XRP has lagged behind Bitcoin in terms of price performance so far in 2024, with a roughly 2.5% drop since the beginning of the year compared to the leading cryptocurrency’s 60% gain in the same period. In contrast, the XRP/BTC pair has experienced a 40% decline since the start of the year. However, the pair is showing signs of recovery in the days leading up to Bitcoin‘s 2024 halving event.

What to Expect on the XRP Front?

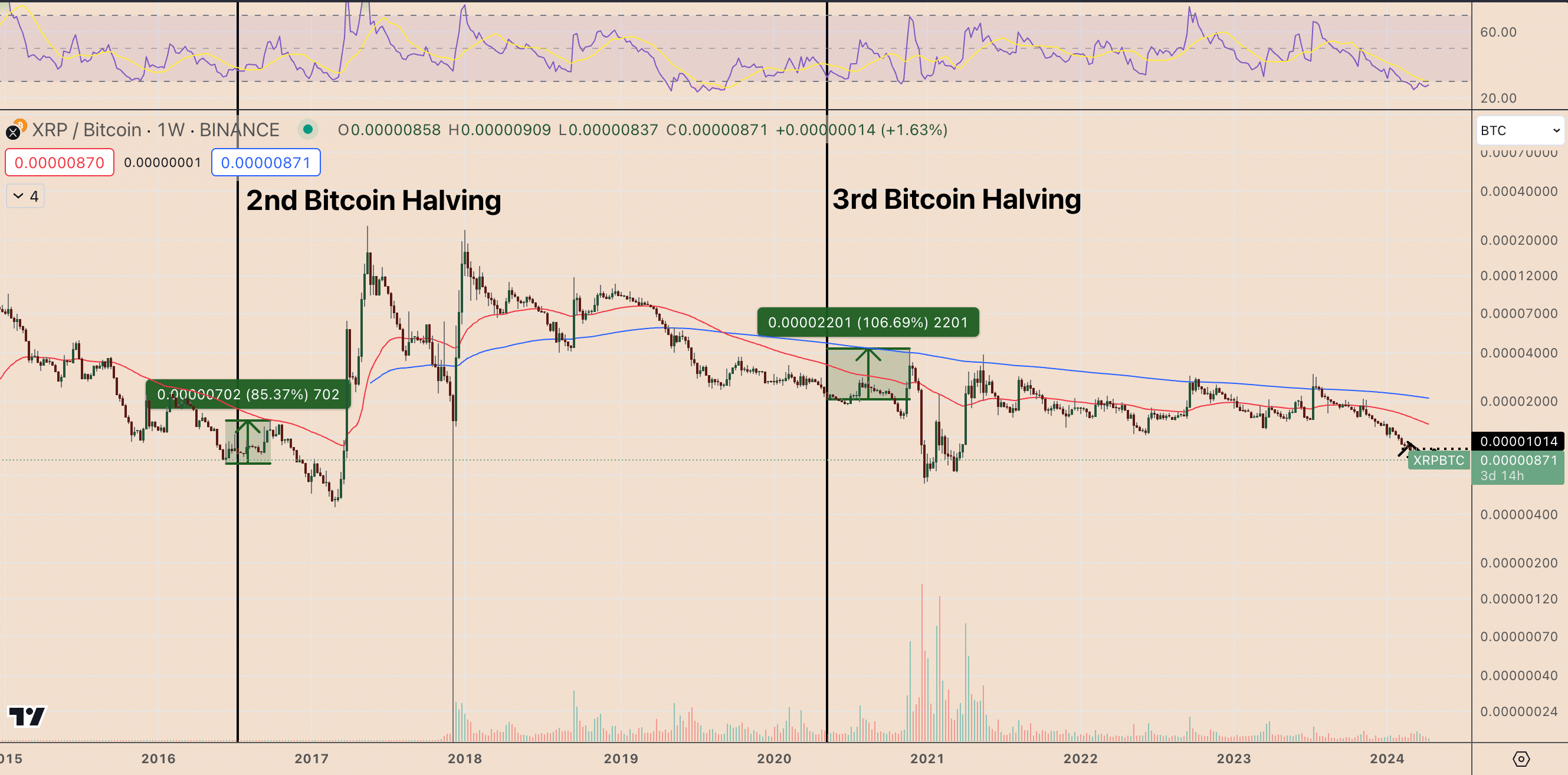

Historically, XRP has tended to outperform Bitcoin during periods surrounding halving events. For instance, the XRP/BTC pair surged over 100% following Bitcoin’s third halving event in May 2020. Similarly, during the second Bitcoin halving event in July 2016, the pair saw an 85% increase. These patterns raise the likelihood of XRP outperforming Bitcoin following the halving event on April 19th.

