The native network of Binance, the leading cryptocurrency exchange by volume, BNB, has become one of the most popular protocols in the crypto space in terms of activity. Nevertheless, in the past few months, other protocols have been capturing Binance’s market share, especially due to increasing DEX (decentralized exchange) volumes on their own networks.

BNB and ETH Volume Race

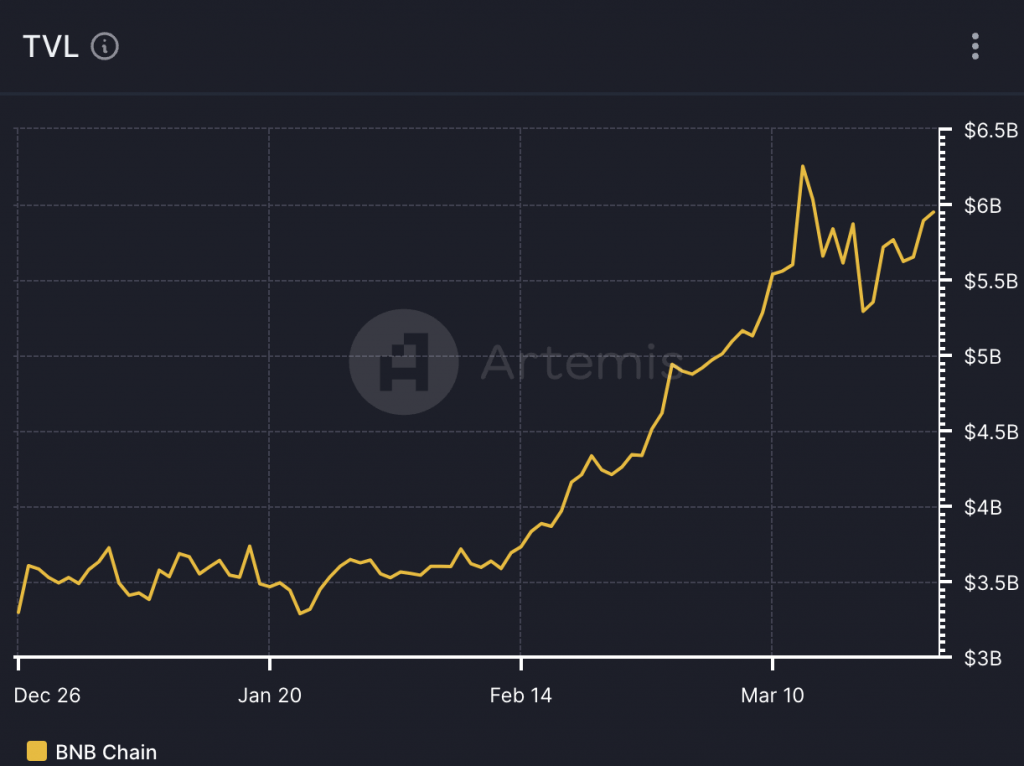

However, in the last few days, DEX volumes on the BNB network have shown a significant increase, enough to surpass the DEX volumes on Ethereum (ETH). The rise in DEX volume could also draw more users to the Binance Chain ecosystem. This situation could create a network effect, as the growing user base makes the network more valuable and attractive to additional users. Consequently, the Total Value Locked (TVL) on the BNB network could also increase.

According to analyses of Artemis’ data, the TVL of the BNB network has grown significantly in the last few weeks, reaching approximately 6 billion dollars at the time of writing. Moreover, BNB is generally the native token used for transactions on its network. Higher DEX volumes could mean more transaction activity, which in turn could increase the demand for BNB to pay for gas fees associated with these transactions. Furthermore, these developments could further increase the price of BNB.

Expectations for a New ATH in BNB!

At the time of writing, BNB is trading at $594.86, marking a 2.67% increase in the last 24 hours. The price of BNB has been fluctuating between $635.2 and $501.1 over the past few weeks. Having tested the resistance level of $635.2 several times in the past, the BNB price faced some corrections before once again heading towards a downward trend against resistance.

If BNB retests this level, there could be potential for BNB to break through and reach its ATH of $690.93. For BNB to reach this level, a price appreciation of 13.32% is required. However, the CMF was relatively neutral at 0.07. This could indicate that there is very little buying pressure for BNB at the moment.

Türkçe

Türkçe Español

Español