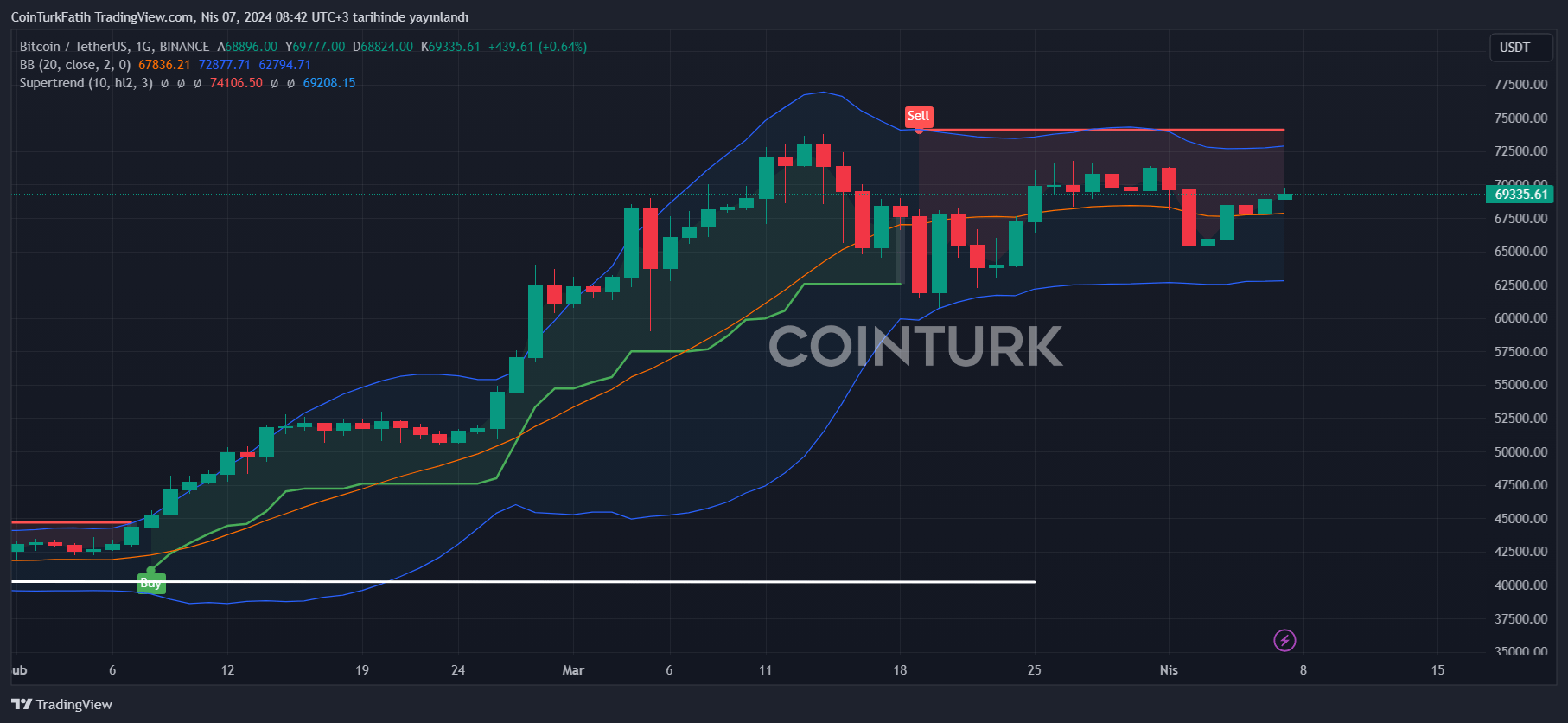

Bitcoin price has reclaimed the $69,000 mark, but there are still a few hurdles to overcome before the halving. The Fed has repeatedly stated that they expect the decline in inflation data, which has been coming since the beginning of 2024, to continue throughout the year. We are now entering a crucial week, and if Wednesday’s data also comes in negative, the crypto market could become turbulent. The next 7 days are filled with major developments that have the potential to increase volatility in cryptocurrencies.

Cryptocurrencies Await Significant Events

The first week of April is about to end, and cryptocurrencies started Sunday on a positive note. Even though volumes decreased over the weekend, we saw BTC prices return to $69,000. About 27-28 hours ago, we mentioned that 2 important signals could trigger a new move to $70,000 on Saturday and Sunday, and that’s what happened. So, what will happen in the world of cryptocurrencies this week?

April 8, Monday

- 05:00-08:00 Aptos Event (Hong Kong Web3)

- WOO Announcement

- Hong Kong Web3 Festival (April 6-9)

April 9, Tuesday

- 02:00 Fed/Kashkari Speech

- Paris Blockchain Week

- Mina Protocol Devnet Upgrade (final before Berkeley update)

April 10, Wednesday

- 15:30 US Core Inflation (Expectation: 3.7% Previous: 3.8%)

- 15:30 US Inflation (Expectation: 3.5% Previous: 3.2%)

- 15:45 Fed/Bowman

- 21:00 Fed Meeting Minutes

- SUI Basecamp Event

- Paris Blockchain Week (Solana Foundation’s BONK and PYTH Event)

April 11, Thursday

- 15:15 European Central Bank Interest Rate Decision (Expectation: Steady)

- 15:30 US Core PPI (Expectation: 2.3% Previous: 2%)

- 15:45 Fed/Williams

- 19:00 Fed/Collins

- 20:00 Fed/Bostic

- GLMR Unlocking Event ($1.35 Million)

April 12, Friday

- ETHDam Event

- Oasis Network Announcement (Brand Refresh, at ETHDam Event)

- APT Unlocking Event ($340 Million)

April 14, Sunday

- CYBER Unlocking Event ($12.7 Million)

Note: On April 15 and 16, STRK and ARB will have unlocking events worth $124.8 million and $138 million, respectively.

Will Cryptocurrencies Rise?

Inflation data and Fed Minutes will be decisive for the week. If inflation is positive, there is no major event expected to pressure prices in the short term on the macroeconomic front. Details in the minutes are also crucial. As ETF channel sales have subsided, depending on inflation and the minutes, we could see a new rally before April 20.

Altcoin unlocking events could negatively affect the related cryptocurrencies. Throughout the week, we may see positive announcements specifically for altcoins during ongoing events.

Türkçe

Türkçe Español

Español