Cryptocurrency projects often have unique stories of their launches, surges, and retractions, and Polygon (MATIC) is no exception. However, recently, the price of MATIC has been stuck in an uncertain range for about two years. So, what does this mean and what can we say to investors?

What Does the Polygon Price Chart Tell Us?

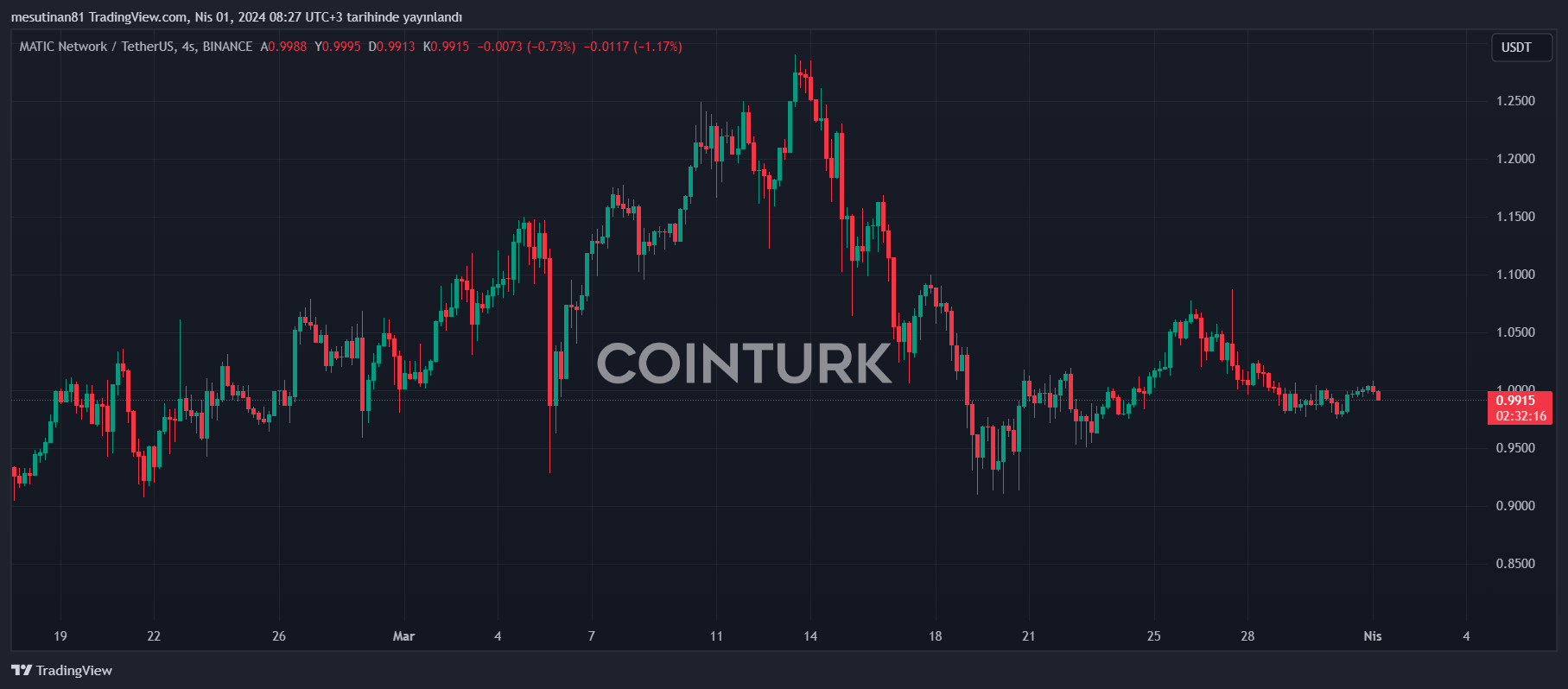

At first glance, the price chart of the cryptocurrency Polygon shows that it has been hovering around $0.941 for a long time. This level corresponds to the middle of the range between $0.315 and $1.568. However, the movement within this range is not particularly noteworthy. Currently, a price close below the $0.762 level could suspend bullish expectations.

Technical analyses seem to confirm the current downward trend of the price. However, the cryptocurrency MATIC’s price is also supported by fundamental factors.

Beyond technical analysis, a drop below the 50 level in RSI could create an environment where long-term investors may see the dip as an opportunity. This could be a chance for investors who want to accumulate the altcoin MATIC at lower prices.

Warnings Persist Despite Optimism in the Crypto Market

Despite the generally positive sentiment in the market, a word of caution is necessary. Particularly if major cryptocurrencies like Bitcoin lose value, catastrophic scenarios for altcoins could emerge. In such a downturn, if Polygon’s price closes a weekly candlestick below $0.762, lower levels could be expected, and the bullish thesis would be invalidated. This could lead to a 35% drop in MATIC, bringing the price down to the level seen on June 5, 2023, which is $0.501.

At this point, it must be said that the future of MATIC’s price remains uncertain. However, what is important for investors is to capitalize on opportunities in this uncertain environment and minimize risks. Whether this is a rebirth for Polygon or the end of the road will be shown in time. Nevertheless, a bull season is now expected in the cryptocurrency world, especially for altcoin projects, which could positively impact the price of MATIC.

Finally, looking at the psychology of the MATIC investor, the price’s hesitant behavior seems to have tired investors somewhat. It must be noted that this disappointment could also reflect on the price.