Mina Coin, although not yet fully successful in creating its own ecosystem, continues to attract strong interest. With its advantages, Mina Coin has managed to keep investors aligned with its long-term goals, and the awaited upgrade is nearing. So why is the Berkeley Upgrade so important? What will it mean for the price of Mina Coin?

Mina Berkeley Upgrade

Mina‘s significant mainnet upgrade has been eagerly anticipated and will fundamentally bring three important features. With MIP1, MIP2, and MIP3, we will see the network become more functional in various aspects. In the long run, it could compete with other smart contract platforms and even stand out with its advantages.

The three main innovations are: Crypto Traders Are Rushing to This App – Here’s Why You Should Too

- Easier zkApp programmability (MIP 4)

- Kimchi, a stronger proof system (MIP 3)

- Removal of Supercharged Rewards (MIP 1)

“Contributors to the ecosystem have pushed the limits of the network, engaging in extensive testing to bring us to this point. After completing the Upgrade Mechanism Test (UMT), the final stage of testing, the team is preparing to upgrade Devnet, an environment designed for testing and experiments, before deploying the upgrade to the Mina Protocol’s mainnet.”

As the final step before the mainnet, we could see a significant price increase for Mina Coin if everything goes smoothly with the mainnet launch.

Mina Mainnet and Berkeley

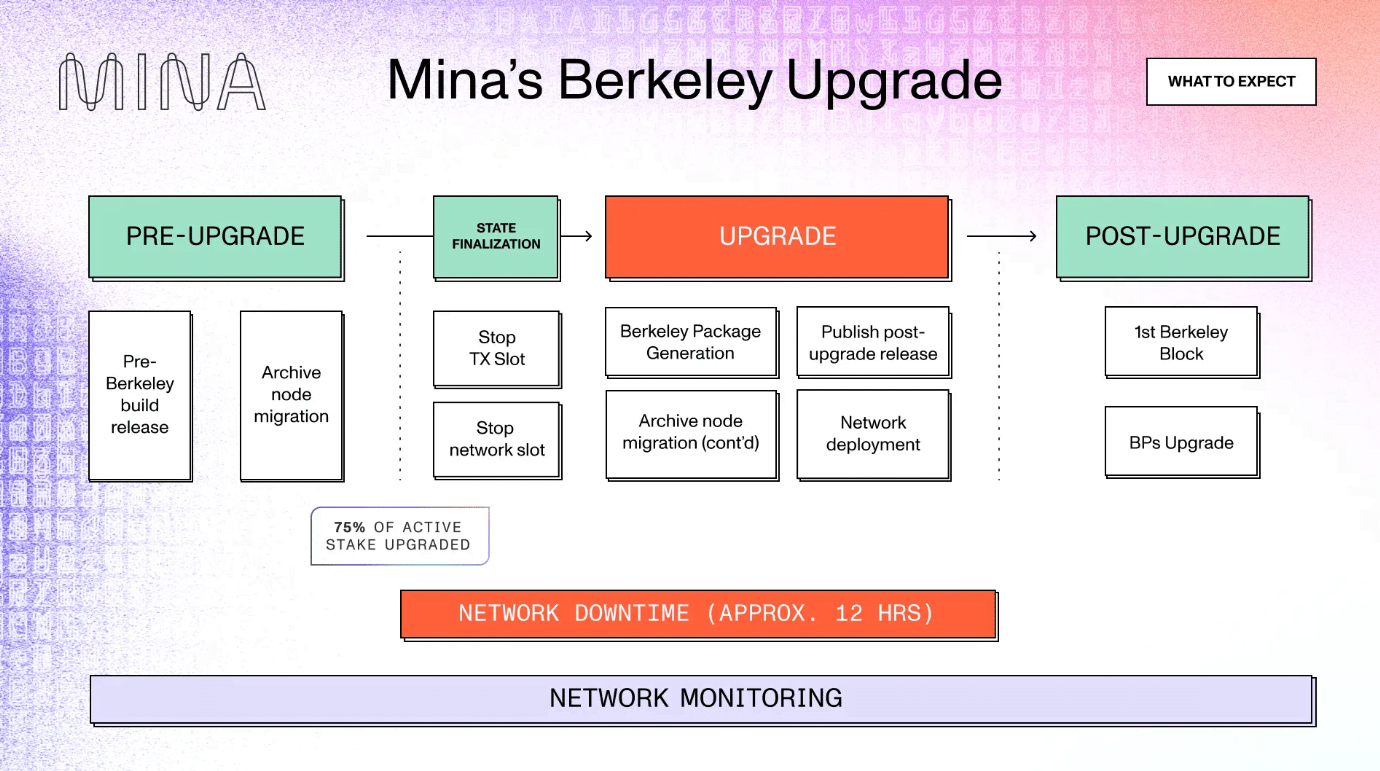

There will be a 12-hour outage in the final phase before the mainnet. After the Berkeley update begins, within 5-11 hours, o1Labs will export the state of the fork block and release the post-upgrade package planned to be run after the fork. Release notes will be shared on GitHub 11 hours after the upgrade starts. The first Berkeley block is expected to be produced one hour after the release of the post-upgrade version.

