Bitcoin, at the time this article was prepared, was trading above $69,000, but its retreat from the peak negatively impacted altcoins. However, there are some exceptions, one of which is CHZ Coin. Today, the price lingered around the $0.15 threshold. So, what do current predictions indicate for CHZ Coin investors? What’s the latest on Bitcoin whales?

How Much Will CHZ Coin Be Worth?

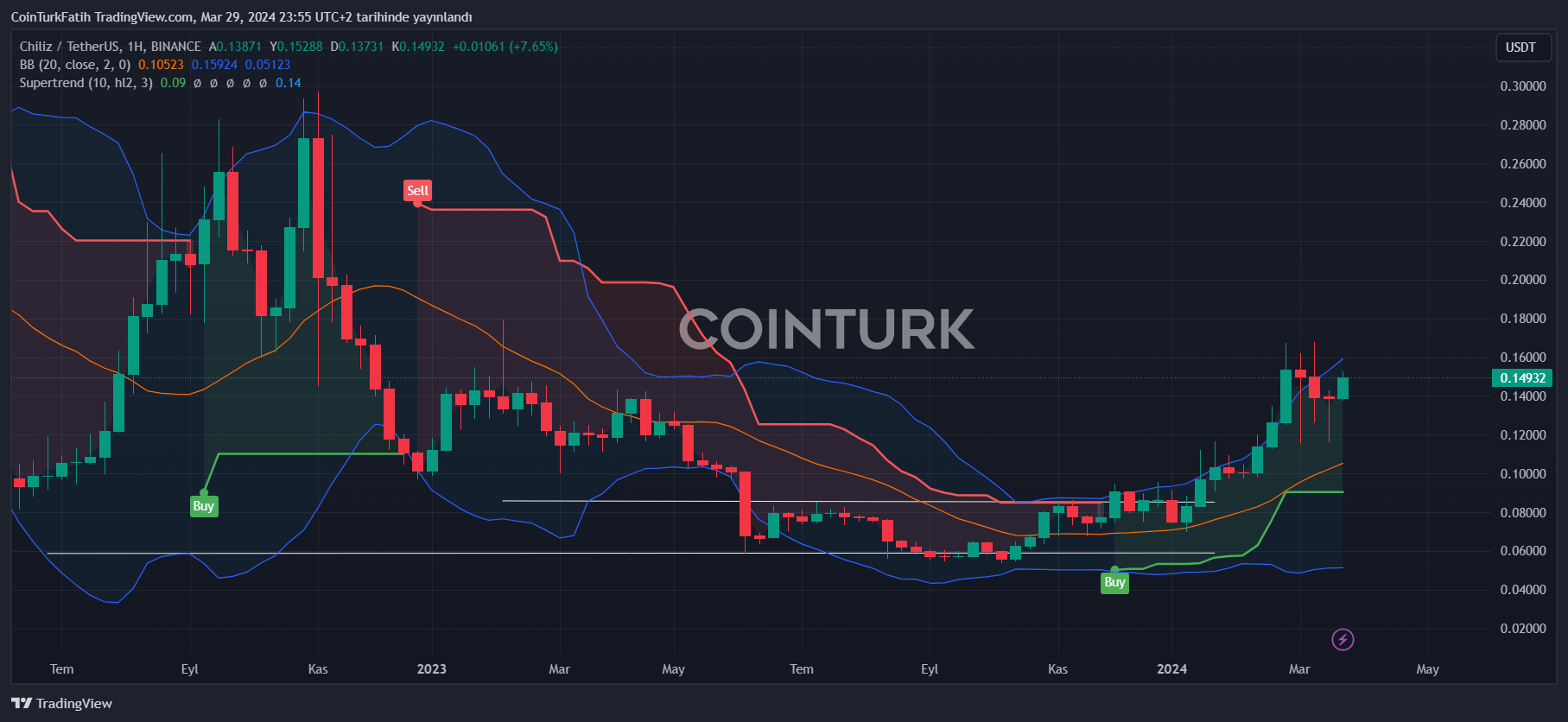

As this article is being written, the CHZ Coin price is at $0.149. It has achieved a daily gain of over 3% and stands out positively while most altcoins are in the red. The weekly chart targets closing above $0.156. However, since the week of February 26, the price has attempted to surpass this area four times but was pushed back by profit-taking.

This week, however, it is recovering from the support level with more determination. CHZ bulls, struggling to push the weekly peak higher amid Bitcoin price fluctuations, have managed to catch the wind for now. Closures above $0.156 and $0.17 in April could likely extend the rally to $0.2 and beyond.

