Following the approval of spot Bitcoin ETFs on January 10, the cryptocurrency market continues to move into a completely different phase. Bitcoin nearly doubled in value from those days and refreshed its all-time high (ATH) for consecutive days. During this period, Grayscale, known for its sales, provided significant information about a major initiative today.

Investment Opportunity for Millionaires

The company made an announcement to X on Friday. The announcement stated that Grayscale has launched a “dynamic income fund” that will focus on investing in proof-of-stake tokens.

According to Grayscale’s statement, the fund, abbreviated as GDIF, will be available to accredited investors with a net worth of at least $2.2 million.

On the other hand, the company also stated that GDIF will be positioned as Grayscale’s “first actively managed investment product.” According to Grayscale, this financial instrument will operate with the motto of optimizing income in the form of staking rewards associated with the proof of digital assets.

The fund will manage the staking and removal of multiple tokens while helping investors generate income in the process.

Meanwhile, in recent months, Grayscale’s spot bitcoin ETF was approved, allowing people to invest in cryptocurrency without having to purchase it themselves, and it is being monitored by the Securities and Exchange Commission.

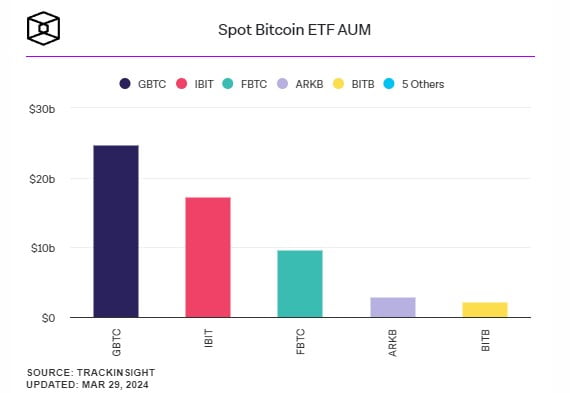

According to data provided by The Block Data Dashboard, billions of dollars in transactions occurred following the approval of the ETF in January. As of today, Grayscale ranks second in volume after BlackRock’s spot bitcoin ETF.

Critical Point in the Regulation of the Fund

Grayscale also summarized how GDIF will operate. The statement was as follows:

Interests in GDIF have not been and will not be registered under the Securities Act of 1933 … or any state or other securities laws.

Grayscale’s announcement also stated that the fund “will not be registered as an investment company under the Investment Company Act of 1940 … and will not be subject to certain restrictions and requirements of the Investment Company Act, and investors will not be provided with the protections of the Investment Company Act.”

What Is the Current Price of Bitcoin?

While all this was happening, eyes were on the price of Bitcoin. As of the time of writing, the price of Bitcoin has fallen back below $70,000.

This could be attributed to the speeches of the US FED Chairman Powell. The BTC price is currently trading at $69,800, which represents a drop of approximately 1.5%.

Türkçe

Türkçe Español

Español