The largest cryptocurrency Bitcoin (BTC), while consolidating above the $70,000 level, has investors trying to predict the next price movement amidst changing market dynamics and fluctuating ETF inflows. Recent on-chain data indicates an increase in demand and a decrease in sell-side liquidity, providing a positive signal.

Sell-Side Liquidity at Historic Low Levels

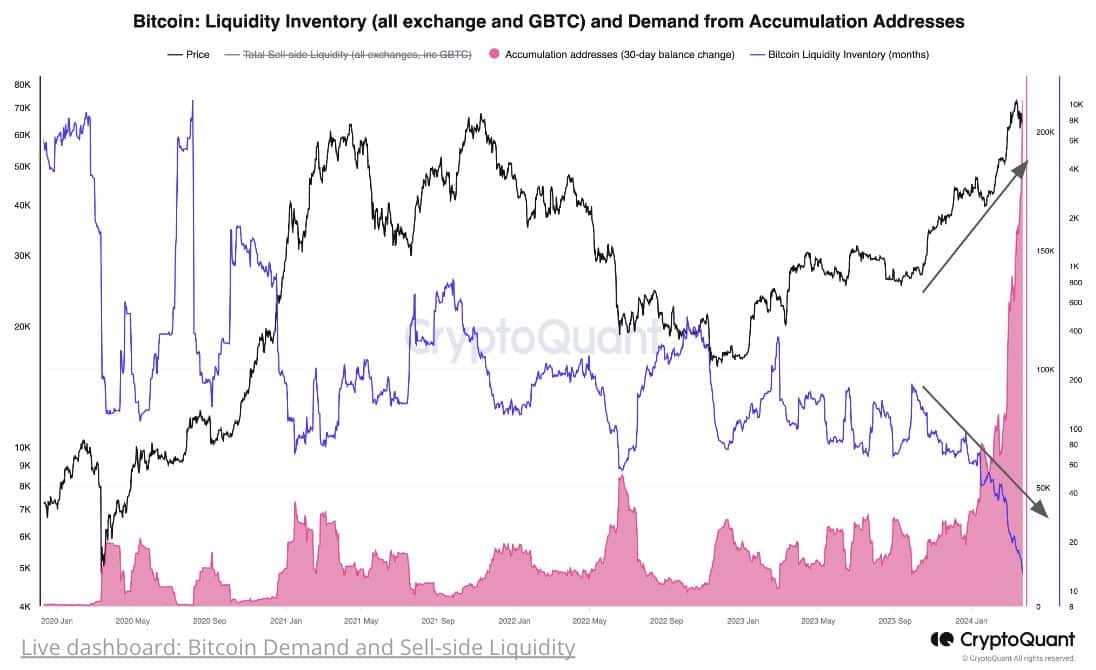

The latest findings from on-chain data provider CryptoQuant show a significant decrease in sell-side liquidity for Bitcoin, reaching historically low levels. This imbalance between increasing demand and decreasing supply has raised hopes for Bitcoin’s future price trajectory and market sentiment.

CryptoQuant’s analysis reveals that Bitcoin’s sell-side liquidity has reached unprecedented low levels, with projections indicating that it may only meet the increasing demand over the next 12 months. The current supply in wallet addresses focused on accumulation being so low underscores the intensity of the demand increase for BTC. Moreover, the imbalance between demand and supply could have profound effects on Bitcoin in the coming days, potentially triggering a strong rally.

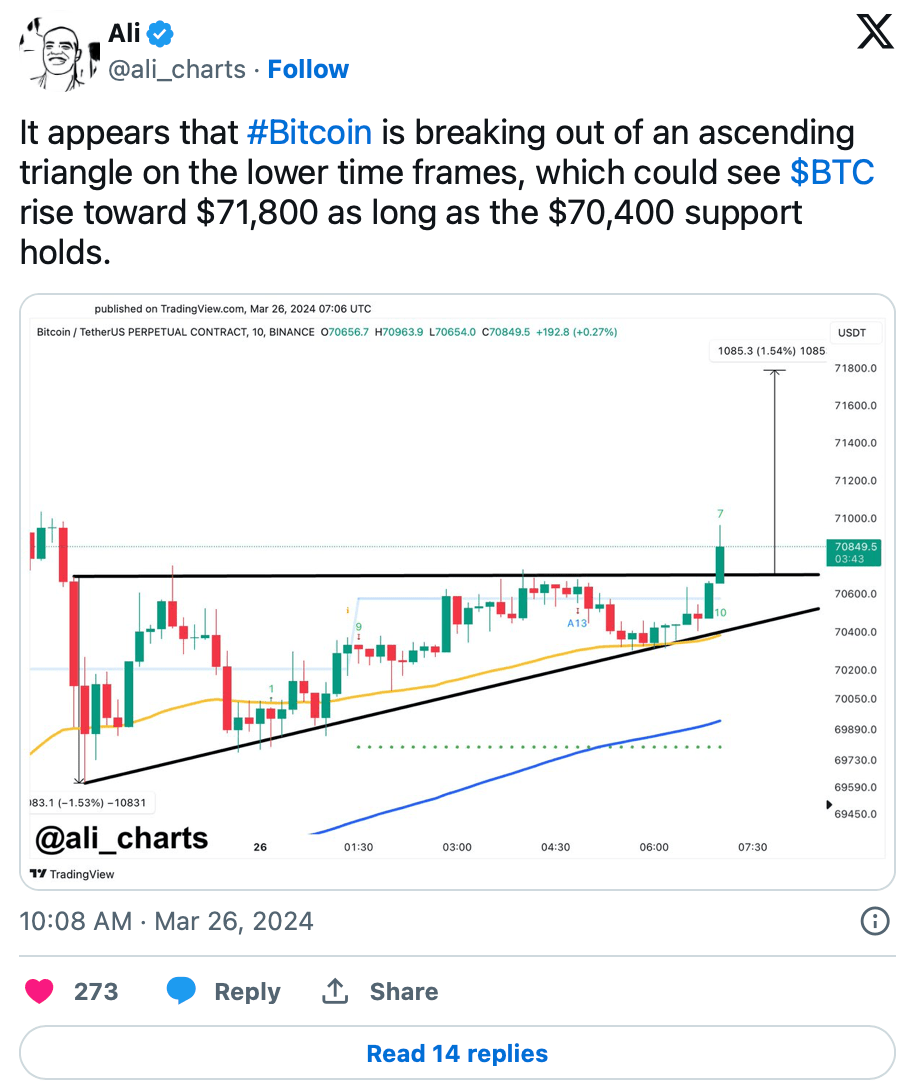

Furthermore, according to experienced cryptocurrency analyst Ali Martinez, Bitcoin appears to be breaking out of a bullish formation known as an ascending triangle pattern, and if it holds above the $70,400 level, it could rise to $71,800. This technical setup is supported by the general market expectation and suggests further upward potential for the largest cryptocurrency’s price.

Options Market Sounds Alarm for Ethereum

According to the latest market analysis by leading crypto firm QCP Capital, encouraging inflows into Bitcoin spot exchange-traded funds (ETFs) from institutions like Fidelity have contributed to the price rising above $70,000. The options market also reflects a bullish sentiment for Bitcoin, with significant demand for call options exceeding $100,000 strike prices and expiring in December.

In contrast, Ethereum (ETH) faces potential downside risks, as indicated by significant purchases of ETH put options with a strike price of around $2,800 and expiring in April. This shift in market dynamics has led to a decline in ETH reminiscent of previous market downturns.

Türkçe

Türkçe Español

Español