Cryptocurrency investors did not see a great start in April, but the LTC price has once again surpassed $107. This positive diverging altcoin is moving in the opposite direction of the general market sentiment. So what is the current situation with Bitcoin prices? What are the current predictions for Litecoin (LTC)? Here are the latest market predictions and LTC commentary.

Bitcoin (BTC)

The first quarter of the year was dazzling, and we saw altcoins led by BTC achieve massive gains. Spot Bitcoin ETFs saw nearly $12 billion in inflows. This figure was exclusive of net inflows on cryptocurrency exchanges, and we have all experienced the results together. Bitcoin, which reached an all-time high of $73,777 in March, has now lost some ground.

Risky assets generally rose in the first quarter of 2024. The S&P 500 Index (SPX) increased by 10.2%, marking its best first-quarter performance since 2019, while Bitcoin rallied by approximately 69%. While the 7-month winning streak continues, a significant portion of investors remains cautious with concerns that prices won’t keep rising indefinitely.

If BTC loses the $60,000 level, it will validate these concerns. More ambitious experts predict we might see a new bottom near $45,000.

Litecoin (LTC)

Last year, during the halving period, Litecoin was quite strong. In fact, those wanting to offset losses in other altcoins achieved significant gains with LTC for a while. Recently, however, the application for derivative products for LTC by the Coinbase exchange pushed the price up. This application also certified LTC as a commodity.

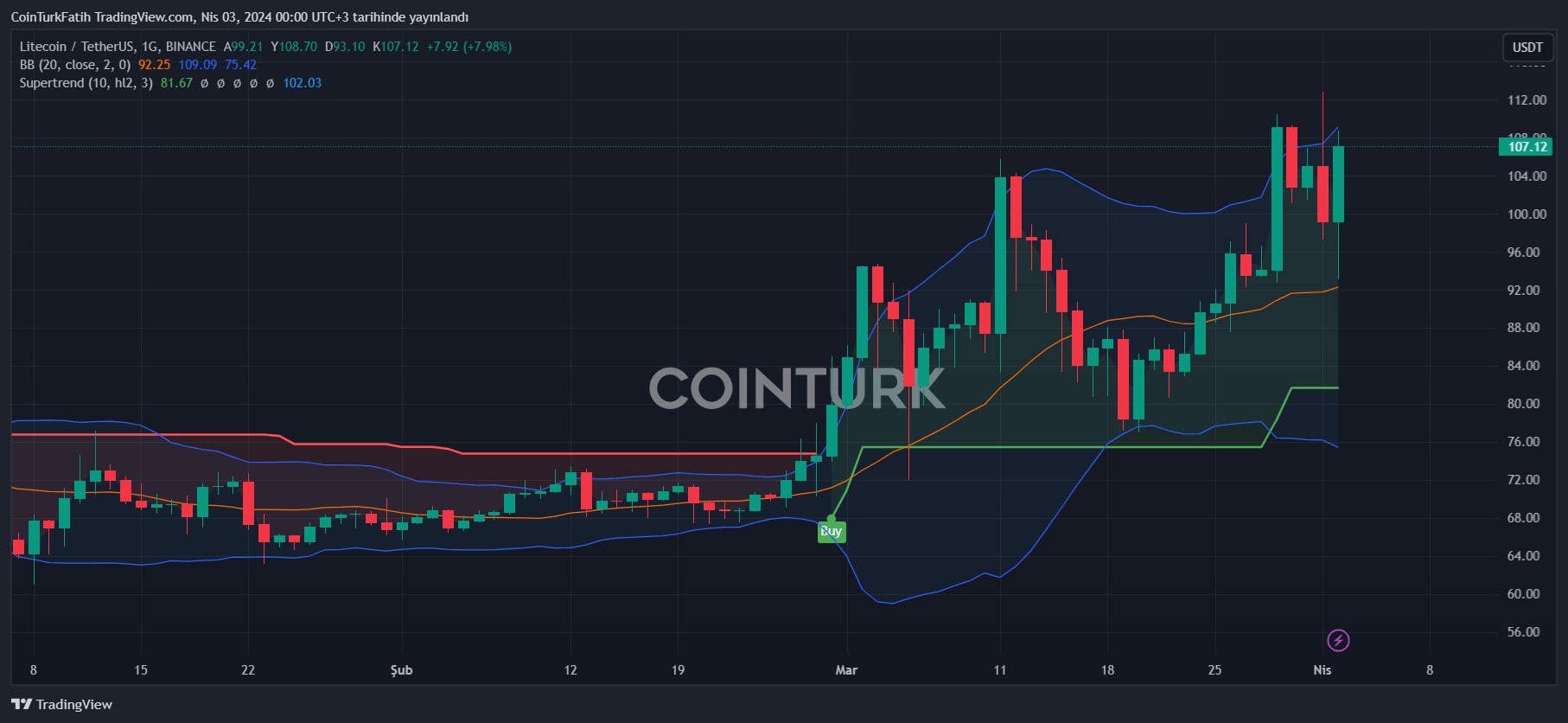

In March, LTC continued its steady rise by reaching higher peaks and had risen to $112 yesterday. Despite subsequent sales, the price rebounded from the $93 support level. We had written this week that the reaction from the $93 support could determine the price direction.

Now, the critical threshold for LTC is $112, and if it can close above this level, it may extend the rally towards $120. On the other hand, closures below $105 could lead to a pullback to the main support levels of $98, $93, and eventually down to $77.