Chainlink (LINK) price has started to show signs of an uptrend. LINK has clearly separated from its previous stagnant period, surpassing two significant resistance levels at $13.08 and $16.86. LINK has now consolidated its position above these levels, indicating a profound shift in market sentiment as bears give way to bulls.

LINK Price Inspires Confidence

Since its strong performance in October, Chainlink has been on an upward trajectory, reflecting the broader market’s positive momentum. This resilience in LINK’s price movement has increased confidence among investors expecting further gains.

The altcoin is currently following an ascending parallel channel, a technical model that underscores its potential for further value gains. With newly established support levels at $13.08 and $16.86, previous challenging barriers have now become solid foundations for LINK’s continued rise.

Looking ahead, it is suggested that Chainlink’s price could rise by up to 45%, setting its next target at $28.71. This optimistic outlook is backed by the unwavering strength of buyers determined to support LINK’s upward trajectory.

Is a Bullish Trend on the Horizon for LINK?

Recently, the Chainlink price has retested a certain level and managed to stay above it. This could signify a shift from a resistance to a support level and may be a strong bullish signal for the altcoin. Our potential target is the $28.71 resistance level, last tested in January 2022.

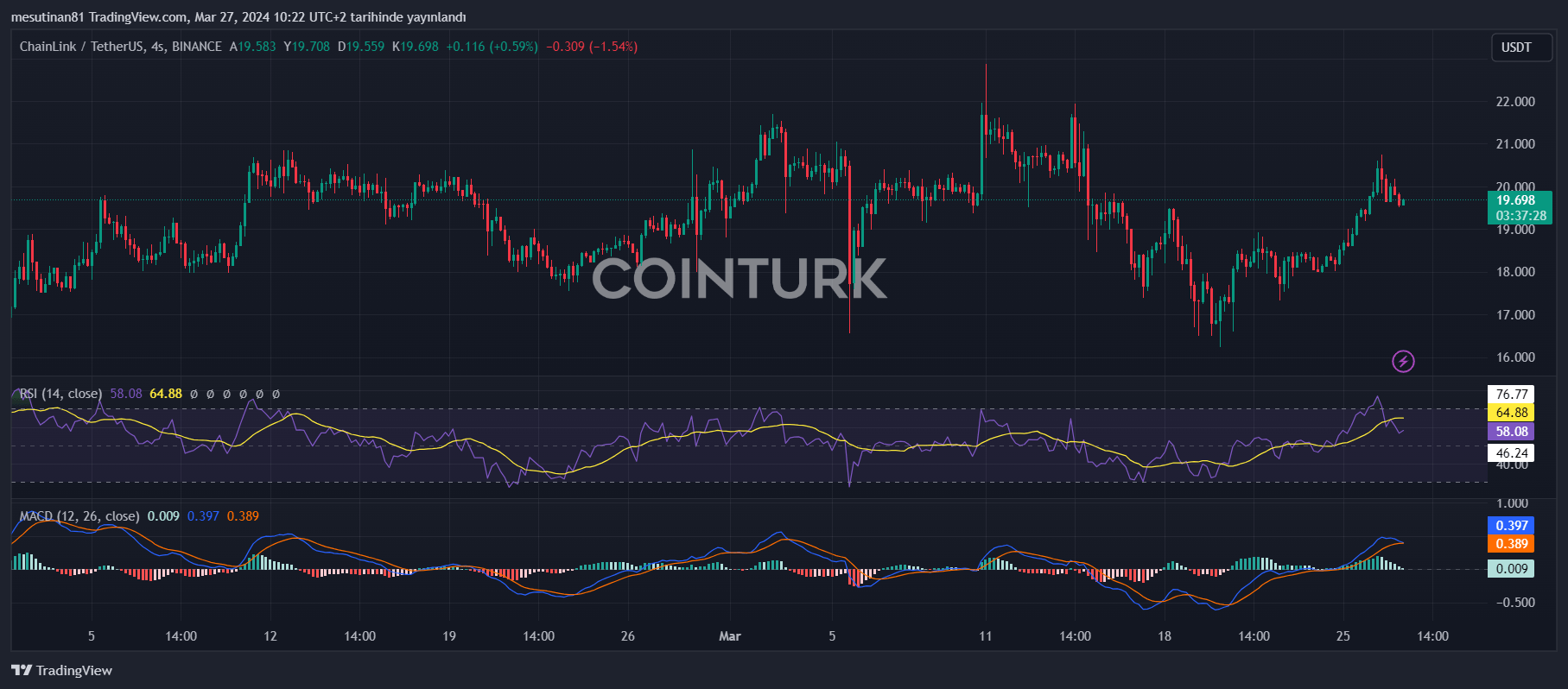

Technical indicators appear quite optimistic. The Relative Strength Index (RSI) is giving a pending buy signal and is trending upwards. Similarly, the Awesome Oscillator (AO) and Moving Average Convergence Divergence (MACD) metric are also in the positive zone, indicating strong bullish momentum in the market.

These momentum indicators being above the zero line can be interpreted as a strong signal for investors to enter long positions or maintain their current ones. However, as always, there are risks involved. If the price falls below the $18.32 support, it could mean that the price may enter a downtrend. In the worst-case scenario, LINK’s price could fall below $13.08, invalidating the upward expectations.

Türkçe

Türkçe Español

Español