Bitcoin and other cryptocurrencies have recently gone through a significant drop. When Bitcoin suddenly reached the $65,086 mark, the decline in altcoins was particularly harsh. Analyst Michael van de Poppe commented on the drop, advising to buy at these lower levels, provided that one has some cash on hand.

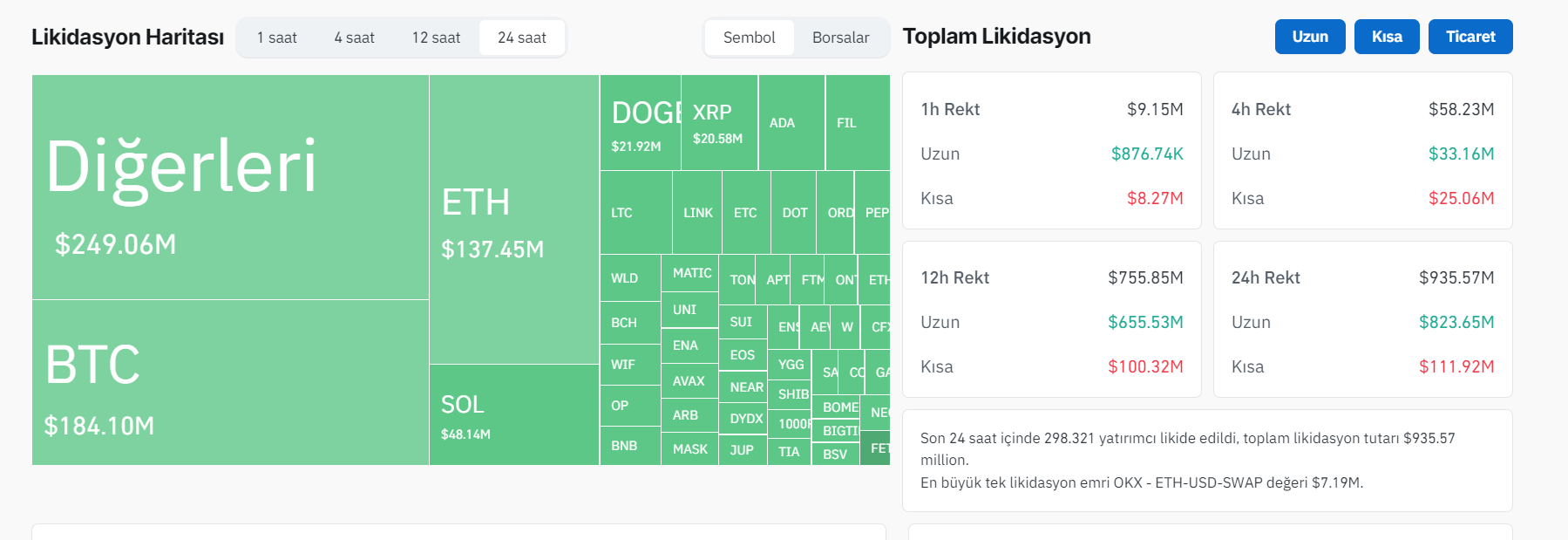

$935 Million Wiped from Bitcoin and Cryptocurrency Markets

According to Coinglass data, the recent sharp decline led to 298,320 investors liquidating their positions in the last 24 hours, totaling $935 million. Comments from an analyst followed the steep drop.

Crypto market analyst closely followed by the community suggests that Bitcoin (BTC) is in an accumulation phase before its next rise. Michael van de Poppe, with 711,500 followers on a social media platform X, indicates that gold and BTC are heading towards their all-time high levels.

According to him, Bitcoin appears to be in an accumulation phase before the next breakout. Gold continues its ascent towards new all-time highs. As this article is being written, BTC’s value is at $67,654.

Special Emphasis on Two Altcoins

Crypto currency analyst Van de Poppe highlights Polkadot (DOT), stating he will soon add DOT to his portfolio and comments:

“Here we go. DOT has reached a low cycle level due to Bitcoin’s influence. I believe a rotation is near; there’s fundamental progress. I am pleased to add it to my portfolio.”

At the time of writing this news, DOT‘s value is trading at $7.29, down 14%. Lastly, Van de Poppe evaluates Synthetix (SNX), a decentralized finance (DeFi) crypto that allows for the creation of synthetic assets on Ethereum (ETH). According to the analyst, SNX is currently showing little to no momentum against BTC. The analyst’s comment is as follows:

“There’s downward momentum and continuity here. Breaking above 6000 satoshis would indicate the presence of a strong force. For now, I can say the momentum is very low. ETH needs to move first, then this will follow.”

SNX‘s value at the time of writing this article stands at $3.24, with a 16% loss in value.