Bitcoin (BTC) price performance factors have included spot Bitcoin ETFs since January. The demand, inflows, and outflows reflect the tendencies of new investors, which is significant. We saw serious fluctuations in BTC price in the first quarter of 2024 triggered by ETF data, which was the catalyst for the last major drop. So, what’s the current situation?

Spot Bitcoin ETF Data

April 1st was crucial following the relatively weak inflows we saw last week. The BTC price drop to the $60,775 support area was linked to the Genesis GBTC asset sales during the week of March 20th. Now, investors need to closely follow both macroeconomic developments and ETF and other factors.

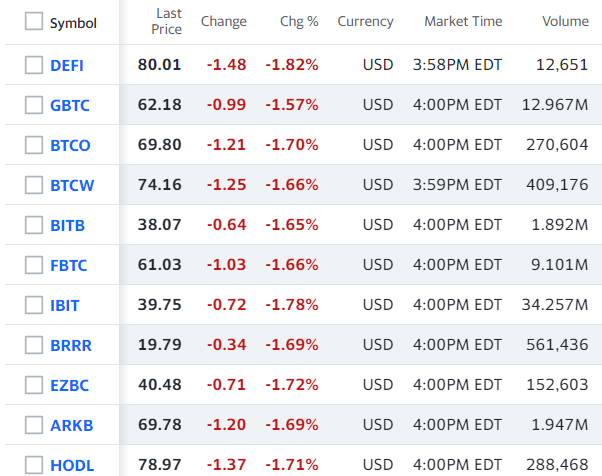

The most anticipated information was the net inflow Grayscale saw on April 1st. This data arrived recently. We saw an inflow of $166.9 million to the IBIT ETF. However, outflows from GBTC were $302.6 million, so the sales have not been fully compensated for yet. Other ETF data are as follows;

- Franklink net inflow zero.

- ARK saw an outflow of $0.3 million.

- Bitwise had an inflow of $1.1 million.

- VanEck inflow was $2 million.

No data for Fidelity has been received yet, and looking at the data so far, there was a net outflow on April 1st. Since $133 million of the GBTC outflows were not compensated, Fidelity must have seen an inflow above this amount to surprise us.

Will Cryptocurrencies Fall?

Unless there is a big surprise, the net outflow in the ETF channel will be confirmed in a few hours, and after the Fidelity data arrives, we will have passed the first day of the week with a net outflow. The outflows in the ETF channel also negatively affected the demand in crypto exchanges, so it is likely that we will see the BTC price below $69,000 in a few hours.

Additionally, Fidelity generally sees inflows behind Blackrock, and even if it sees an inflow of $200 million, investors might still experience FOMO due to hundreds of millions in net inflows, which could negatively affect the price. Looking at volume data, Grayscale, Fidelity, and Blackrock volumes have decreased. Despite the volume decrease, the high GBTC outflow is an extra negative situation. In conclusion, a drop in cryptocurrencies can be expected, but since no one can predict the future, another price catalyst could unexpectedly drive the BTC price up in a few hours.

Türkçe

Türkçe Español

Español