Recently, the price of Bitcoin has been trading above $69,500 as we enter a week filled with significant economic data. Additionally, starting today, Bitcoin ETN products will be available for trading on the London Stock Exchange. At this stage, investors should pay attention to which developments. Let’s look at the details.

This Week, Bitcoin Investors Should Monitor US Economic Indicators

Investors are gearing up for a series of macroeconomic events and data releases, including key US economic indicators and interest rate decisions from leading central banks. In the United States, the Consumer Price Index (CPI) for March will be announced on April 10th, followed by the release of the Federal Open Market Committee (FOMC) minutes for March on April 11th. The probability of the FOMC not changing interest rates in May is a high 93.3%.

As the month progresses, major central banks are expected to maintain interest rates at current levels, reflecting the stance of the Federal Reserve. The announcement of strong US economic data has reduced expectations for a rate cut, leading to a sustained high-interest-rate environment. Consequently, there has been significant volatility in US stocks, which are considered a leading indicator for risky assets.

Bitcoin’s Volatile Journey Continues in the Crypto Market

In the crypto market, the $70,000 price level for Bitcoin (BTC) has recently become a battleground. However, other cryptocurrencies are also facing downward pressure alongside Bitcoin.

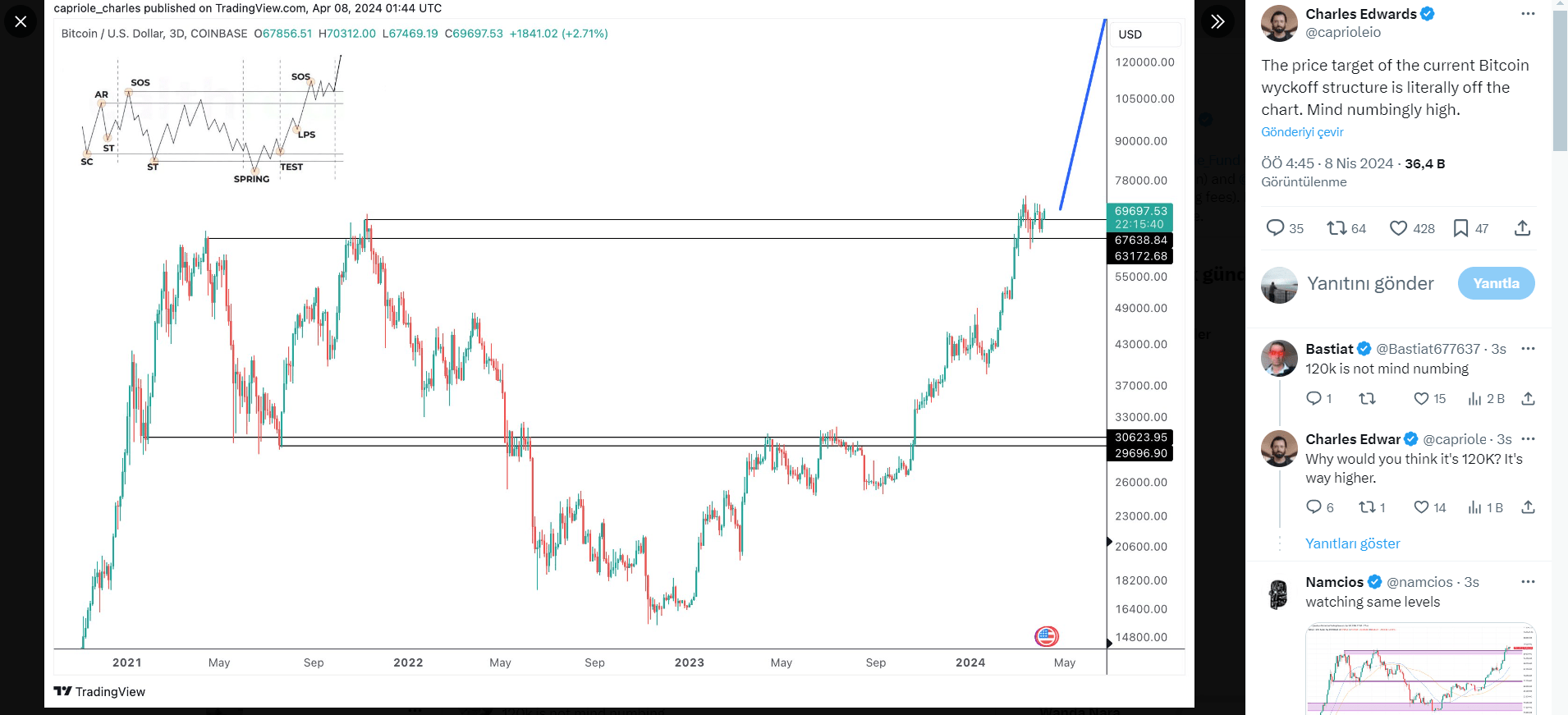

Market analysts predict that Bitcoin’s price may consolidate until the halving and could continue an upward rally to as high as $120,000 by the end of the year. These predictions also consider the significant accumulation of Bitcoin by prominent investors, the “Bitcoin whales.” In recent transactions, one of these whales purchased $90 million worth of BTC.

