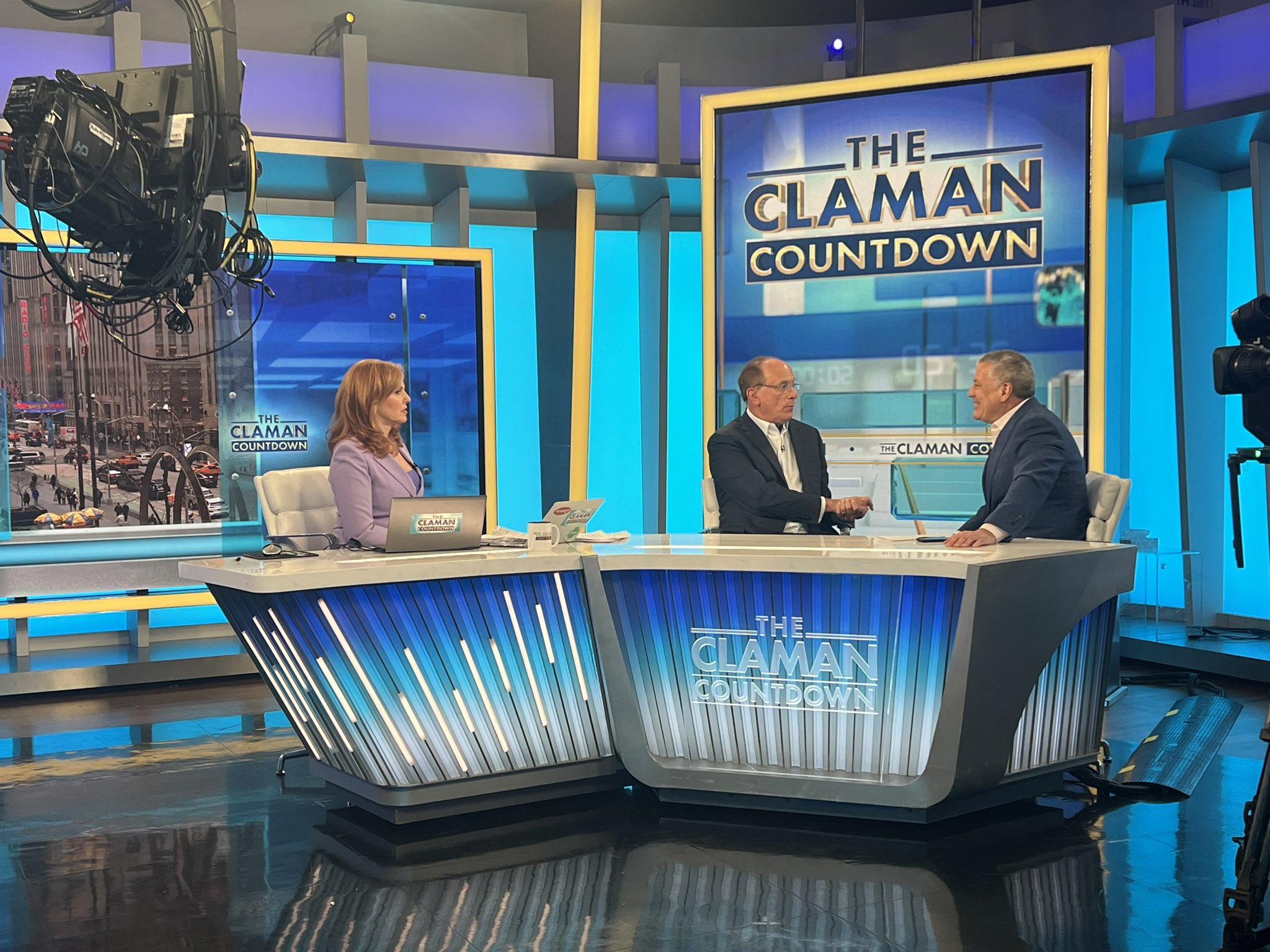

Bitcoin price volatility continues, with altcoins once again dipping into the red. News from Coinbase has shaken the market. However, we have seen that such types of FUD do not have significant consequences during bull markets. Meanwhile, as this article is being prepared, the CEO of the world’s largest asset management firm continues to answer questions on FOX.

BlackRock and Ethereum

The SEC is taking steps regarding the potential classification of Ether as a security due to its PoS transition. Despite the “commodity” definitions made by the CFTC and the Department of Justice, and even the approvals of Ether futures ETFs, the SEC is attempting a 180-degree turn. Could this pose a hurdle for the Ethereum ETF?

BlackRock CEO says no, this will not be an obstacle. The SEC will make its final decision on the BlackRock Spot Ethereum ETF in July, and the ongoing process seems to be laying the groundwork for a rejection. However, the BlackRock CEO stated that even if Ether were to be labeled as a security tomorrow, the company would not back down from launching an Ethereum ETF.

Bitcoin ETF has seen massive interest, even surprising CEO Fink, who said;

“You’re asking what we would do if the SEC classifies it as a security. I think that classification wouldn’t be too bad. We could still initiate an ETH ETF even if it were a security.”

Türkçe

Türkçe Español

Español