Bitcoin price outlook isn’t looking very positive, and the expected support from the ETF channel has not been forthcoming. As a result, BTC has not been able to test the ATH level, and a new selling period for altcoins has begun. March was marked by the RNDR Coin, which also took its share of this negativity. So what are the current predictions?

Render (RNDR) Commentary

The RNDR Coin, which benefits from the excitement in the AI field by renting out GPUs, made a significant impact last month. At the beginning of last year, the team announced a change in the mechanism aimed at increasing the token price with a very ambitious launch. It then became one of the best-performing altcoins of 2023.

The hype that started with the launch of ChatGPT at the end of 2022, the team’s announcement that they would make the token more valuable, and the general market rise that began at the end of 2023 and has continued to date positively affected the RNDR Coin price. From January 2023 to the peak in March 2024, the price increased by 3152%.

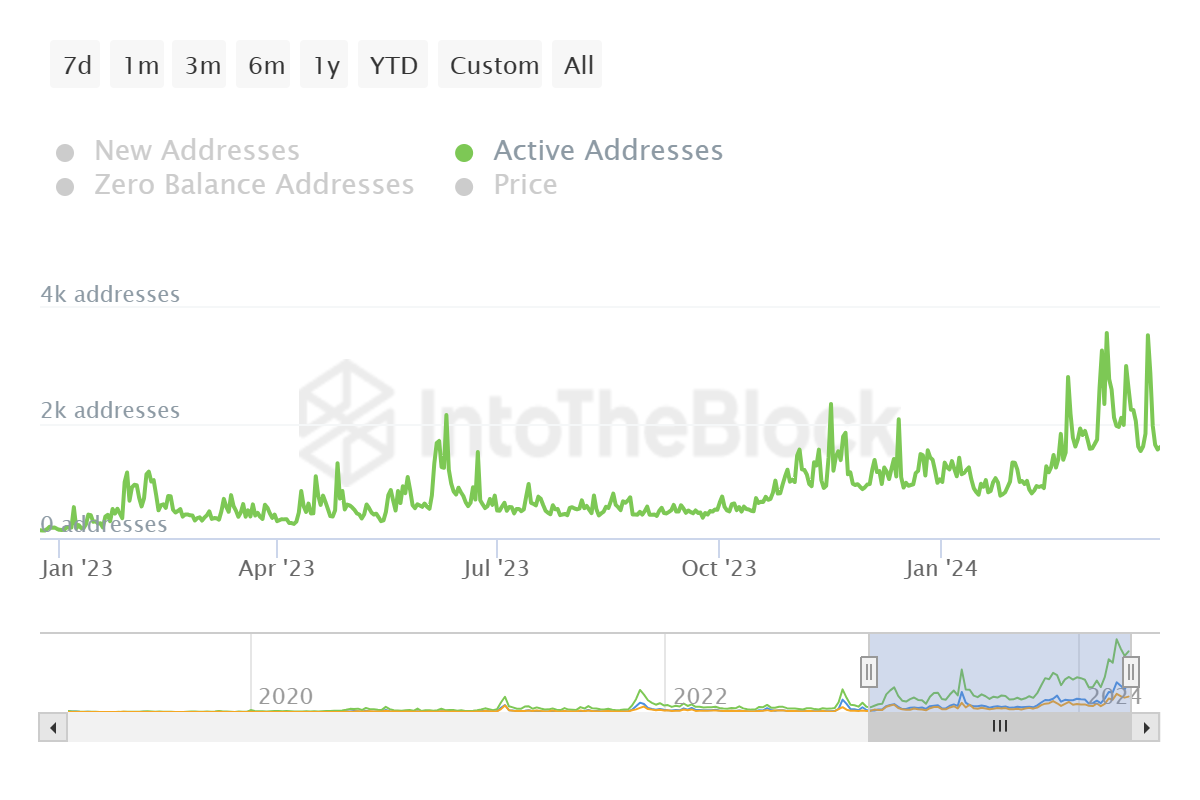

However, rises and falls do not last forever. Another negative aspect specific to RNDR Coin is the sell signal in the Active Addresses metric, which represents investors joining the network and making transactions. The metric dropped from 3,530 to 1,580 in just a few weeks, showing everyone how much investor interest has weakened.

