After the historical data for the first quarter of 2024, cryptocurrencies began the fourth month of the year on a negative note. However, the situation is not all bad. Bitcoin reached its all-time high about a month ago, the current price is not so far from the peak, and altcoins are still trying to maintain key support areas. So, what are the expectations for BTC and ETH before the April 20 halving?

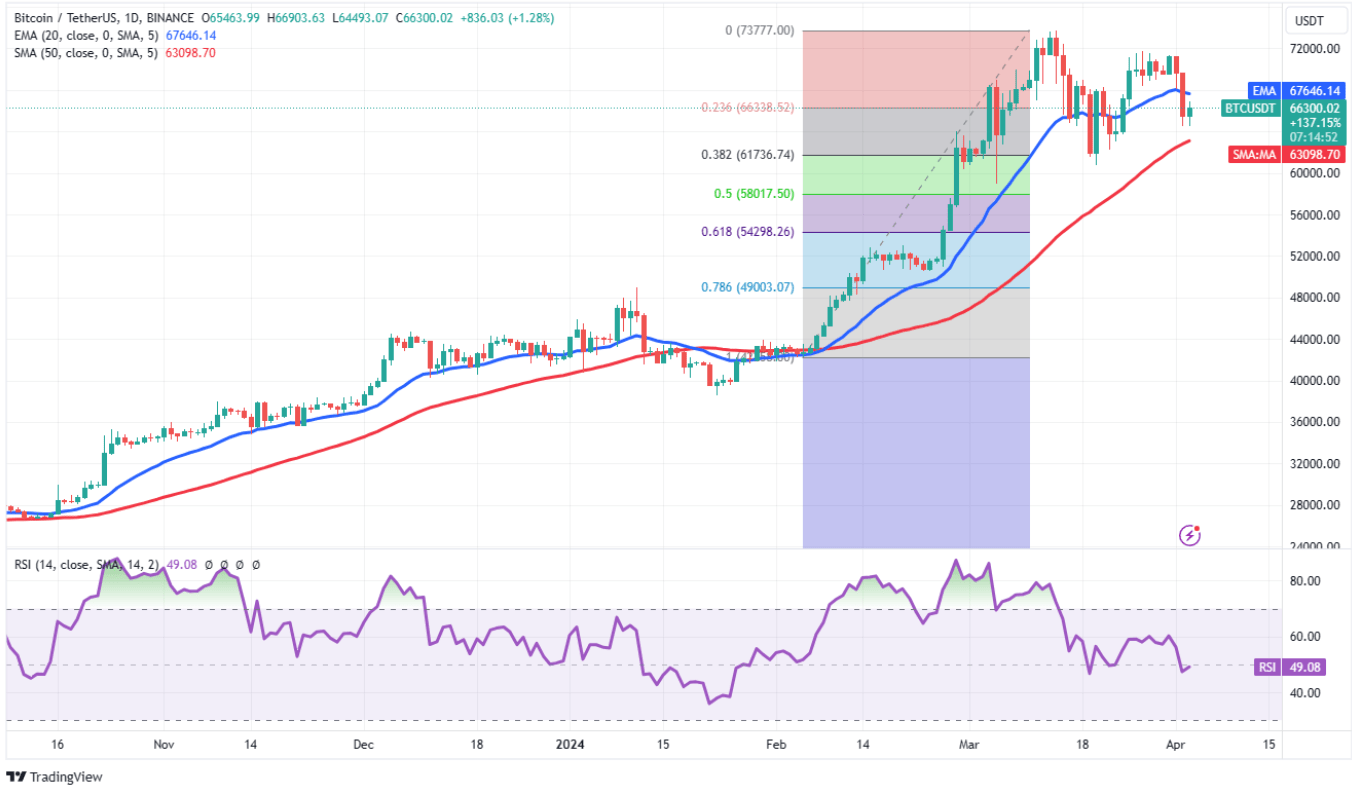

Bitcoin (BTC)

In the 14th week of the year, the BTC price fell by 8.33 percent and is currently under bearish control. Bloomberg ETF analyst Eric Balchunas pointed out in his March review how the total volume rose from 42.2 billion dollars in February to 111 billion dollars.

Before the halving, crypto analyst Rekt Capital warns about historical data. BTC block reward halvings in 2016 and 2020 came with a 38% and 20% decline, respectively. This data suggests that we could see deeper sell-offs in the current situation.

Another significant detail fueling short-term negativity was the bulls’ failure to push BTC price above 71,700 dollars. This led to the price falling below the 20-day exponential moving average (67,646 dollars) on April 2nd.

