NFT sales volume indicated a weekly decline with nearly a 14% drop on April 5. The fourth consecutive week of declines in NFT sales contrasts with record figures recorded in other crypto sectors throughout March. Let’s examine what happened in the crypto market last week.

Losses Persist in the NFT Market

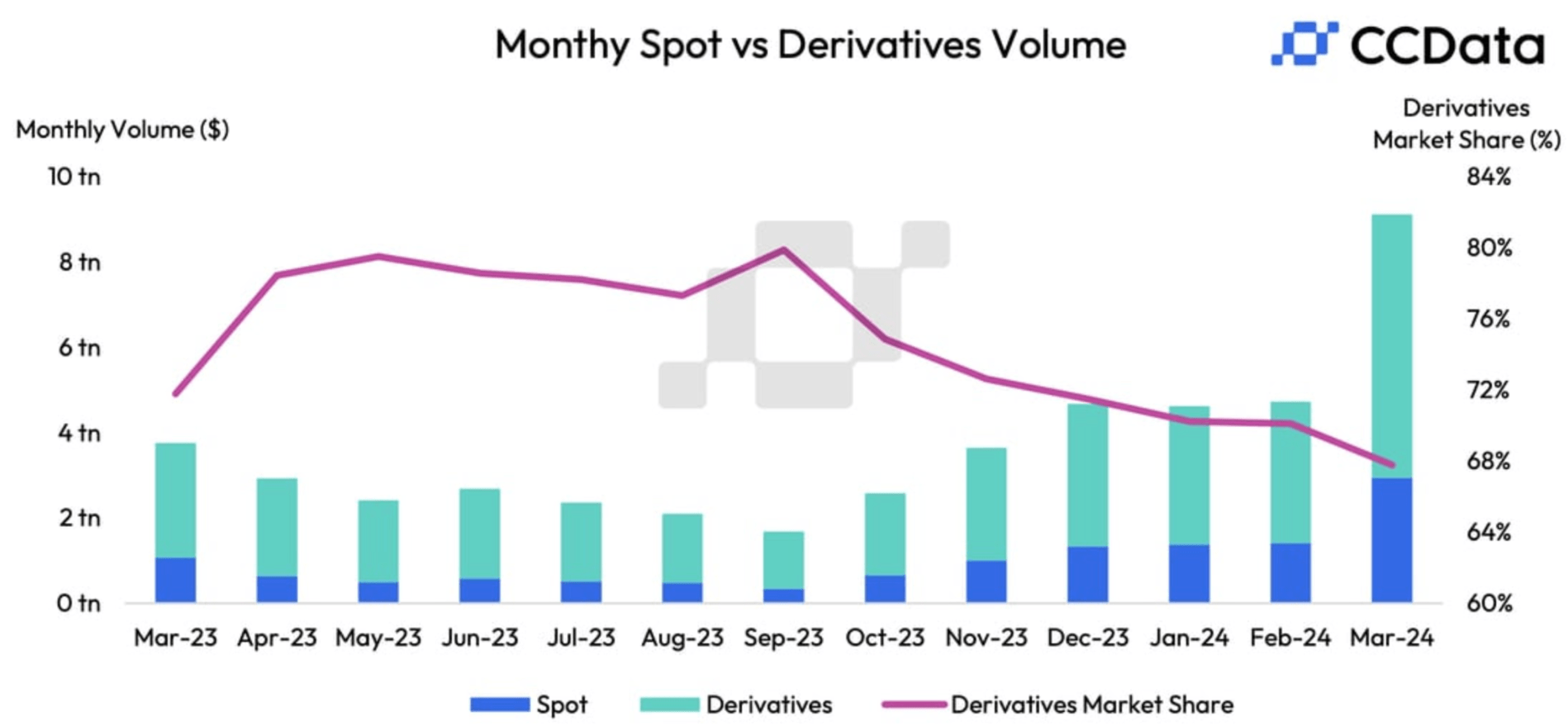

According to data, the combined transaction volume on centralized crypto exchanges in March nearly doubled to reach $9.1 trillion. The report suggests that this is consistent with Bitcoin‘s rise and the buildup to the anticipated halving event at the end of April.

Despite reaching the highest transaction volumes in March for both centralized and decentralized crypto exchanges, NFT markets continue to retreat with weekly declines. Data from the analytics platform CryptoSlam shows a decrease in NFT sales across the leading six blockchain networks, continuing until April 5.

Bitcoin NFT sales were approximately $67 million, an 18% decrease from the previous week. The Ethereum ecosystem followed with $64 million in sales but also experienced a 9% decline.

Verdict Reached in OneCoin Case

According to the U.S. Attorney’s Office for the Southern District of New York, Irina Dilkinska, the former legal and compliance director of the OneCoin fraud, was sentenced to four years in prison by U.S. District Judge Edgardo Ramos for her role in the $4 billion fraud. The Bulgarian citizen Dilkinska, found guilty of conspiracy to commit wire fraud and money laundering, was also ordered to pay $111 million in restitution.

OneCoin defrauded investors by marketing its fake cryptocurrency and promising guaranteed returns. Prosecutors say the company also resembled a pyramid scheme in terms of selling educational courses on crypto investment and offering rewards for bringing in more participants.

The Bulgarian company was founded in 2014 by Ruja Ignatova and her partner Karl Greenwood, who is currently serving a 20-year prison sentence. Ignatova disappeared in 2017 after a U.S. federal warrant was issued for her arrest.

Pantera Capital’s Earnings Impress

According to a report made public by Bloomberg, Pantera Capital’s $300 million Liquid Token Fund achieved a 66% return in the first quarter, supported by the nearly doubled price of Solana.

Gains in RBN, Aevo, and STX also contributed to these returns, as cited in a shareholder letter quoted by Bloomberg. The Solana ecosystem has recently been adding value, especially with memecoin projects and airdrop events.

Türkçe

Türkçe Español

Español