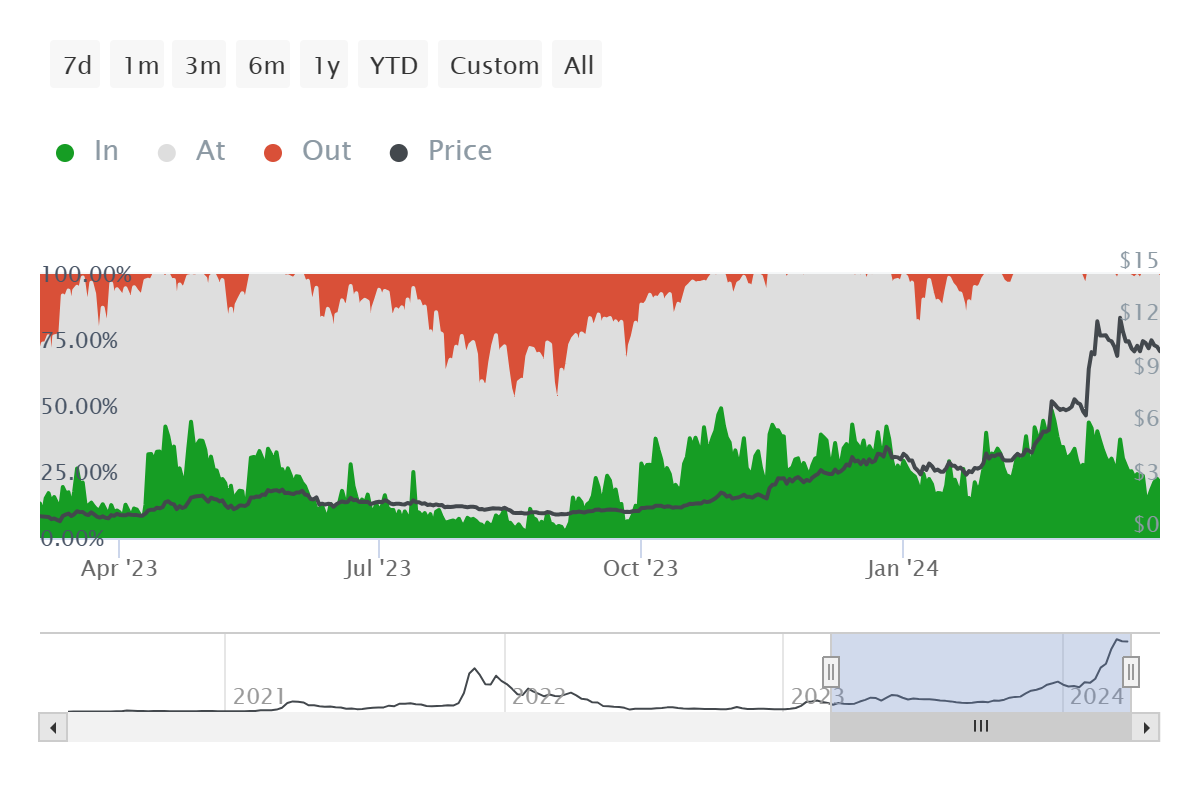

Moreover, since the profitability rate of active addresses is still above 20%, we may see the continuation of profit-taking sales if the general market sentiment turns even more negative.

RNDR Coin Price Prediction

In the first section, we tried to explain why the price has fallen and may continue to fall. A similar outlook is also present for Solana-based BONK Coin. These details could imply a possible broad market correction that could unexpectedly crash the price of SOL Coin. Keeping this in mind, one could be more cautious regarding Solana-based tokens (WIF and others).

If the RNDR Coin price loses the key $10 support level, it could fall to $8.7 and $8.05. This would be a correction that could balance the profitability of active addresses.

However, if the 50 and 100-day moving averages are strongly defended and the weakness on the BTC front returns to normal, the rally could extend. But we must not forget that no one can see the future and that crypto is full of surprises.

Türkçe

Türkçe Español

Español