If the resistance area can be cleared, spikes up to $0.27 would not be surprising. With league finals and upcoming cup matches, we may see a short-term hype period in the fan token field.

Bitcoin Whales on the Move

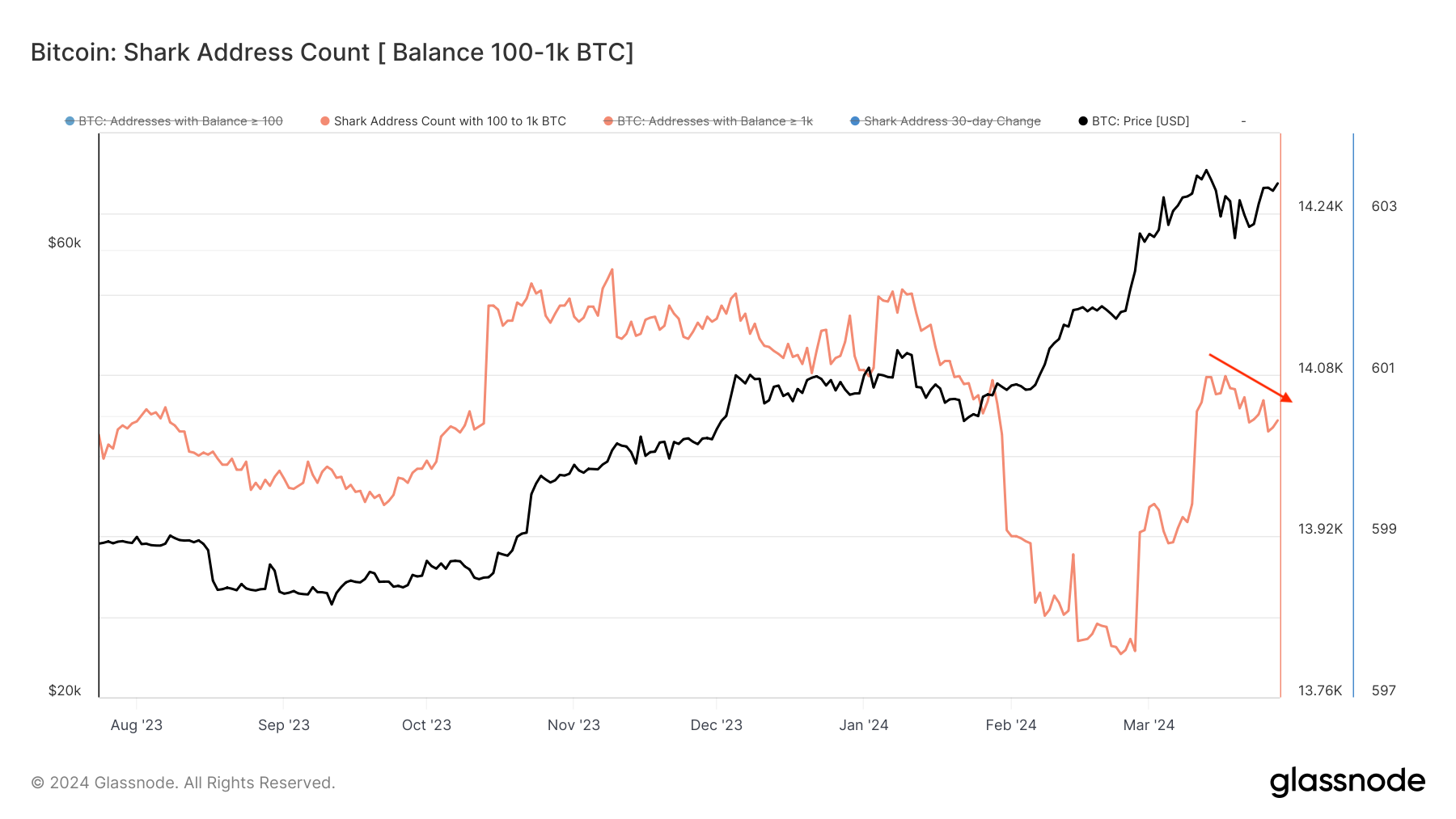

Bitcoin prices are fluctuating, but whales are accumulating. The flow of BTC from investors known as Sharks to whales indicates short-term profit opportunities are being seized. Smaller whales, owning 100-1,000 BTC, have continued a selling trend since March 12.

