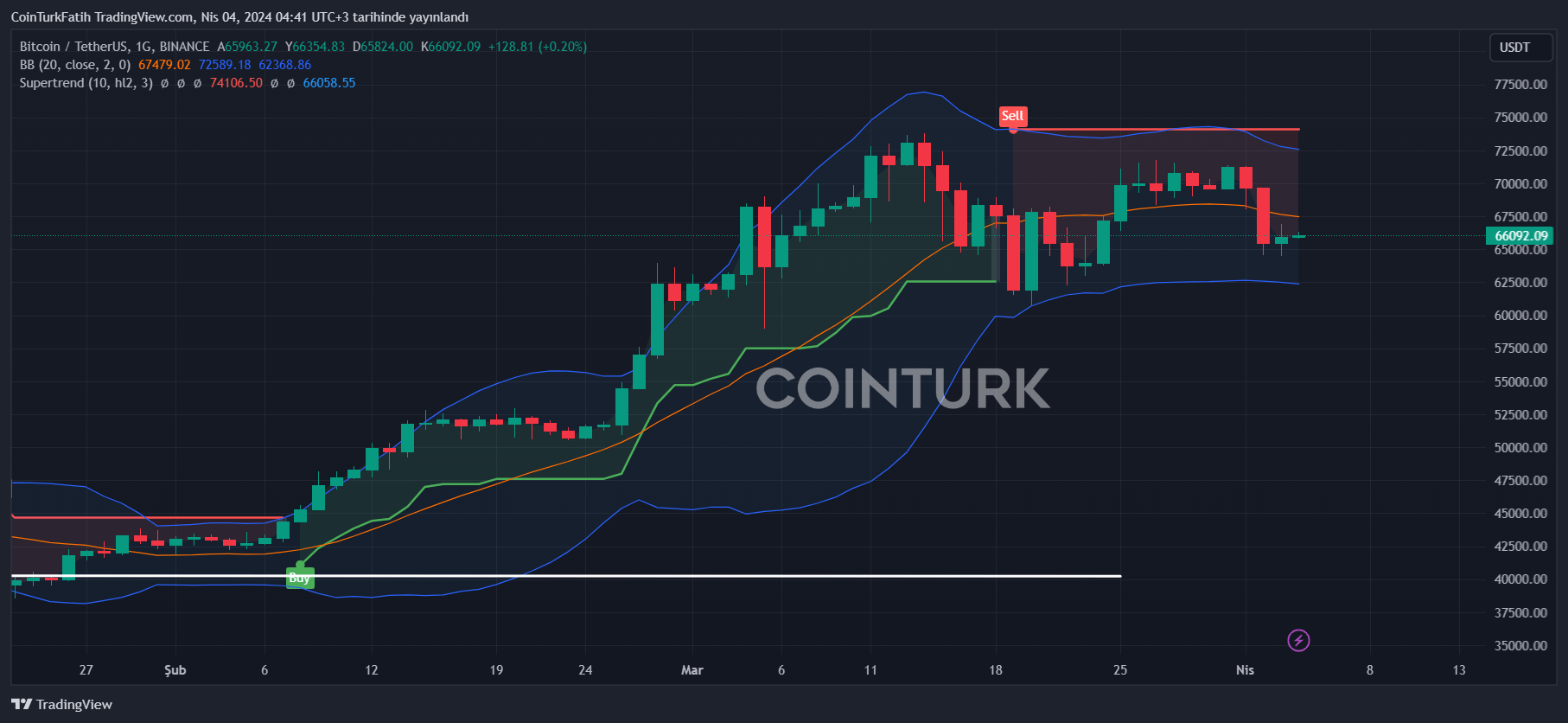

Bitcoin price is currently at $66,250 as this article is being prepared, with a weak recovery attributed to the latest data. We have long experienced the impact of figures from the Spot Bitcoin ETF channel on the price. In the coming hours, these data could provide insights into the outlook for the cryptocurrency markets.

