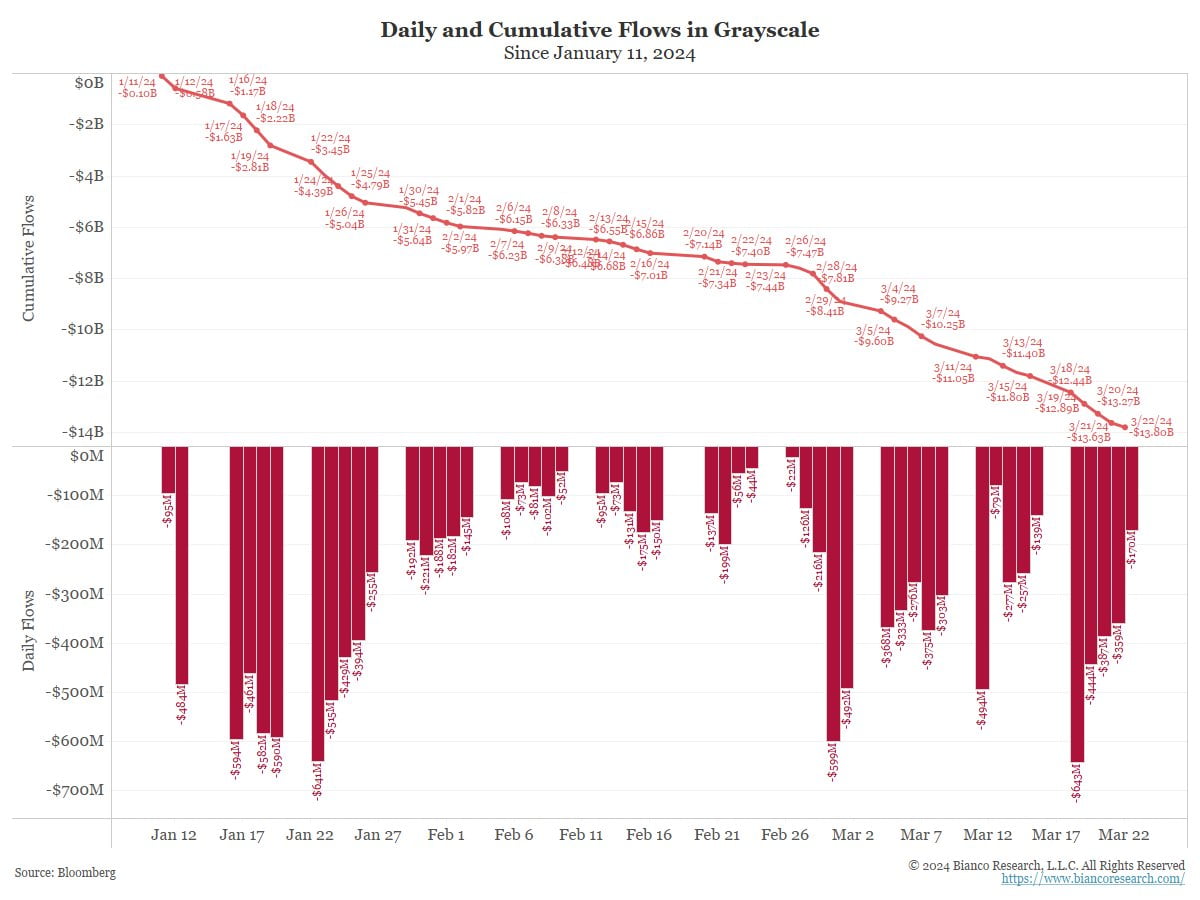

According to a market analyst, Grayscale may be maintaining high fees for its spot Bitcoin exchange-traded fund to prevent asset owners from withdrawing their money, while predicting that the price of Bitcoin will continue to rise. The Grayscale Bitcoin Trust (GBTC) has been experiencing daily outflows since its launch on January 11, and as of March 25, the outflows have totaled over $14 billion.

What’s Happening on the ETF Front?

Many, including Jim Bianco, founder of Bianco Research and former Wall Street analyst, have pointed to GBTC’s fees as an issue. In a March 25 post, Bianco estimated that at least half of the GBTC outflows were investors moving to lower-fee ETF funds. Grayscale’s ETF fund charges an annual management fee of 1.5%, which is five times the average 0.30% of other spot Bitcoin ETF funds.

Bianco suggested two possible reasons why Grayscale is not lowering its fee. The first is the belief that GBTC owners will not leave because the asset manager’s owners have analyzed the tax bill and concluded that exiting would be too costly until they need the money.

As of March 25, GBTC has approximately $24.7 billion in assets under management, according to YCharts data. Bianco also believes that Grayscale’s steadfastness on fees could stem from optimism that Bitcoin’s price will rise above $100,000 in the next year or two. Bianco shared the following statement:

“According to this scenario, Grayscale is predicting that the Bitcoin price will rise enough to offset most or all of its outflows.”

Responding to Bianco’s theory that there may never be any entries into the GBTC fund, Bloomberg ETF analyst Eric Balchunas said:

“My guess is that we will see a few more big days of outflows, followed by a slow trickle into infinity. If the Bitcoin price rises, they will be fine in terms of revenue.”

Insights from a Prominent Figure

Spot Bitcoin ETF funds in the United States emerged as a result of Grayscale’s victory last year in a lawsuit against the Securities and Exchange Commission, which forced the SEC to review Grayscale’s proposal to convert GBTC into an ETF fund. Bianco posed the following question:

“Why did GBTC spend all its time and effort suing the SEC to allow it to convert to an ETF fund and only manage it in this way?”

In response to this question, Balchunas speculated that Grayscale knows that even if GBTC bleeds out to the last investor, the ETF craze will raise Bitcoin enough to compensate for the losses and keep the assets under management stable. Balchunas added that Grayscale has long said it would convert GBTC, so it has to follow through, and it’s hard to kill 80% of your revenue stream in one go, which is why they haven’t lowered the fees.

Türkçe

Türkçe Español

Español