.5 hours ago;

“Lately, there has been a lot of talk about spot Ethereum ETFs. I personally have not backed down on this issue and believe that ETFs should be approved. However, at this point, I want to discuss how the perceived “lack of SEC engagement” should be viewed.

In recent months on the path to Bitcoin ETF approval, Grayscale and others received positive and constructive interaction from the SEC. We had in-depth discussions and debated the finer details of creation/redemption procedures, cash and in-kind, APs, LPs, custody, etc.

All these issues have been resolved and are the same when comparing spot Bitcoin with Ethereum ETFs. The only difference is that the ETF holds Ether instead of Bitcoin. Thus, in many ways, the SEC has already been involved, and issuers have less to engage with this time around.

As we approach the final approval/rejection dates at the end of May 2024, I may feel differently, but at this point, I do not think the perceived lack of regulatory engagement should be an indicator of one outcome or another.

Also, I completely agree with others like iampaulgrewal and BrianQuintenz on why spot Ethereum ETFs should be approved: consistency with ETH futures ETFs, regulation of ETH futures as commodity futures (as opposed to securities futures), high correlation between futures and spot.

Investors want access to Ethereum in the form of a spot Ethereum ETF, and they deserve it, and Grayscale believes this case is as strong as for spot Bitcoin ETFs. We look forward to discussing these important products with the Commission.”

Ethereum ETF and Doubts

Craig believes that since most procedures for crypto ETFs have been overcome, this apparent lack of communication should not be a problem. However, the SEC has different question marks in the BTC and ETH ETF processes. The disadvantage for ETH is the risk of centralization in the staking structure, creating environments against investors.

BTC‘s process was much less complex. The SEC was cornered in that process because its strongest argument was the risk of fraud, and the previously approved futures ETF invalidated this defense. The same happened in the Grayscale case. But now the process for ETH is more complex.

Türkçe

Türkçe Español

Español