Bitcoin recovered by 2% on April 4th, following encouraging signals from the US Federal Reserve that sparked a broad rally in risk assets. Data from TradingView showed that Bitcoin‘s price on central crypto exchanges rose to $67,510 at the Wall Street opening. While Bitcoin joined US stock indices in an intraday rise, gold fell after reaching an all-time high of over $2,300.

What’s Happening on the US Front?

The previous day, Fed Chair Jerome Powell spoke in a dovish tone about economic policy, suggesting that interest rate cuts could come before the end of 2024, a significant boon for risky assets. Speaking at the Stanford Business, Government, and Society Forum organized by the Stanford Graduate School of Business in California, Powell stated:

“Since last July, we have been keeping our policy interest rate at its current level. As seen in the individual projections released by the FOMC two weeks ago, my colleagues and I continue to believe that the policy interest rate is likely at its peak for this tightening cycle.”

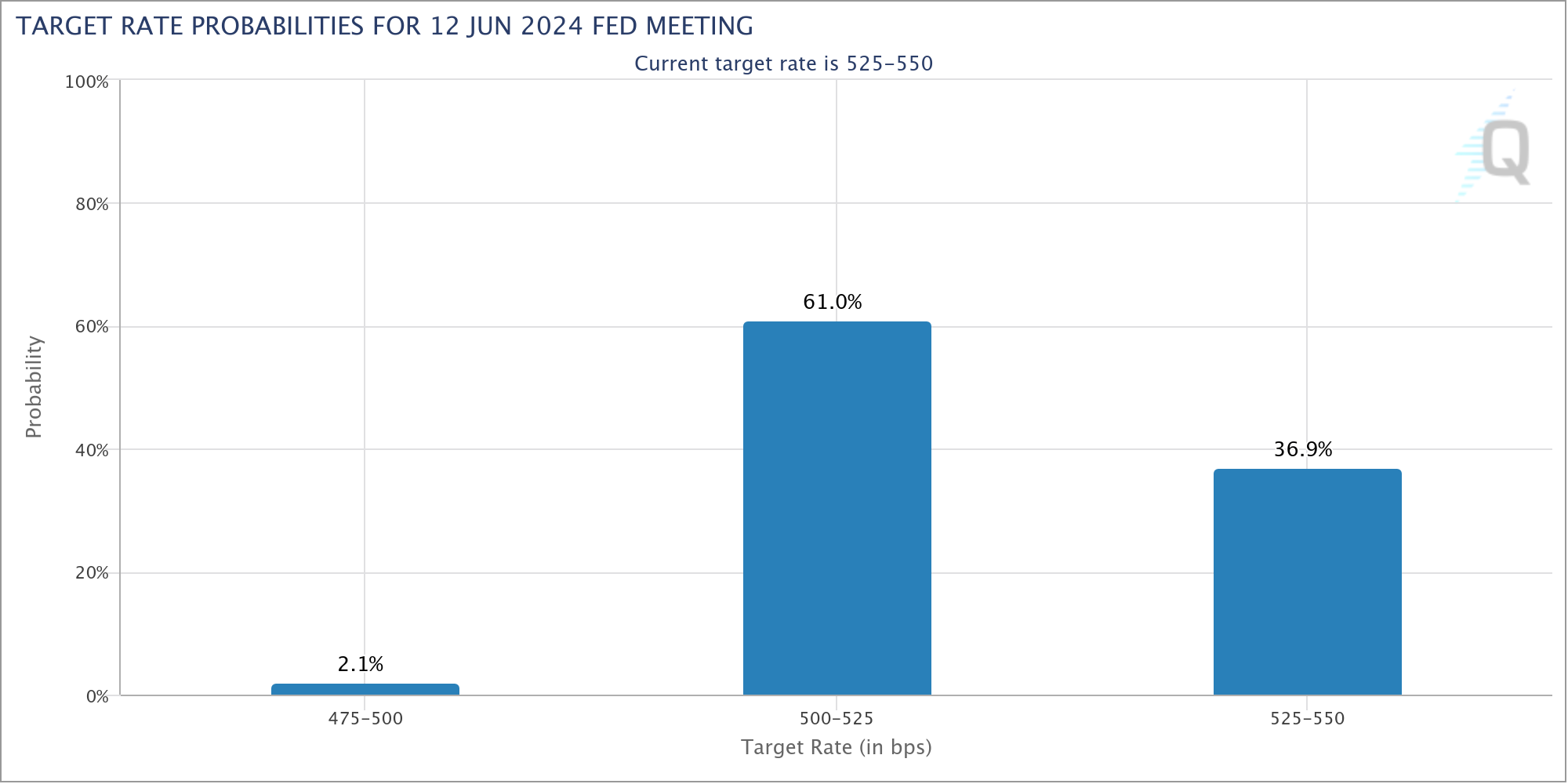

Powell referred to the upcoming Federal Open Market Committee (FOMC) meetings in May. However, the latest data from the CME Group’s FedWatch tool still shows only a 61% chance at best for a minimum 0.25% interest rate cut at this meeting or the next one in June.

Meanwhile, the latest US initial jobless claims came in slightly above expectations at 221,000 against the anticipated 214,000, providing additional upward momentum for market movement.

Analysts’ Take on Bitcoin

Analyzing the current Bitcoin market structure, popular investor and analyst Pierre noted that the 200-period exponential moving average (EMA) on the 4-hour time frames provided support.

Optimistic as usual, analyst Jelle looked at promising signals on the daily chart as a reason to suspect the next upward continuation. Bitcoin’s Relative Strength Index (RSI) crossed above the key 50-point mark on the daily close. Jelle shared the following remarks on the subject:

“Bitcoin has locked into a hidden bullish divergence on the daily chart. This divergence typically emerges during strong uptrends and signals the next leg will be higher.”