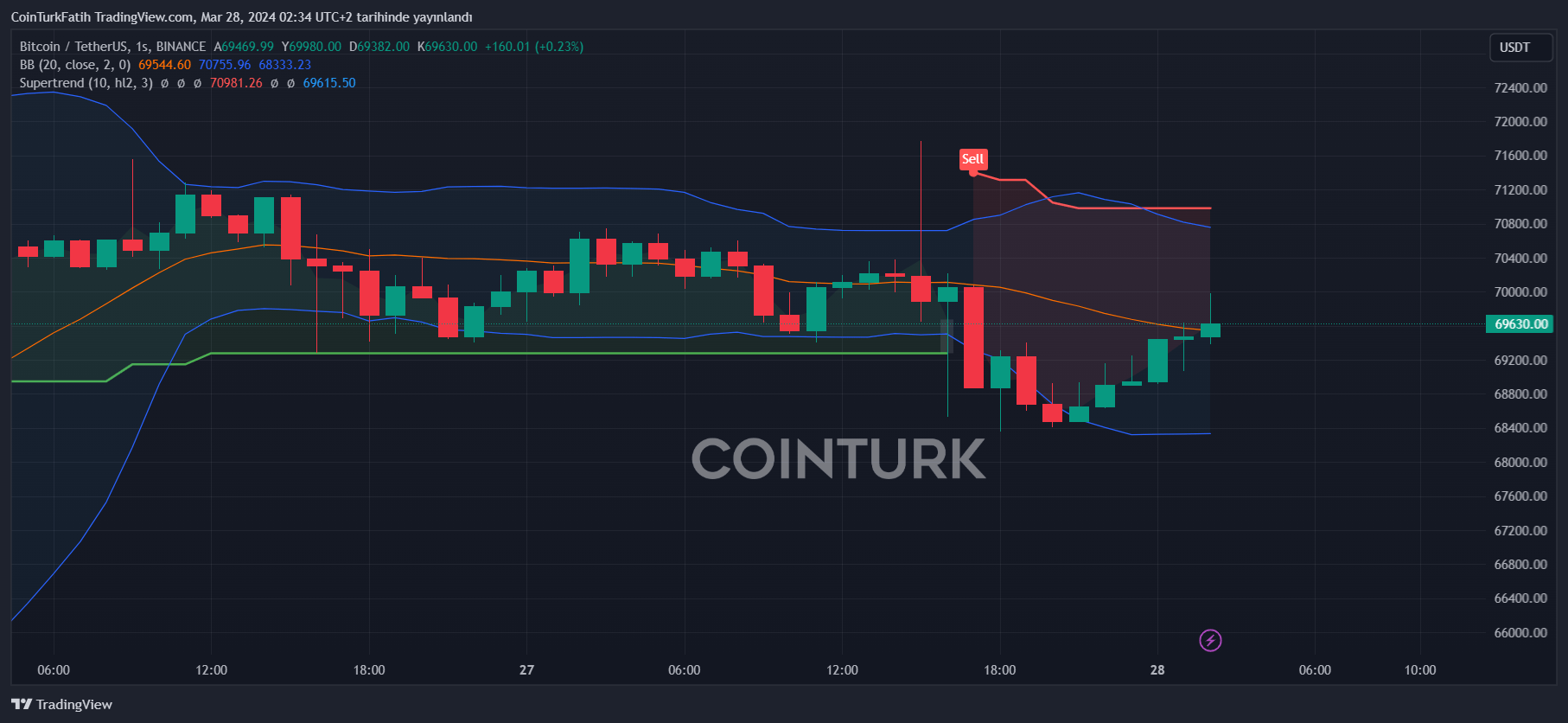

Bitcoin price aimed for $70,000 again after a drop following developments in the Coinbase case. We had mentioned earlier that strong inflows into the ETF channel could push Bitcoin‘s price higher. Then, unexpectedly, a decision against Coinbase was announced, and FUD related to staking services pulled the markets down.

Why Is Bitcoin Rising?

At the time of writing, the rise in Bitcoin’s price was due to BlackRock’s Spot Bitcoin ETF, IBIT, seeing an inflow of $362 million on March 27. ARKB also contributed to balancing outflows from GBTC with exciting net inflows exceeding $200 million. With $300 million in GBTC outflows and other ETF inflows, we saw a net inflow of over $260 million.

This situation indicates that the demand in the ETF channel remains vibrant, suggesting that investors’ appetite for risk could increase in the coming hours. ETFs like ARKB, which are used to weak inflows, have recently seen impressive inflows, likely reflecting institutional demand.

In the next two months, institutions will submit reports to the SEC related to their ETF holdings. These reports will clarify the actual entities behind movements that have raised suspicions of institutional entries. This could also mean that potential purchases by popular companies may have significant positive effects on the markets.

Bitcoin (BTC) Forecast

The SEC is tasked with deciding which cryptocurrencies are securities. As seen in a letter sent from the US Congress this week, politicians are increasingly frustrated with the confusion this issue causes. Disagreements among institutions also damage their credibility.

Moreover, April will host the halving event. Historically, halving block rewards has triggered price increases, so investors may act more boldly as we approach the end of March.

Another feature of April is the clarification of the 3-month performance of spot Bitcoin ETFs. Volumes in ETFs are exciting, net inflows are strong, and these are important details for investment advisors to recommend spot Bitcoin ETFs to their clients. Furthermore, major investment firms will need to review 3-month data next month and classify BTC ETFs as investable, non-investable, or risky.