Bitcoin (BTC) fork, Bitcoin Cash (BCH), significantly increased its value by over 20% last week. Today, it reached its highest level in the last three years, marking a notable achievement. Before a slight pullback, the altcoin‘s price surged over 10% in the last 24 hours, exceeding the $700 mark for the first time since 2021.

Reached Up to $712.23

This surge in Bitcoin Cash’s price followed the successful completion of its second halving event, which initially triggered a temporary dip in BCH value. However, the altcoin quickly recovered and continued its upward trajectory, reaching as high as $712.23. At the time of writing, BCH is trading at $692.27, up 9.38% in the last 24 hours.

According to on-chain data provided by Santiment, Bitcoin Cash’s Relative Strength Index (RSI) is currently at 79, reminiscent of levels observed during price movements in March. The RSI is a key indicator that measures the velocity and magnitude of price changes. While values above 70 typically indicate overbought conditions, in the case of this altcoin, it reflects strong investor interest and continued buying momentum rather than predicting an imminent drop.

Despite the overbought RSI levels, investor sentiment towards Bitcoin Cash remains bullish, as evidenced by the current 30-day Market Value to Realized Value (MVRV) ratio of 13%. While some analysts may interpret this ratio as bearish, historical data shows that BCH has recorded strong price increases even under similar MVRV ratios in the past. This suggests that investment activity and the upward price trend have the potential to continue, confirming confidence in the altcoin.

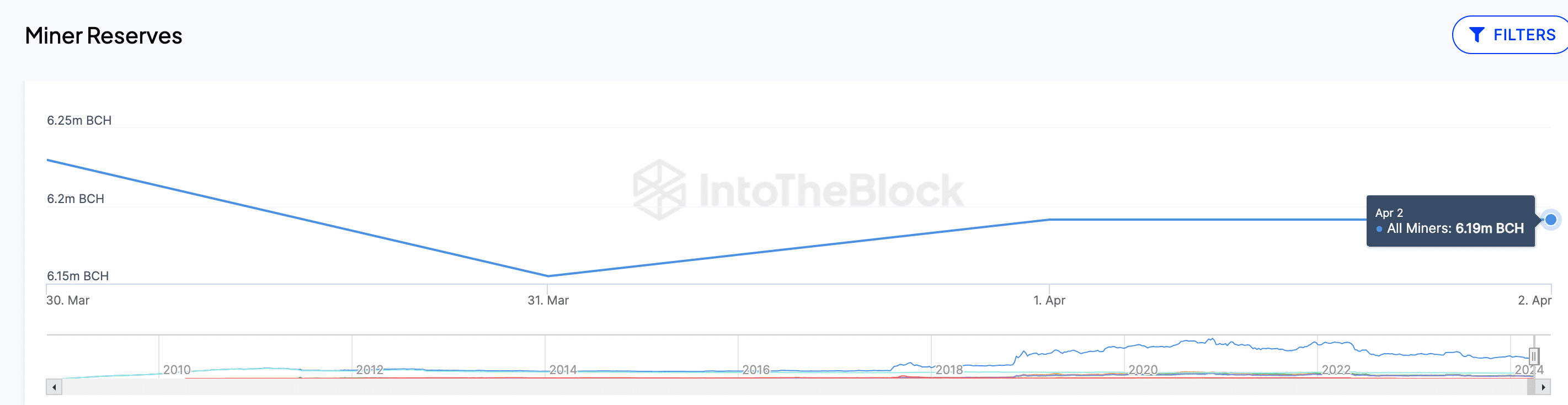

Miners Start Accumulating BCH Again

The recent price increase of Bitcoin Cash coincides with a decrease in selling pressure from miners who have shown interest in accumulating BCH again following the second block reward halving event on April 4. Data from IntoTheBlock indicates a significant increase in the amount of BCH held by miners. Specifically, the amount of BCH held by miners rose from 6.15 million units on March 28, the lowest level in five years, to 6.19 million units on April 2, representing a $242 million accumulation.

The accumulation by Bitcoin Cash miners between March 29 and April 3 has sparked optimism among investors, and the post-halving accumulation could serve as a significant catalyst for pushing BCH potentially towards the $1000 mark, paving the way for further price increases.

Moreover, the analysis of BCH order books across various cryptocurrency exchanges also confirms a bullish outlook for the altcoin. Analysts suggest that if BCH manages to sustain above the $700 threshold, it could be expected to continue its rally towards the pivotal $1000 mark.

Türkçe

Türkçe Español

Español