Cryptocurrency traders should know that leveraged trading carries the risk of losing all their savings. You will remember yesterday and tonight. The deep red candles in Bitcoin and altcoins were such that we somewhat expected the declines to be annoying. When Coinglass revealed data showing nearly $1 billion in liquidations, we saw how significant the downturn was.

Leveraged Trading in the Crypto World

In the world of cryptocurrency, if you are spot trading, you can find solace in downturns with the saying that you are not at a loss until you sell your assets. At worst, you wait here. When the market rises, you recover your losses and then sell when you are in profit.

However, with leveraged and futures trading, the game changes. Depending on your position in downturns or upswings, you are constantly on edge. You can’t sleep peacefully. Fear of being liquidated keeps your mind fixated on ongoing prices. You can’t take your eyes off the screen. Eventually, this can lead to a deterioration in your health. In the pursuit of making money, you might end up losing your health as well.

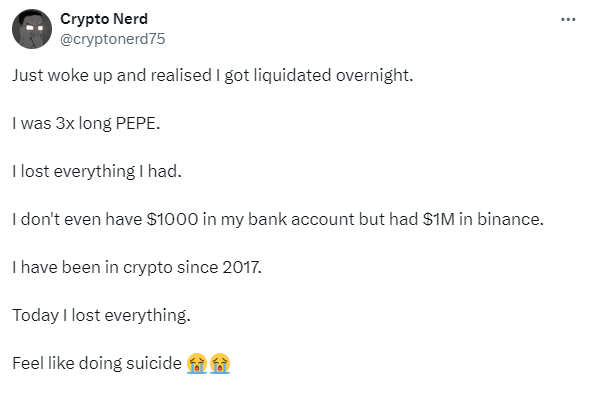

PEPE Investor Loses Entire Savings

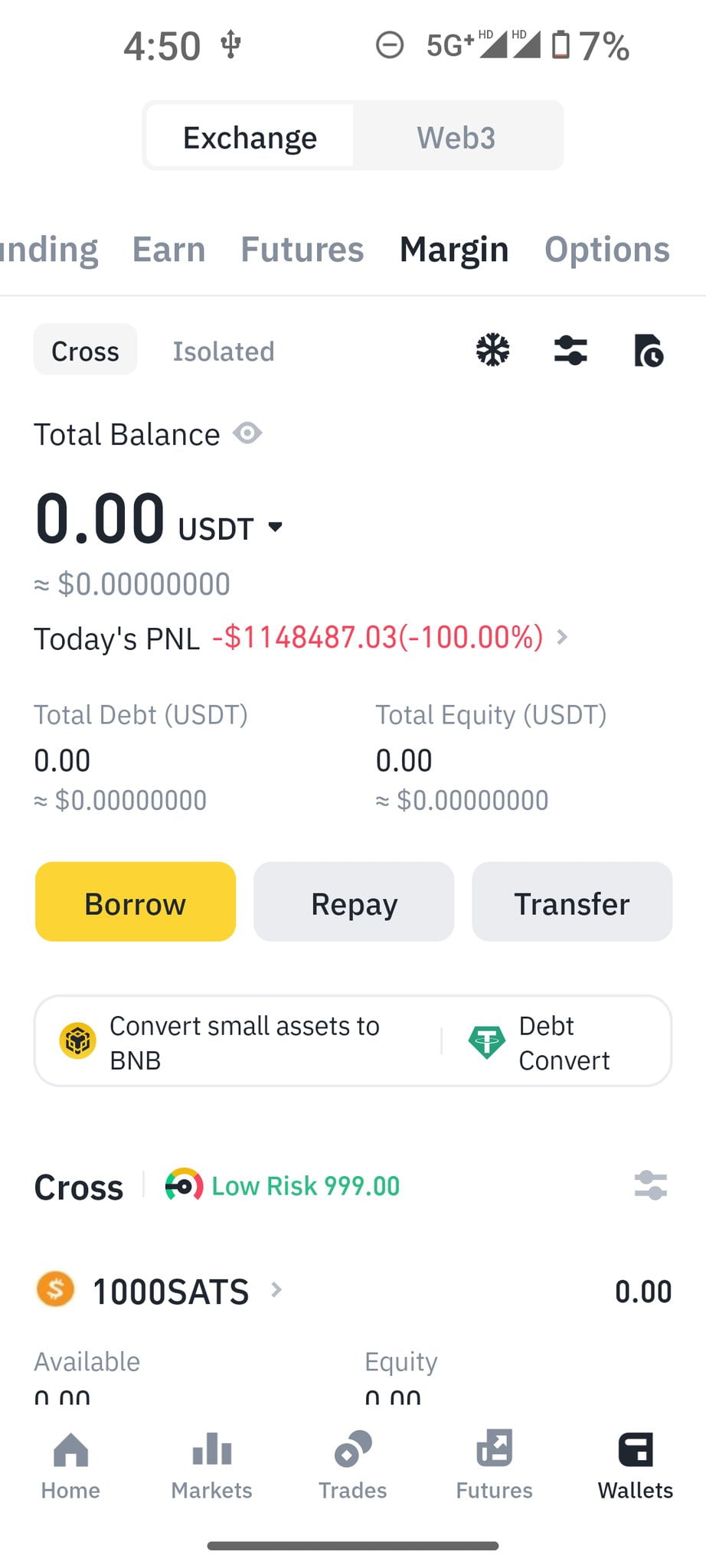

Today, we witnessed an example that unfolded just as I described above. A trader, who took a 3x long position in PEPE, shared his experience. When the trader woke up in the morning and looked at the screen, his eyes probably widened in shock. He faced the bitter reality of being liquidated overnight.

The trader says he lost everything. What’s more painful is that he mentions not even having $1,000 in his bank account. All his money was in Binance. Look at the amount liquidated: just over $1.1 million. He says he has been in the cryptocurrency field since 2017, for 7 years. The last sentence is very meaningful. He says he feels like he has committed suicide.

Seeing this statement, I can’t help but think that those who open leveraged trades should perhaps think a hundred times over. At the end of the day, there’s nothing to gain. We see an example where excessive ambition and greed result in damage and failure. Just ask yourself this question: What would have been the outcome if this trader had done spot trading in cryptocurrencies instead of leveraged trading?

Türkçe

Türkçe Español

Español