Death Cross is a significant setup in technical analysis and a harbinger of declines. It usually forms when a major price drop has already started, but the detail to note is its potential to accelerate sales. In other words, the Death Cross is a signal to prepare for a scenario where losses could deepen significantly.

Polkadot (DOT)

As the article is prepared, DOT Coin, trading below 9 dollars, is struggling to make a comeback, but BTC is not helping. This week is a busy period on the macroeconomic front, and BTC investors continue to worry about the risk of larger double-digit declines before the halving. Naturally, this situation also accelerated sales in altcoins.

Compared to October 2023, the price of DOT Coin remains weak and has not reached its 1-year peak despite a recent uptrend. While most altcoins have hit their peaks from early 2022 and late 2021, DOT Coin has not managed to remove its name from the list of lagging altcoins.

Current indicators point to an increased risk of further declines for DOT Coin price. For instance, the RSI is below the neutral zone, and investor appetite has significantly diminished. The negative sentiment in the overall market and weak performance in the last bull season do not paint an optimistic picture for Polkadot.

DOT Coin Price Prediction

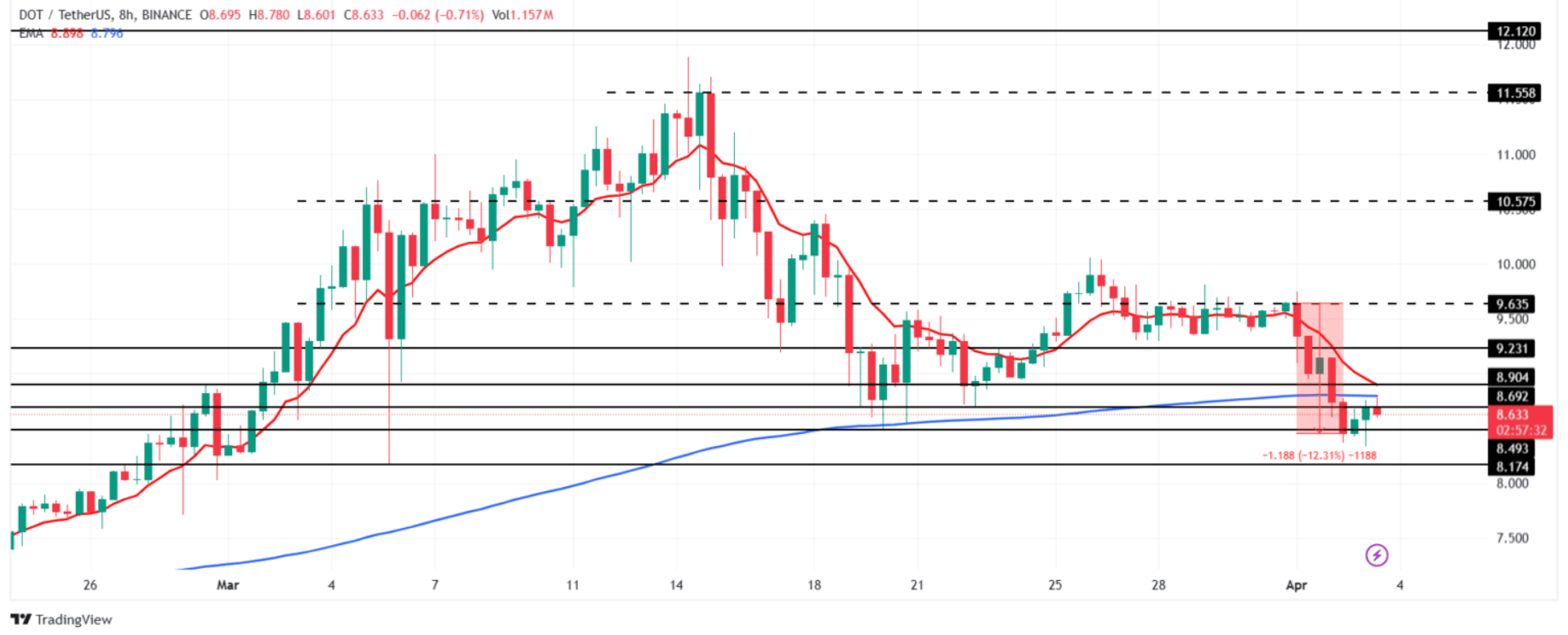

While Polkadot is trading at $8.63, a Death Cross has formed on the DOT Coin chart, as it has on multiple altcoins. This Death Cross, which occurs on four-hour charts of different altcoins, reminds us of the risk of deepening market downturns. This formation occurs when the 50-day Exponential Moving Average (EMA) crosses below the 200-day EMA, while the opposite scenario, a golden cross, signals a potential major rally.

According to the major sell signal, the trend towards recovery seems to be failing, increasing the likelihood of the bears pushing DOT price to $8.1 and $8. On the other hand, closures below $8 would undermine the chances of recovery. If the feared scenario does not occur and DOT price positively diverges during the process, testing $9 and targeting above $9.63 is likely. For the scenario where the rally accelerates, normalization of double-digit prices is necessary.