Bitcoin and the world of cryptocurrency have recently undergone a correction, causing investors to enter a waiting mode. This has led to a correction wave in some cryptocurrencies of up to 50%. Naturally, this situation is quite frustrating for those who bought at high levels. They are currently waiting at a loss. The cryptocurrency Injective (INJ), which has corrected by 40%, seems to have left its investors in a difficult position. So, what can be expected from the cryptocurrency at this stage?

What Price Levels Should Be Expected for the Cryptocurrency Injective (INJ)?

The cryptocurrency Injective (INJ) has recorded two successive breakouts after a long period of consolidation. If history repeats itself or if the past movement is replicated and the altcoin INJ bulls emerge, the AI-powered crypto token could embark on a journey towards a new high.

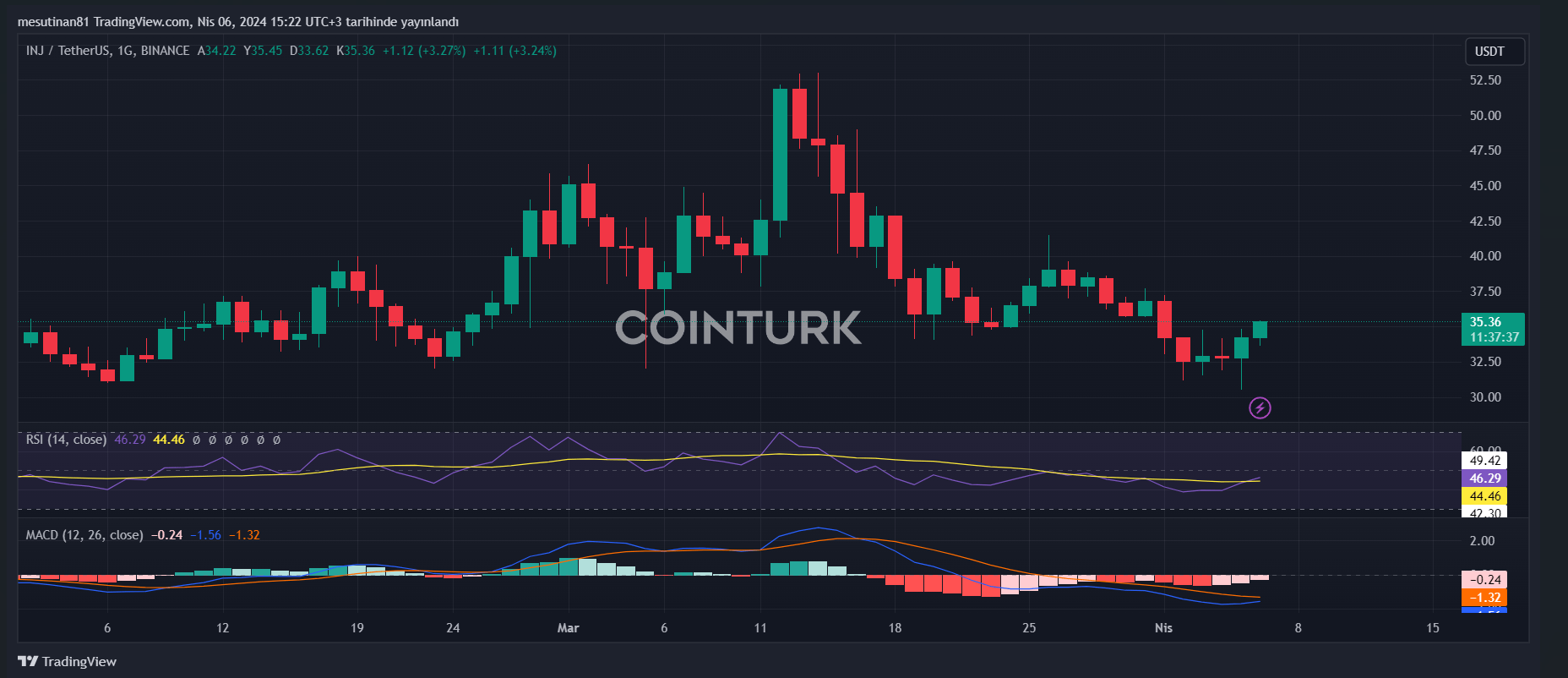

The price of Injective is preparing for a strong recovery. Since being rejected at $53, the price of Injective has fallen by approximately 40%. However, the cryptocurrency INJ price continues to receive significant support within the demand zone ranging from $28.64 to $30.40.

What Do the Indicators Suggest for INJ?

While the Relative Strength Index (RSI) defends further downside, the cryptocurrency INJ price could recover. Key levels to surpass in a northward trajectory are at $40 and $45. A strong breakout above these levels could enable INJ price to recapture its highest range around $53.

In a high-rise scenario, the cryptocurrency INJ price could overcome this blockade and record a new local peak around the $55 or $60 threshold. Notably, the bullish thesis is contingent on the demand zone holding as support.

What Levels Should Be Watched If Sellers Step In?

If sellers pull the significant cryptocurrency INJ price below the centerline of the supply zone and manage to close at $29.53, it will confirm the continuation of a downtrend.

Such an event could potentially extend the decline of the AI coin to the $25 threshold. A daily candlestick closure below this base would invalidate the bullish thesis for the cryptocurrency INJ.

Türkçe

Türkçe Español

Español