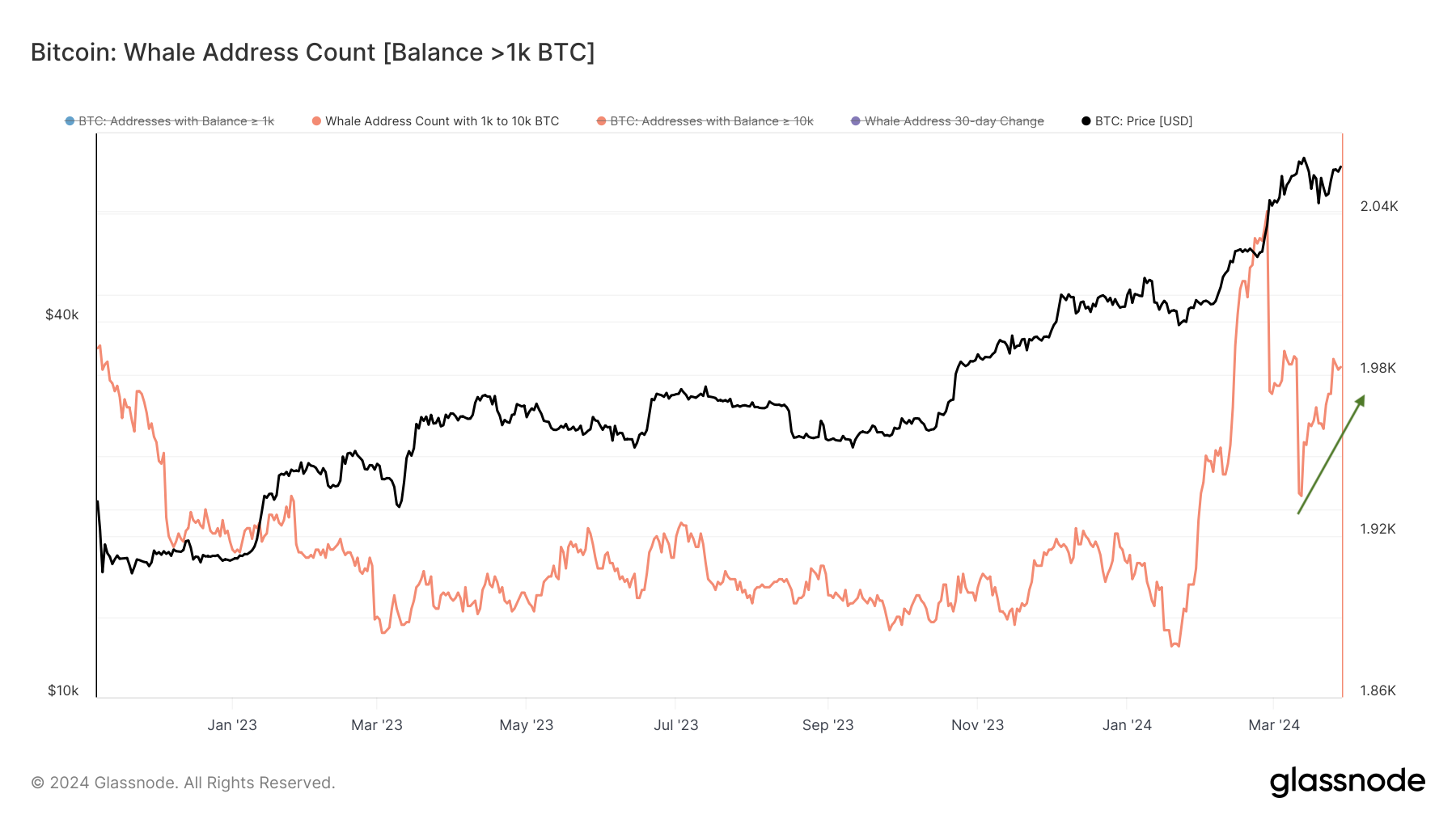

The decrease in shark assets is consistent with the increase in whale accounts during the same time frame, suggesting market optimism for the future. The larger whale group, being less affected by short-term downturns and moving cautiously, could weaken selling pressure.

Big investors likely preparing for post-halving peaks could lead us to expect a positive trend in the coming months. Additionally, if whales are accumulating in anticipation of future price increases, smaller investors may also start to build their holdings.

For now, there are weak but steady positive inflows in the ETF channel, so the outlook remains positive.

Türkçe

Türkçe Español

Español