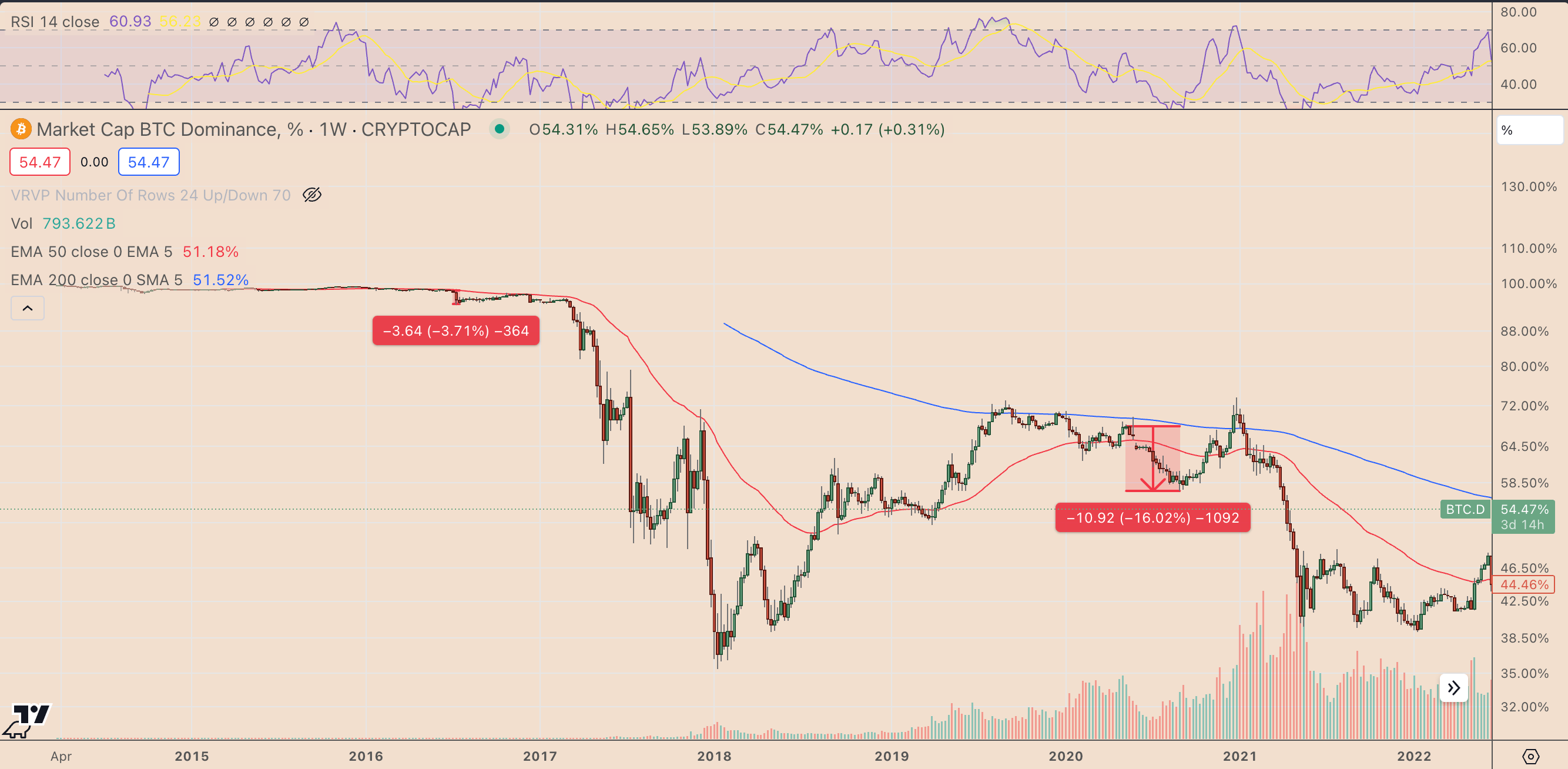

XRP/BTC gains are largely due to a decrease in Bitcoin’s dominance following selling pressure. This trend indicates that investors often shift their investments from Bitcoin to altcoin projects after such events, typically initiating a period known as altseason.

