Bitcoin price continues its zigzag path, with high volatility in the last 24 hours causing investor anxiety. They have good reason to be nervous, as everyone vividly remembers the impact of the war between Russia and Ukraine on the markets. The big day is tomorrow, and the latest news indicates that tensions have not yet subsided.

Monday in Cryptocurrency Markets

In a few hours, global markets will start to open, and investors will witness the true scale of volatility. Iran’s attack initiated 24 hours ago caused almost no damage to Israel. Nearly all missiles and drones were destroyed in the air, and now the focus is on Israel’s response to this unsuccessful assault.

Although Iran mentions no further missile launches to reduce tensions, Israel’s situation is different. According to recent reports, the war cabinet has approved defense/attack plans for an unspecified duration. Some sources suggest a response within 48 hours, but the military spokesperson did not mention such a detail in the latest statement.

Crypto Predictions

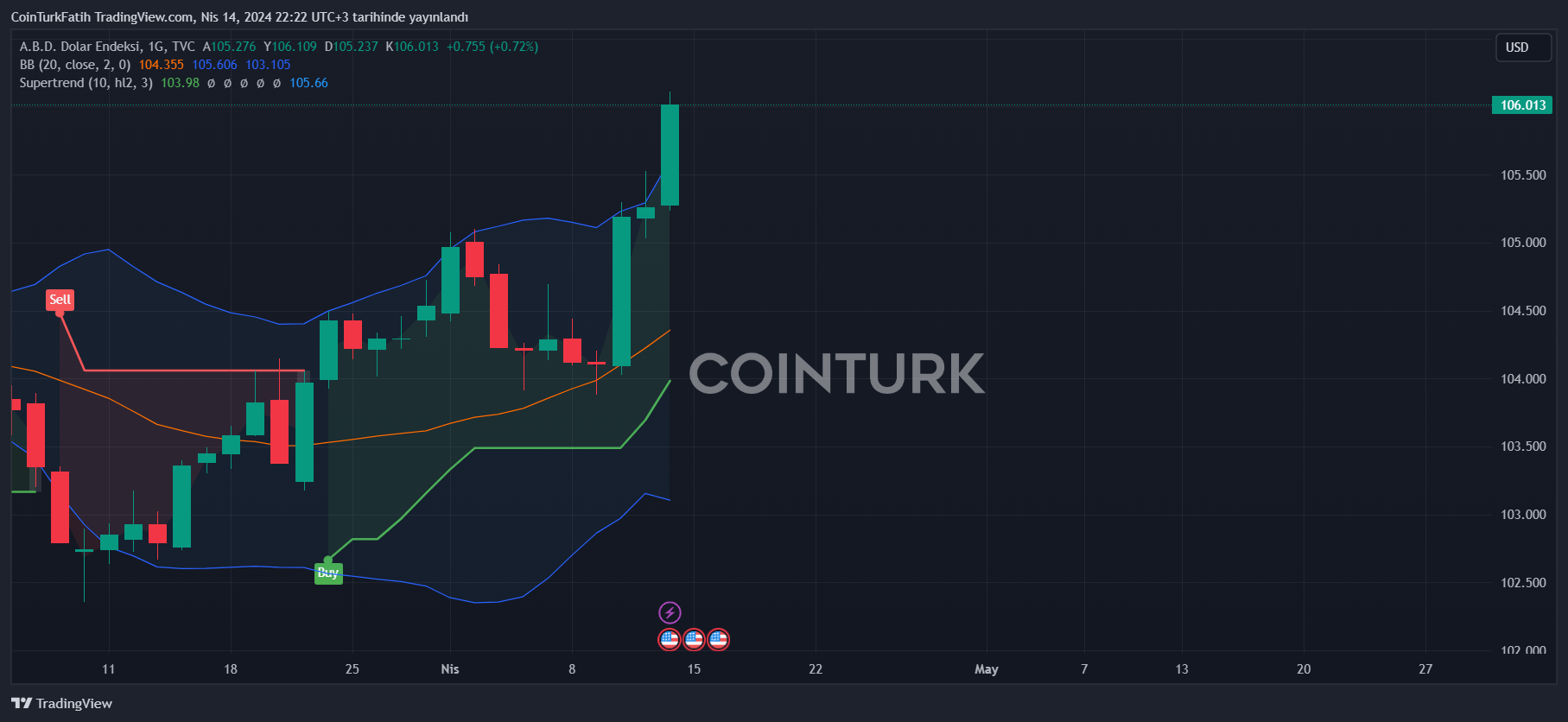

US and other markets are closed. Approximately 17-18 hours from now, the US stock markets will open. Investors are looking at Bitcoin prices to see what Monday holds for them, as the market turmoil at the close of Friday suggests a challenging day ahead. While gold-linked stablecoins have surpassed the $2400 level, the melting price of BTC indicates a potentially tough day tomorrow.

In a feared scenario, the US market opening could lead to voluminous sell-offs in spot Bitcoin ETFs. This situation could cause a drop in the spot price of cryptocurrencies similar to what we experienced on March 20th. The rise in gold-indexed tokens and the fall in BTC suggest that losses in the stock market are also likely.

Moreover, we will hear statements from Fed members throughout the week. The negative impact of the conflicts between Russia and Ukraine on inflation is well known to us. Now, with the onset of war in Iran, the expected rise in oil prices and increased shipping costs could further unsettle Fed members. If Fed members declare the heightened tensions of the past 48 hours as a serious threat to the fight against inflation, it could trigger a second major downturn in risk markets.

And of course, we cannot see the future. In a few hours, the parties may step back, and negotiations for a diplomatic resolution of the issues could begin. The crypto world used to be full of surprises, and now the entire world is.

Türkçe

Türkçe Español

Español