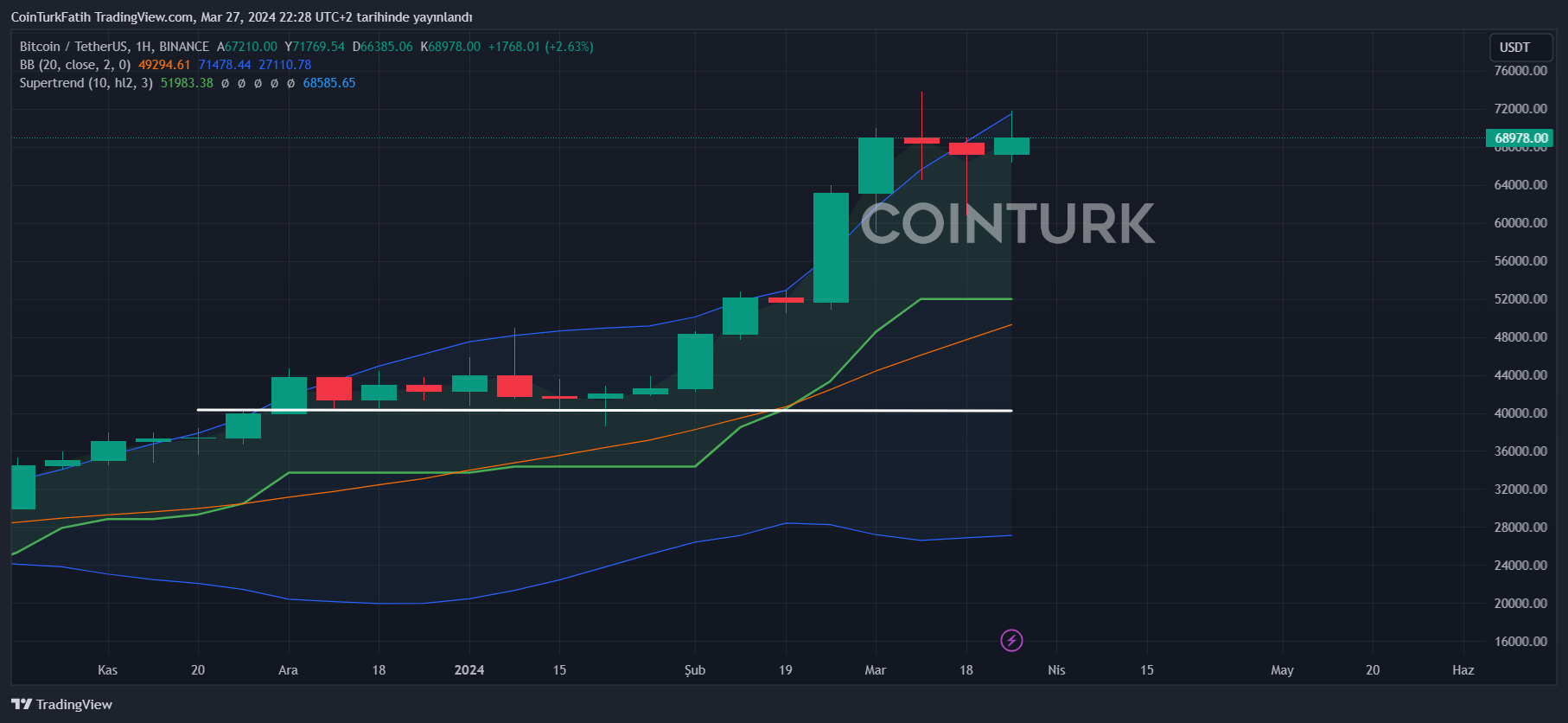

Bitcoin (BTC) is trading at $68,940 at the time of writing, after a sharp decline from its $71,769 peak. Investors had been optimistic about the continued rise in altcoins due to consistent closures above $69,000 for some time. So what happened today that cryptocurrencies fell despite net inflows into ETFs?

Bitcoin (BTC)

In the five days leading up to March 27, the Bitcoin price surged from $63,800 to over $71,000, causing the liquidation of $151 million in short positions. Although net inflows in ETFs resumed this week, developments in the Coinbase case have turned things upside down. The consideration of staking services as investment contracts could significantly restrain exchanges.

The provision of stake services to customers in the US region could be halted. This could have far-reaching consequences since the workings of altcoins like Ethereum are based on staking. Therefore, in the future, PoS altcoins could also face unregistered investment contract/security lawsuits.

The decision is not yet final, but it’s normal for the markets to decline due to a ruling that could support the SEC’s goal of labeling altcoins as securities. Moreover, this FUD could continue to pressure the market for some time. An important development that could counterbalance this negativity was the letter sent to the SEC by US Representatives yesterday.

The SEC’s lack of guidance and clarity on crypto securities, their legal compliance process, and other issues is being clearly criticized by politicians.

Will Cryptocurrencies Rise?

Experts expect a relaxation in the appetite for risk markets due to macro pressures and the S&P 500 index’s failure to maintain its all-time high of 5,320 reached on March 21. Uncertainty regarding the Federal Reserve’s interest rate decisions for 2024 is confusing investors.

While the first rate cut was expected in March, it is still not certain whether the SEC will make a cut in one of the next two meetings. Paul Hickey, co-founder of Bespoke Investment Group, shared his concerns about the lack of earnings growth, which poses the greatest risk to the stock market, indicating potential weakness in the equity markets. This situation could negatively affect crypto due to the positive correlation between them.