Bitcoin price is heading upwards, having finally reclaimed the $69,000 level. The next target is $71,700 and the all-time high (ATH) level. The upcoming two weeks of April are expected to be highly active due to both US economic data and the halving event. So, what are the current price predictions from popular crypto currency experts?

Crypto Expert Commentary

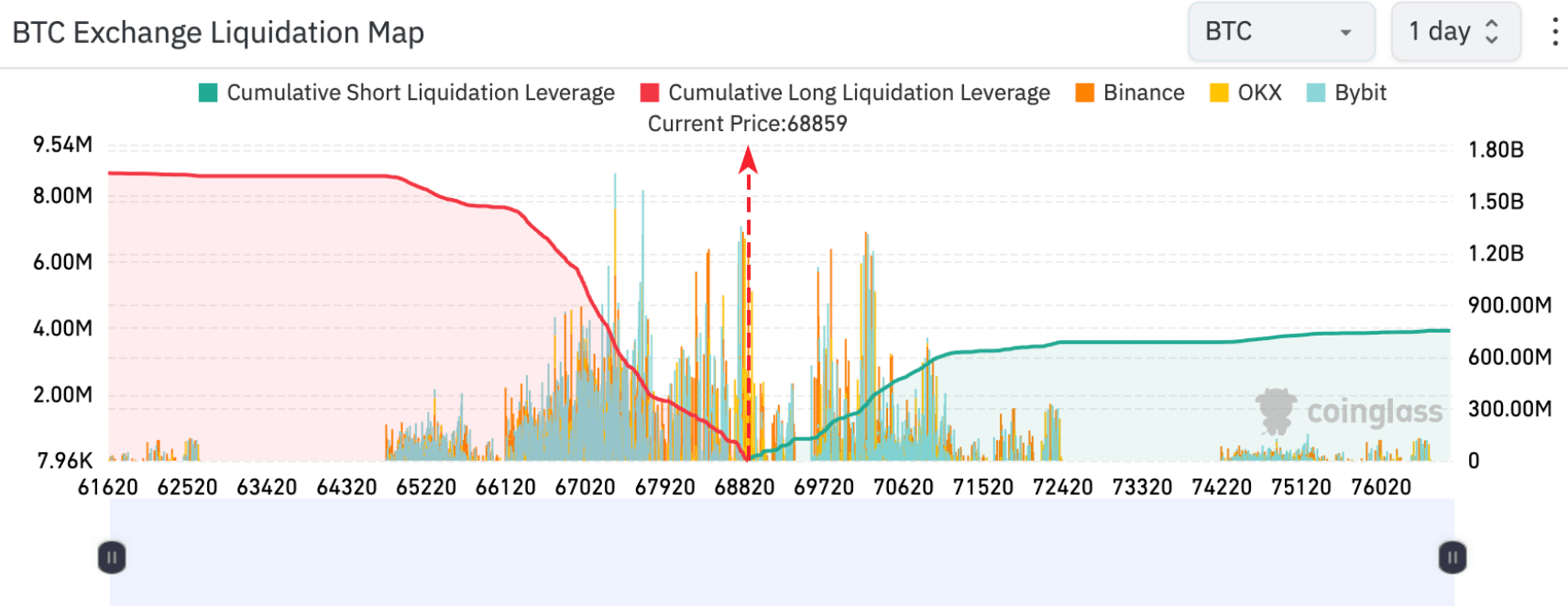

Dylan LeClair, a senior analyst at UTXO Management, recently made predictions about the current state of Bitcoin. In an analysis note published within 24 hours, he emphasized that a climb to $70,000-$75,000 for Bitcoin would put significant pressure on short positions.

“As we consolidate, there’s significant short liquidation happening between $70,000 and $75,000.”

If BTC returns to $70,000, according to CoinGlass data, we will see a liquidation of $174 million in short positions. Reaching the upper limit of $75,000 would mean the liquidation of positions worth $830 million.

A 7.5% change resulting in over $500 million in liquidations isn’t surprising; we last saw this in mid-March when the trend turned downwards, resulting in over half a billion dollars in liquidations. Since that day, no such significant movement has occurred.

Bitcoin Won’t Fall to $50,000

LeClair does not see a likelihood of Bitcoin‘s price dropping to $50,000. At the time of writing, such a drop would mean a roughly 27% decrease from its current level, which, considering support levels and the size of liquidations, seems unlikely to the senior crypto commentator.

“Even though there’s a large cluster of long positions that could be liquidated around the $50,000 level, considering the structure of higher lows and the current lack of sudden froth in the derivatives market, I find the probability of revisiting this level quite low. Of course, it’s not impossible.”

BTC last fell below $50,000 to $49,725 on February 13th. It wasn’t surprising since it was the first time it had reached $50,000 since December 2021.

While discussing bullish predictions, LeClair also mentioned BlackRock’s update to the Bitcoin exchange-traded fund (ETF) prospectus on April 5th. The company added ABN AMRO Clearing, Citadel Securities, Citigroup Global Markets, Goldman Sachs, and UBS Securities as new authorized participants. This indicates increased trust and investor demand.

Türkçe

Türkçe Español

Español