Bitcoin, began the second week of April in classic bull market fashion, breaking through the $70,000 barrier. The largest cryptocurrency by market cap spent the weekend climbing, leveraging its gains to approach all-time high levels even closer. Market circles are already sensing more bullish expectations ahead of Wall Street’s opening, but can Bitcoin‘s price momentum deliver?

What’s Next for Bitcoin?

Bitcoin is wasting no time trying to reclaim the ground it lost below all-time high levels this week. The weekly close around $69,000 followed an unusual weekend where the BTC/USD pair rose slowly despite the absence of institutional players. However, the real movement came later, and the Asian trading session witnessed a sudden surge in volatility; at the time of writing, Bitcoin had peaked at $72,573.

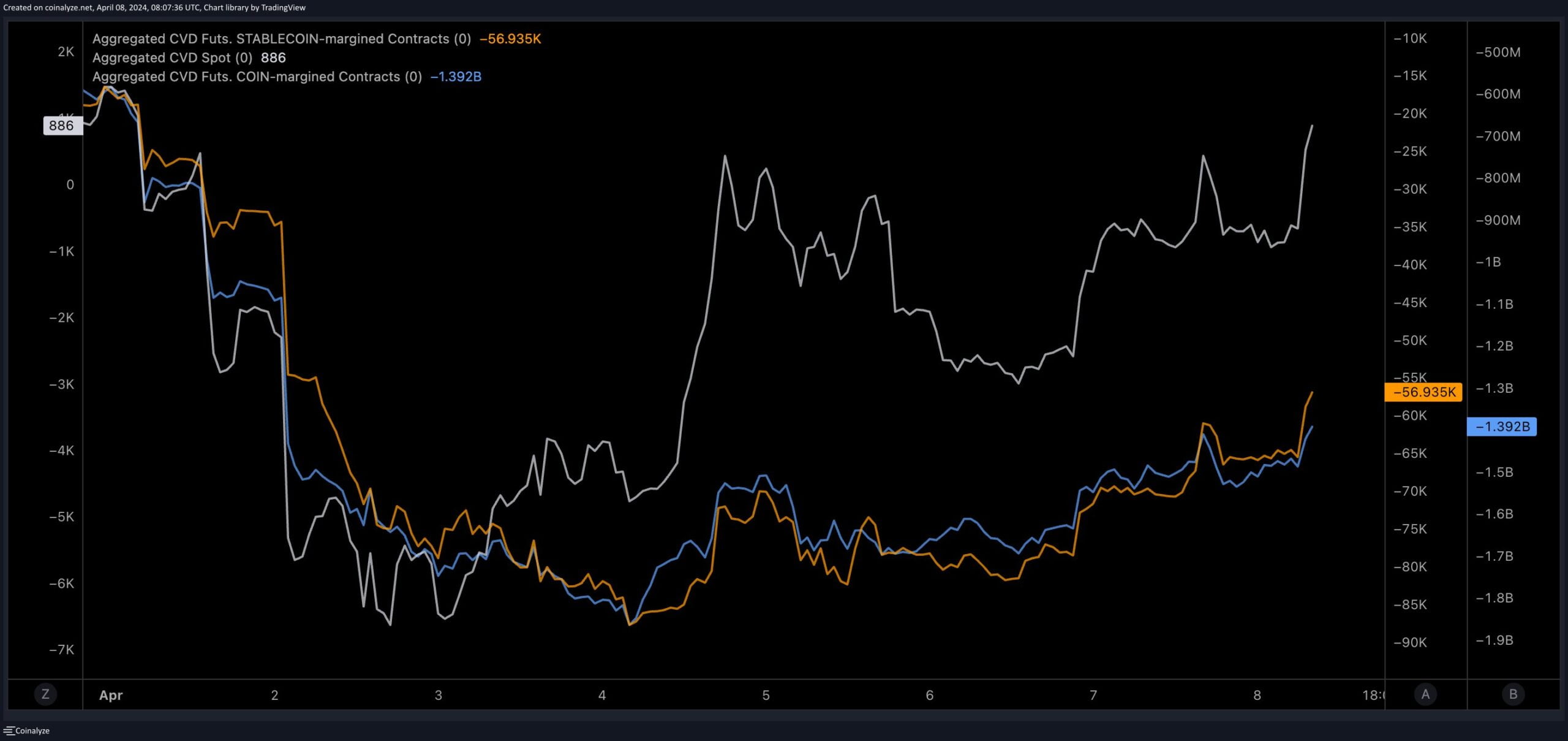

For many well-known market observers, flows from the spot market to the futures market are crucial for maintaining the upward momentum. Popular investor Skew noted that the $70,000 level was contingent on continued interest. A chart showing the Bollinger Bands volatility indicator included the following statement:

“Volatility continues to be moderate in the HTF picture, so $2,000 price volatilities are expected. If we see a price squeeze towards the end of Monday, we’re approaching the band compression zone. At least for the near term, we need to see increased buying volume and spot flows this week to stay above $70,000.”

Analysts Offer Noteworthy Comments

Investor and analyst Crypto Ed suggests that a very clear flag pattern currently present on daily timeframes could offer a pullback to $68,000 before new highs. The prominent figure shared the following via X:

“If we experience this pullback and reach a higher low, brace for a move towards $80,000.”

Furthermore, two recent gaps in the Bitcoin futures market on the CME Group platform, currently around $64,000 and $68,500, were also on the radar as they appeared over the weekends with price movements. Investor Daan Crypto Trades commented along with a chart:

“They tend to be self-fulfilling prophecies if enough people watch them and act in a way that causes the price to close the gaps. The moment the price moves away and people stop caring is often when it has lost most of its value.”