Levels to Watch for BTC

Analysts at CoinGlass anticipate a potential short squeeze for Bitcoin if prices surpass the $72,000 level. This scenario could prompt whales to protect or increase their holdings, potentially driving the price even higher.

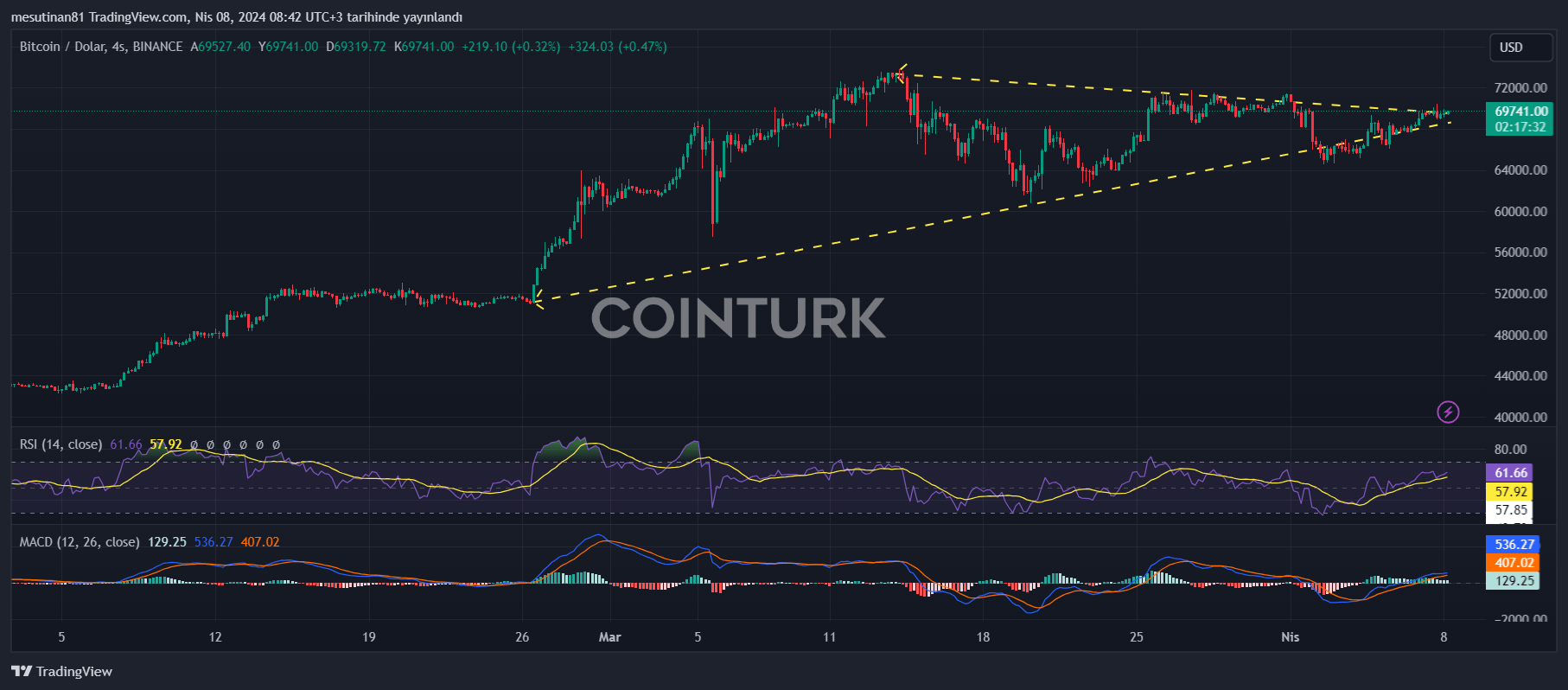

Bitcoin’s current price action is confined within a symmetrical triangle formation, reflecting the market’s uncertainty. A breakout above the triangle could signal an upward trajectory towards levels around $73,777 and possibly even $80,000. Conversely, a breakdown below the formation could lead to a decline towards the $59,000 level.

Türkçe

Türkçe Español

Español