The RSI is in the neutral zone, and closures above 63,098 dollars are currently preventing further pessimism. However, if this area is lost, we could see a decline to 59,000 and 54,298 dollars. The first sign of a turnaround will come with closures above 67,646 dollars, targeting 71,770 dollars and then 73,777 dollars. The medium-term ultimate goal is 80,000 dollars.

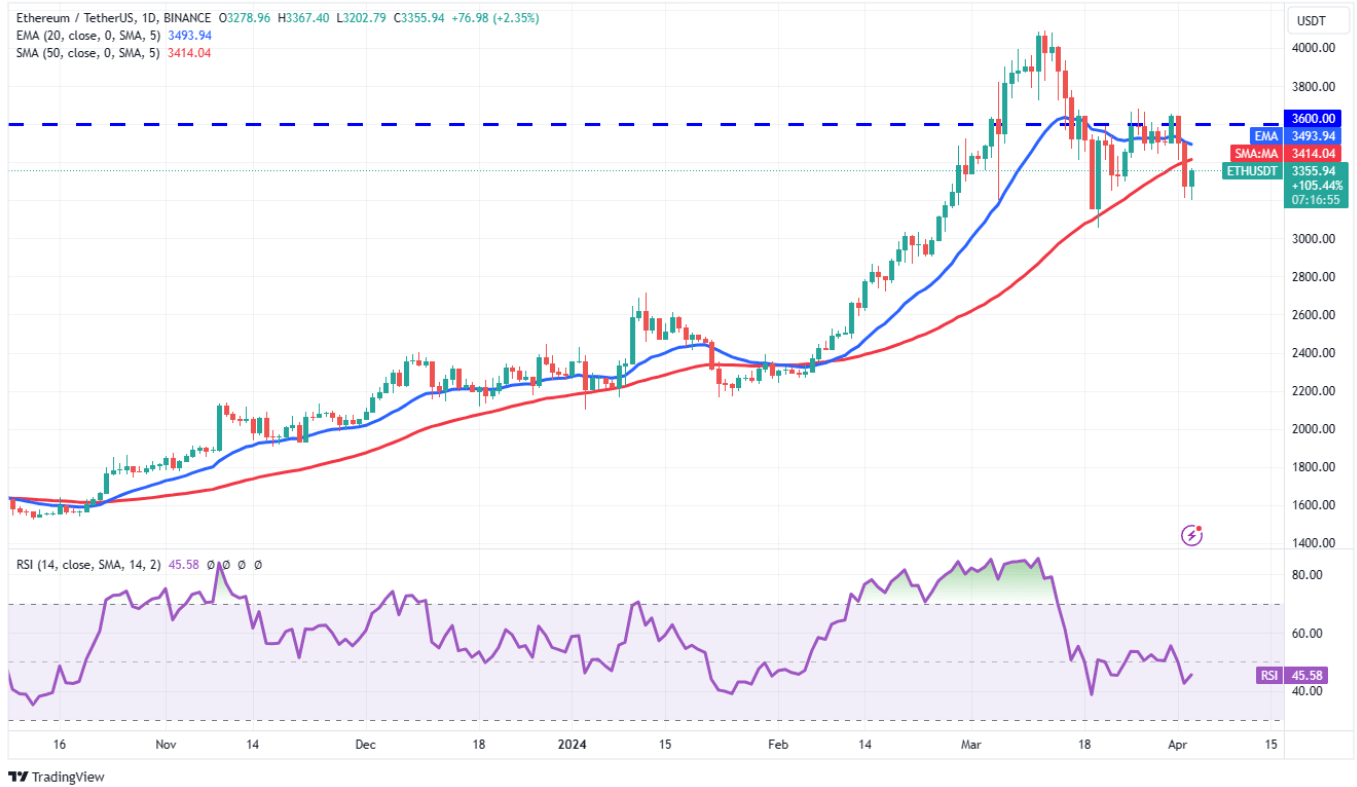

Ethereum (ETH)

Ether fell below the 50-day SMA (3,414 dollars) on April 2nd, and the outlook is not much different from BTC. Additionally, the weakening possibility of an ETF approval also contributed to ETH’s faster losses. The SEC is actively working to shatter the expected optimistic scenario.

As the 20-day EMA (3,493 dollars) turns downward, the RSI flirts with the oversold territory. If BTC doesn’t recover quickly, ETH could fall to 2,700 dollars with closures below 3,056 dollars. Conversely, closures above the 50-day SMA could target 3,679 and 4,000 dollars.

Türkçe

Türkçe Español

Español