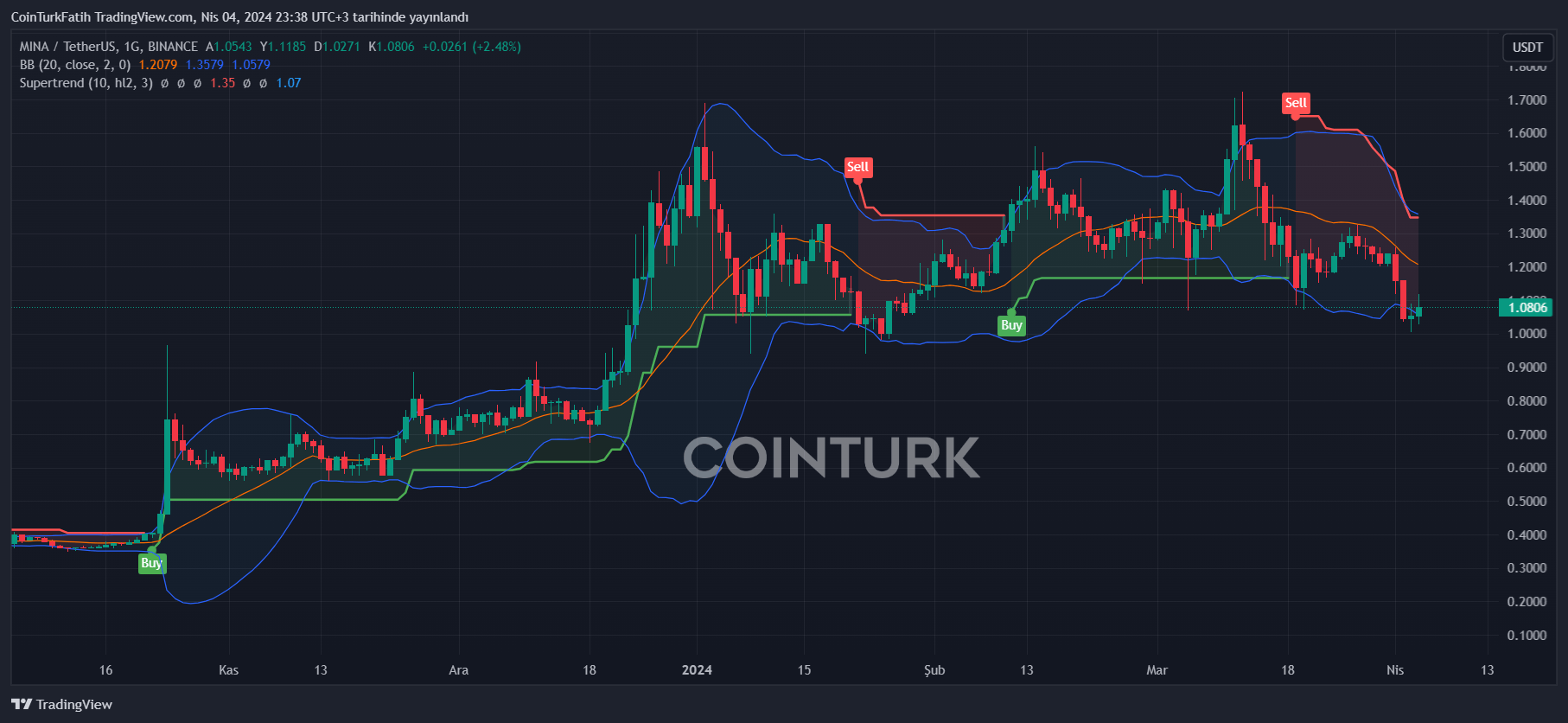

Technical improvements and especially the removal of Supercharged rewards are significant developments that could directly affect the price of MINA Coin. As of the time of writing, the price hovers around $1.08, but the MINA Coin price is likely to trend upward in the second quarter. If the expected scenario unfolds and the mainnet is successfully launched, the price, currently just above the $1.02 base, could climb back to $1.32 and $1.55. After this peak, the second quarter’s bullish target is a $3 top, with the potential to test and even surpass the $5.50 all-time high resistance.

Türkçe

Türkçe Español

Español