One reason for this is that altcoin projects offer significant short-term gains due to their lower market values and higher volatilities compared to Bitcoin.

XRP/BTC Chart Analysis

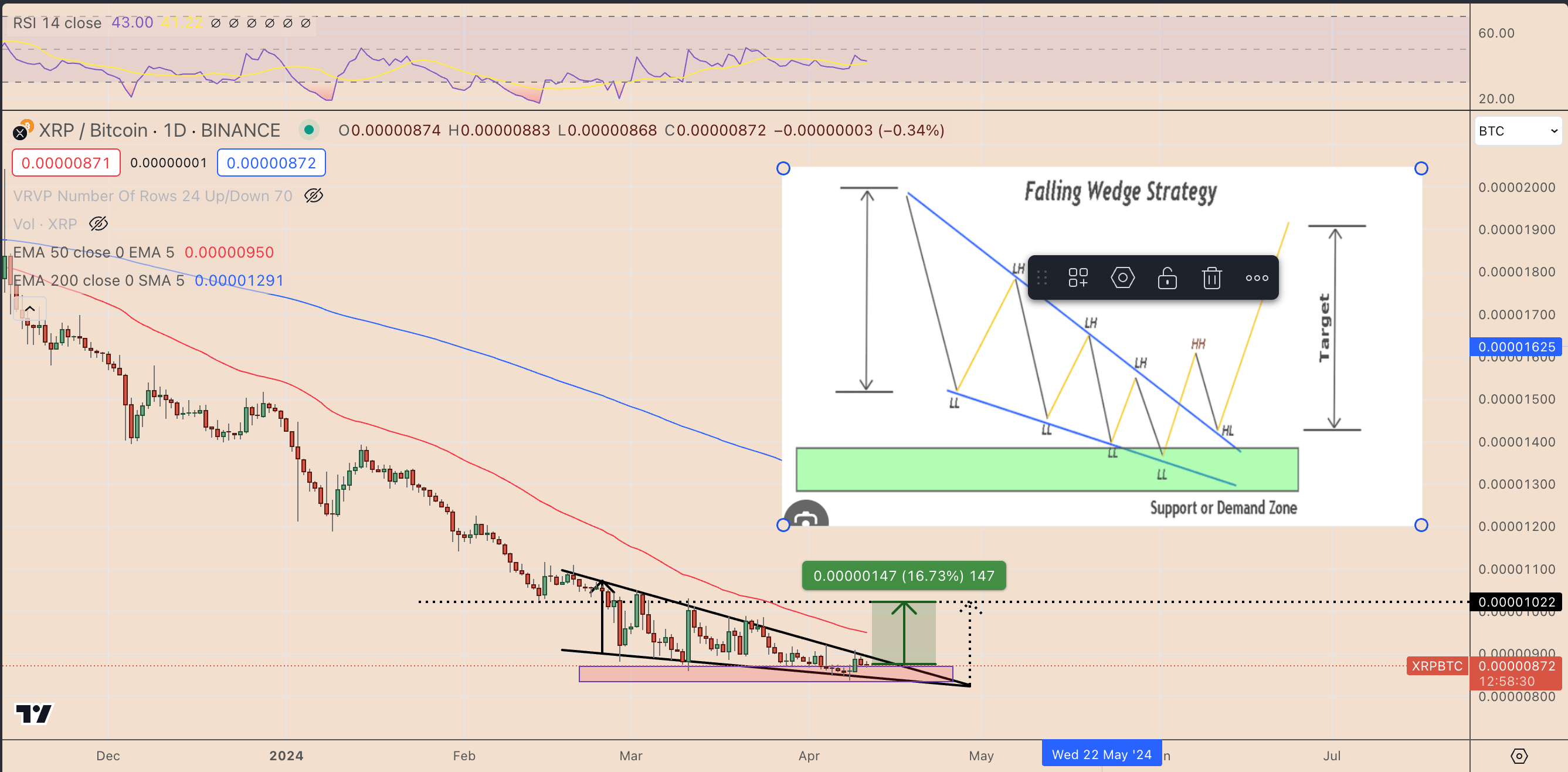

XRP/BTC pair has been moving within a falling wedge formation characterized by two descending, converging trend lines since February. A falling wedge formation is typically known as a bullish reversal trend that resolves after the price breaks above the upper trend line and rises to a length equal to the maximum distance between the upper and lower trend lines. Applying the same technical analysis rule to the ongoing XRP/BTC pair suggests a breakout target of approximately 0.00001022 BTC, a 16.75% increase from current levels, for April/May.

