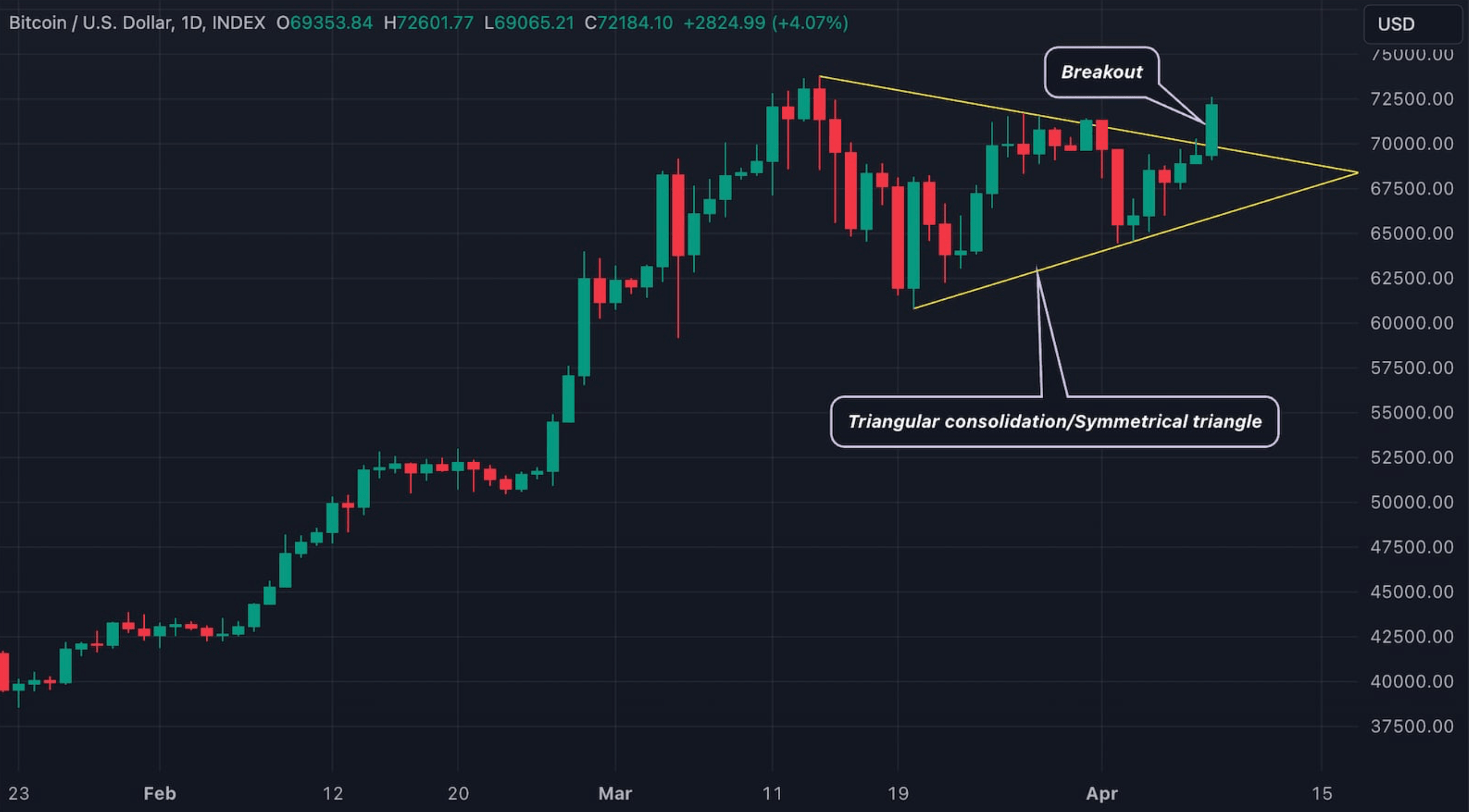

Bitcoin (BTC) has concluded its latest consolidation phase with a breakout that, according to 10x Research’s analysis, potentially paves the way for a rise to the $80,000 level. This price breakout came on the heels of stronger than expected US employment data.

Price Could Soon Reach $80,000

10x Research indicates that Bitcoin, the largest cryptocurrency by market value, has made a significant breakout from a symmetrical triangle consolidation formation. This was supported by a trend line connecting the key resistance levels observed between March 15 and March 27, and March 20 and April 3.

In technical analysis, market participants analyze price patterns to distinguish potential future trends in an asset’s price. The symmetrical triangle formation observed in Bitcoin’s price movement signifies a period of consolidation within a narrowing price range and is typically indicative of an impending breakout. Symmetrical triangles often result in a bullish breakout, as seen in Bitcoin’s recent price action, which can lead to increased momentum.

Markus Thielen, founder of 10X Research, shared his bullish outlook, predicting that if the breakout momentum continues, the price could surpass $80,000 in the coming weeks or even sooner. Thielen advised investors to consider taking a position at $69,280 in the event of a pullback and to set a stop loss at $65,000 in line with the expected upward trajectory.

The projected $80,000 price target represents a significant increase of at least 10% from Bitcoin’s current price of $72,300. This optimistic forecast is underpinned by positive indicators from the US economy, such as strong non-farm payroll data, which have catalyzed a market-wide optimism and risk-taking behavior, highlighting the strength and growth potential of the leading cryptocurrency.

Bitcoin Rises Alongside Various Asset Classes

Bitcoin’s recent performance reflects a market-wide trend characterized by simultaneous rises in various asset classes, including traditional stock indices like the Nasdaq and S&P 500, as well as commodities such as gold. This trend has been dubbed “the everything rally” by analysts.

The rise in Bitcoin is not only due to its unique value proposition but also the growth in the supply of major stablecoins, which provide additional liquidity and support to the cryptocurrency market.