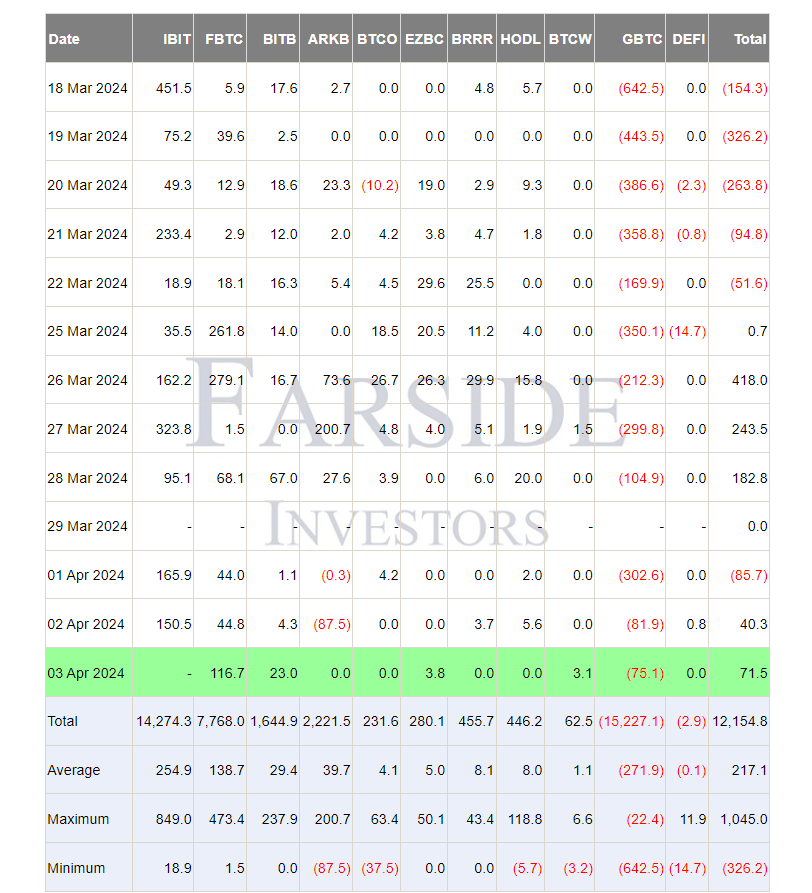

Spot Bitcoin ETF Data

This week has not been great for spot Bitcoin ETFs, and volumes were low yesterday due to both upcoming data and statements by Powell. Even though we have left behind the lowest volume day of the week, the data to be announced on Friday is expected to continue to pressure the markets in the coming hours.

So what was the situation with ETF entries on April 3rd? The picture was not all that bad; in fact, we saw the best net entry day of the week. Moreover, these entries occurred despite weak volumes. Specifically, the $116 million entry into FBTC alongside a daily volume of $491 million suggests that investors are returning to accumulation.

The table above has not yet included the IBIT entry, and BlackRock’s fund saw a net entry of $42.1 million. The day was saved by the weak outflow from GBTC and the strength of Fidelity’s entries compared to current conditions.

Will Bitcoin Price Increase?

Increased risk appetite in Spot Bitcoin ETFs lays the groundwork for optimism in the coming hours. Seeing the biggest entry on the week’s lowest volume day could open the door for a new attempt above $67,000. The current net entry is approximately $113 million, and the Bitcoin price remains above $66,000 as this article is being prepared.

On Friday, employment and hourly wage increase data will be released. Additionally, the pressure from the KuCoin and Coinbase cases on investors does not seem to be disappearing immediately. Experts expect a double-digit decline to be triggered within 10 days, based on historical data. Therefore, expecting massive increases in the Bitcoin price and new attempts above $69,000 may not be sensible in the current environment.

However, positively diverging altcoins could make new upward attempts. Moreover, positive or negative developments tied to surprise news flows could increase volatility. Thus, the expectation for Thursday is cautious optimism and shallow volatility. Of course, no one can see a few hours into the future, and investors need to do their research and develop strategies due to the inherently surprising nature of cryptocurrency.

Türkçe

Türkçe Español

Español