The first quarter of the year is coming to an end, and it has been an extremely productive period for the cryptocurrency markets. We’ve seen ETF approvals, legal cases, the finalization of SBF’s prison sentence, and many other events. Most notably, spot Bitcoin ETFs saw inflows of over $11 billion, and we will soon find out which institutions have invested in Bitcoin through ETFs. So, what are the end-of-March predictions for LUNA, AVAX, and DOGE?

Dogecoin (DOGE)

We have been discussing how DOGE bulls have been working hard for a positive divergence for days. In the past 24 hours, DOGE approached the $0.23 threshold. This was significant, and a 20% daily gain is quite an assertive move. While the Bitcoin price is below its all-time high, DOGE is shining like a star among the largest cryptocurrencies by market value.

For Dogecoin (DOGE), the key region we have mentioned many times is $0.22, and closing above this could help extend the rally to $0.3. Moreover, the tough downtrend that started in November 2021 and lasted 847 days has finally ended. The price, which struggled to stay above $0.16 at the end of 2022 with Elon Musk’s support, has now easily turned the region into support.

If the current positivity continues, DOGE could climb to $0.294 and $0.35. Beyond that, the psychological target of $1, devastated by the SNL Show trauma, could be reached.

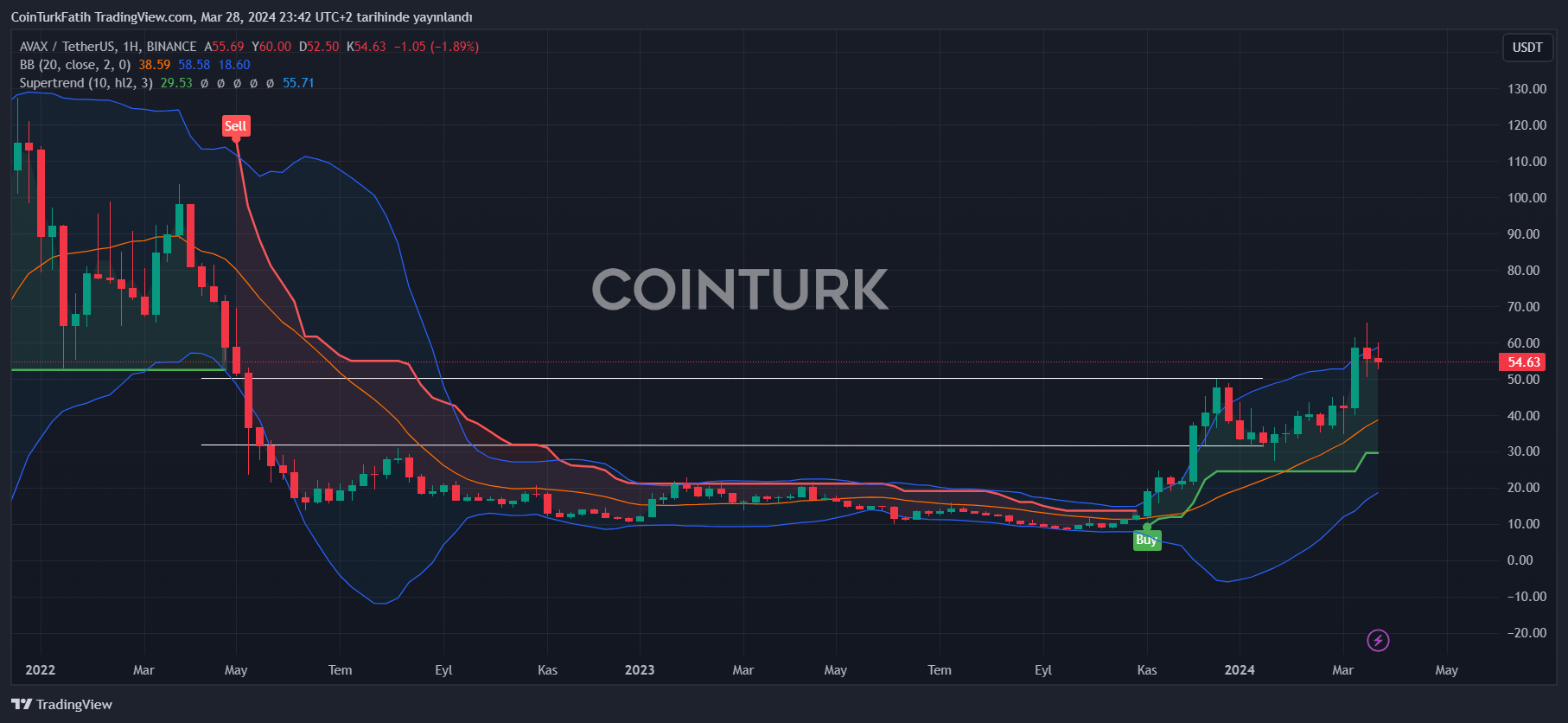

AVAX Price Prediction

After a local peak of $65, fluctuations in the Bitcoin price shook AVAX investors. The long-term bullish trend was gaining momentum when it was trapped by Genesis GBTC sales. Now, since the price has managed to hold above $50.3, it could aim for $65 again.

In the opposite scenario, we could see a drop to the $51.2 and $48 region before the month ends.

LUNA Coin Price Prediction

The FTX fraudster SBF took the wrong flight and, had he gone to Montenegro, he might have remained free under house arrest like Do Kwon. It’s not hard to understand why criminals are so interested in Montenegro. Several extradition orders for Do Kwon were issued and canceled.

Nevertheless, LUNA Coin has not seen massive gains following this decision. As long as the price cannot surpass the $1.4 threshold, the continuation of the long-term downtrend can be expected. In a potential decline, the main target will be $0.8.

Türkçe

Türkçe Español

Español