For investors, crypto has become more complex, but we are now in the midst of one of the biggest crypto bull markets in history. The approval of a spot Bitcoin ETF has opened a significant door for investors familiar with traditional finance to enter the crypto space, both individually and institutionally. The $12 billion worth of ETF inflows since January is the biggest indicator of this. So, what’s the current situation?

Will Cryptocurrencies Rise?

Spot Bitcoin ETF data is shaping the market’s direction. While overselling occurs, crypto exchanges also see accelerated declines, or conversely, BTC rushes to ATH levels when demand surges. We’ve seen how investors through ETF channels create a multiplier effect in crypto during both rises and falls.

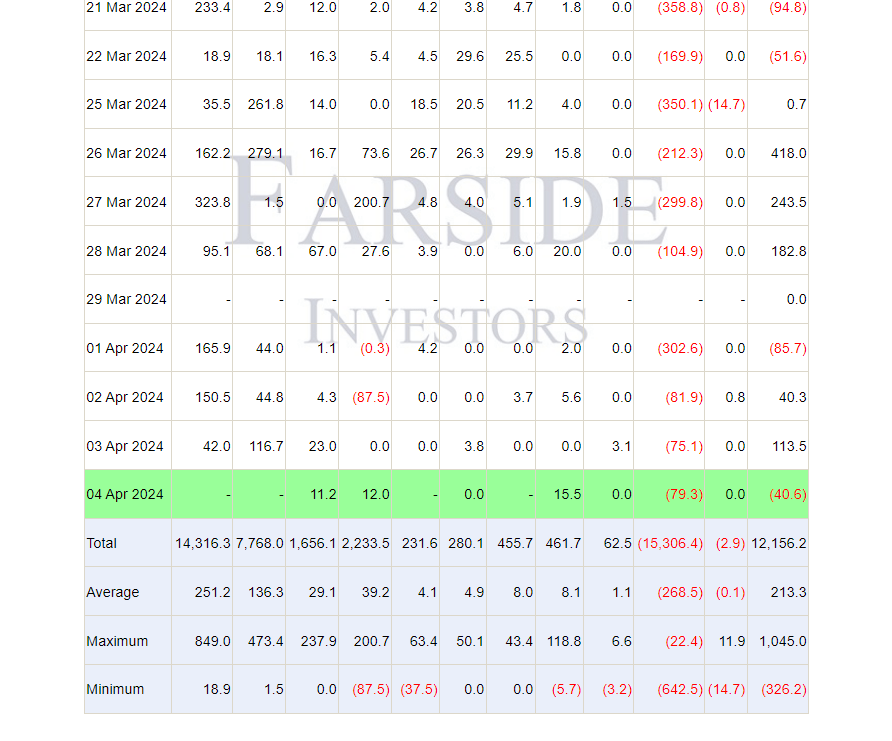

For this reason, it’s essential to closely monitor spot Bitcoin ETF data. This week didn’t go very well, but it was still moderate compared to the nightmare week of March 20. The data from April 4th, however, raised hopes for the coming hours.

April 4th Spot Bitcoin ETF Data

GBTC saw the second-lowest entry of the week with $79.3 million. ETF volumes increased compared to Wednesday. On the other hand, IBIT saw an entry of $141.2 million, again surpassing the $100 million mark. This was enough to offset GBTC’s negativity and turn the day into a net inflow day. Although the IBIT data is not yet added to the table below, according to the latest data, the daily net inflow stands at $101.6 million.

Fidelity data has not arrived yet. However, even if it sees an entry at its weekly lowest level of $44 million, we would have left behind the best day of the week with approximately $141 million in net inflows.

Expectations for April 5-7

Assuming we’ve seen the week’s largest net entry in the ETF channel, we should feel positivity in the markets through the hands of Asian investors within a few hours. The price, which reached $69,300 in the last 24 hours, had seen strong sales. Climbing back to this region and targeting $71,500 is possible.

However, for April 5-7, we need to focus on a few details;

- Fidelity data should also come in as a net entry above $44 million.

- Before the US markets open on Friday, the upcoming employment and wage increase data should favor crypto.

- Since the US data will be announced about 12 hours later, the pressure of this should not be ignored as it could neutralize risk appetite.

- Spot Bitcoin ETFs will start trading about 12 hours later, and the volume we see in the first hour will increase volatility. A rapid increase in volume could lead to a BTC rise and a positive weekend.

Türkçe

Türkçe Español

Español