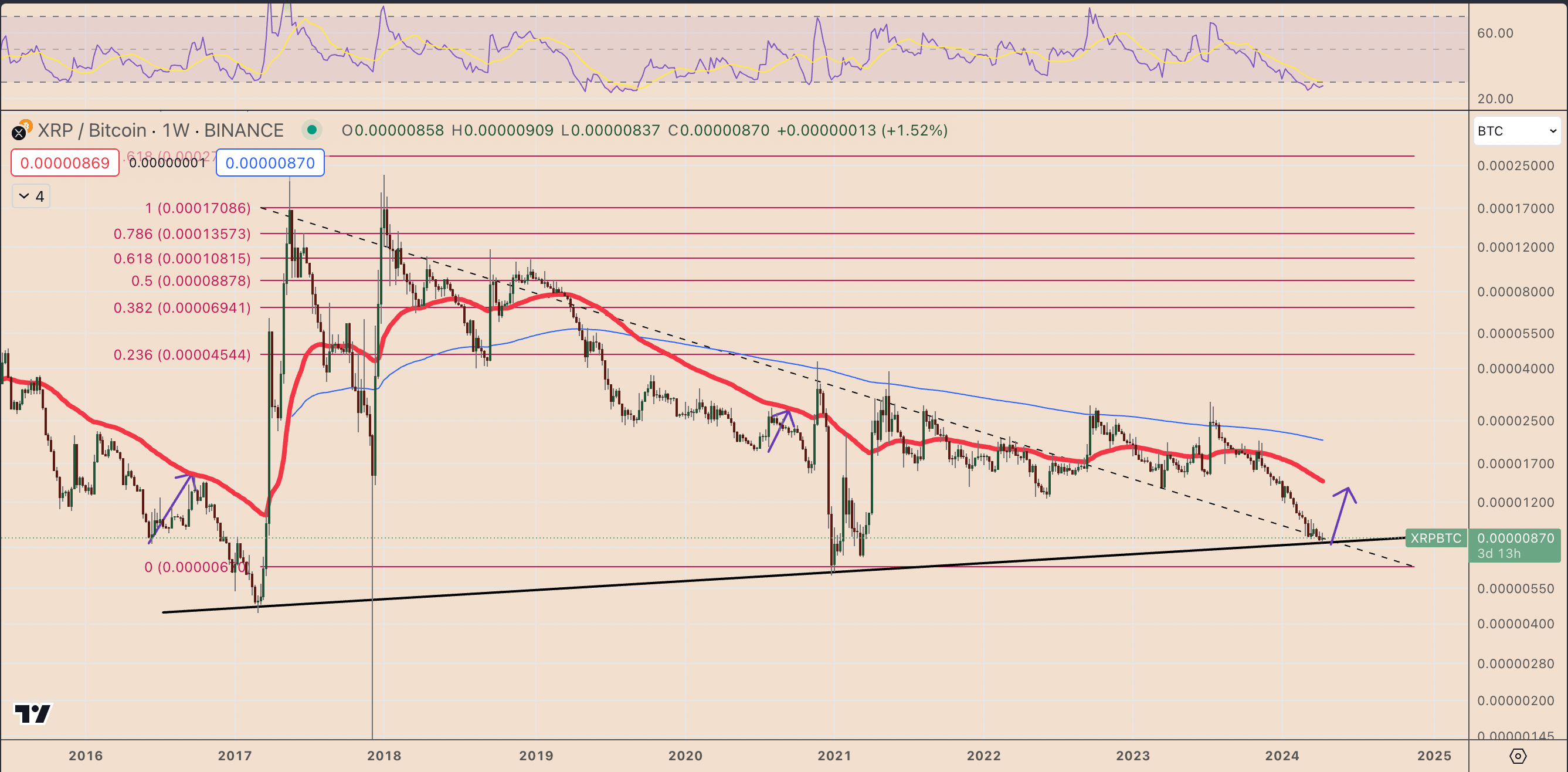

In the 2024 outlook on a weekly timeframe, XRP’s price target against Bitcoin is expected to reach the 50-week EMA level of 0.00001449 BTC, indicating a significant 70% increase from current price points by June. This is particularly notable as investors have consistently focused on the same 50-week EMA level as a bullish target following the previous two Bitcoin halving events.

Türkçe

Türkçe Español

Español