Bitcoin price continues to fluctuate with fresh data on ETF inflows, currently at $70,200. There was negativity on the GBTC front due to Genesis’s ETF asset sales. However, these outflows are being balanced, and we saw an outflow of around $200 million on March 26. Moreover, there are significant inflows in other ETFs. What are the predictions for INJ Coin?

INJ Coin Commentary

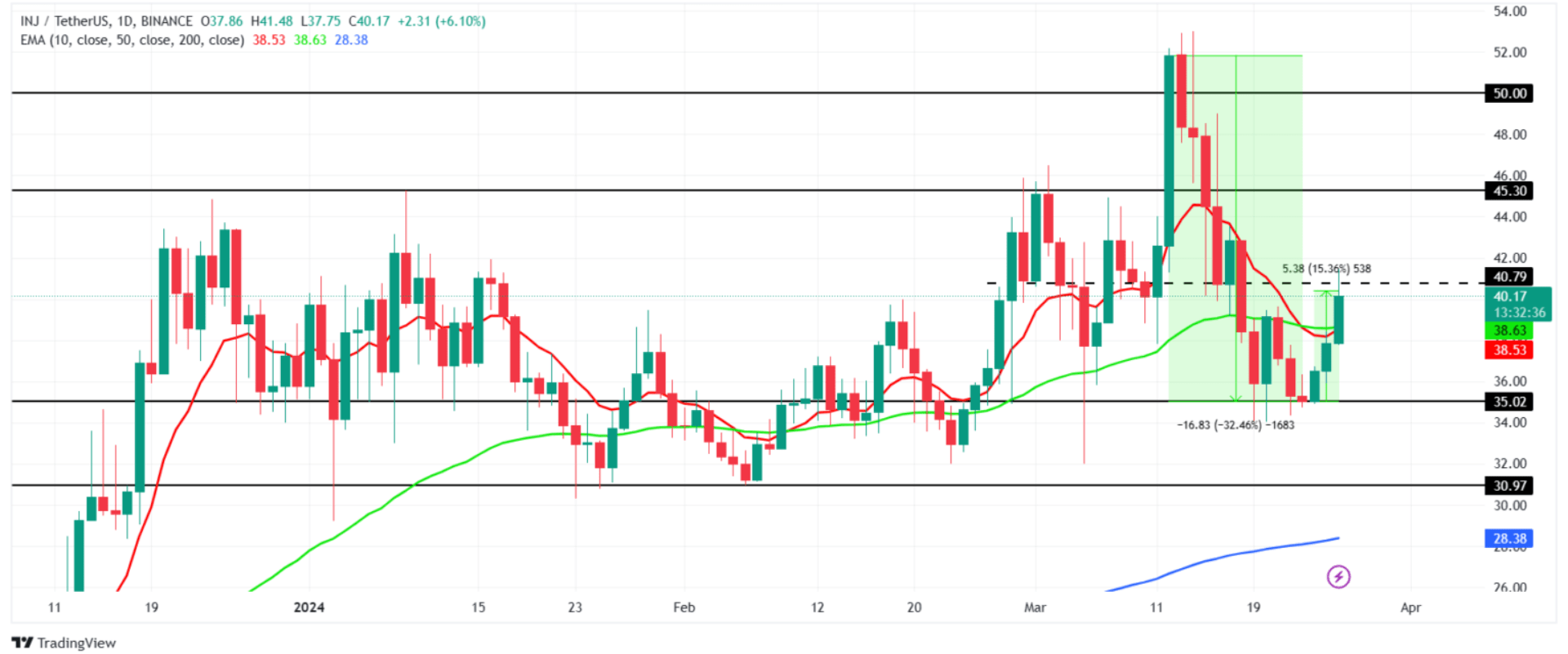

Injective (INJ) price was at $35 72 hours ago and has now approached the $40 mark again. Investors who were shocked by the mid-March double-digit drop have significantly healed their wounds. Furthermore, as the ETF channel continues to improve, Bitcoin‘s price is likely to aim for $73,777 again this week, and the revival in altcoins will continue.

If the KuCoin FUD does not escalate and no other company-threatening details emerge, the expectation for this week is that cryptocurrencies will remain in the green. Wallets that have been waiting profitably for INJ Coin also confirm the expectation of a further price increase.

Whales prefer to stay on the sidelines, which would confirm a strong price surge scenario if they decide to enter the game.

INJ Coin Price Prediction

Bitcoin‘s optimism, whales’ silence, and the recovery following the double-digit price correction all support the bullish expectation for INJ Coin, but first, the $41 resistance area must be overcome.

The price has been stuck in the $35-$45 range for a while. After such consolidations, volatility is expected to increase significantly. If the $41 resistance is breached, the next target will be $45. This could pave the way for a larger rally with the overcoming of the resistance between $50 and $51.85.

However, there is also a downside to consider. If the KuCoin FUD escalates or the clear inflow trend in the ETF channel does not continue, this will have negative consequences for cryptocurrencies in general. In this environment, closing above the $41 resistance will become more challenging, and a pullback to the $35 to $31 levels for INJ Coin can be expected. For now, as BTC stays above $70,000, investors prefer to focus on the positive side.

Türkçe

Türkçe Español

Español