Pepe failed to defend the $0.00000581 level for the second time and suffered a loss close to 50% over the past five days. Most of these losses occurred between April 11 and April 13. Volatility can catch investors off guard, but it can also present an opportunity. PEPE rebounded by 33% from its lowest levels seen on April 13 in about 32 hours.

What’s Happening with the Popular Memecoin?

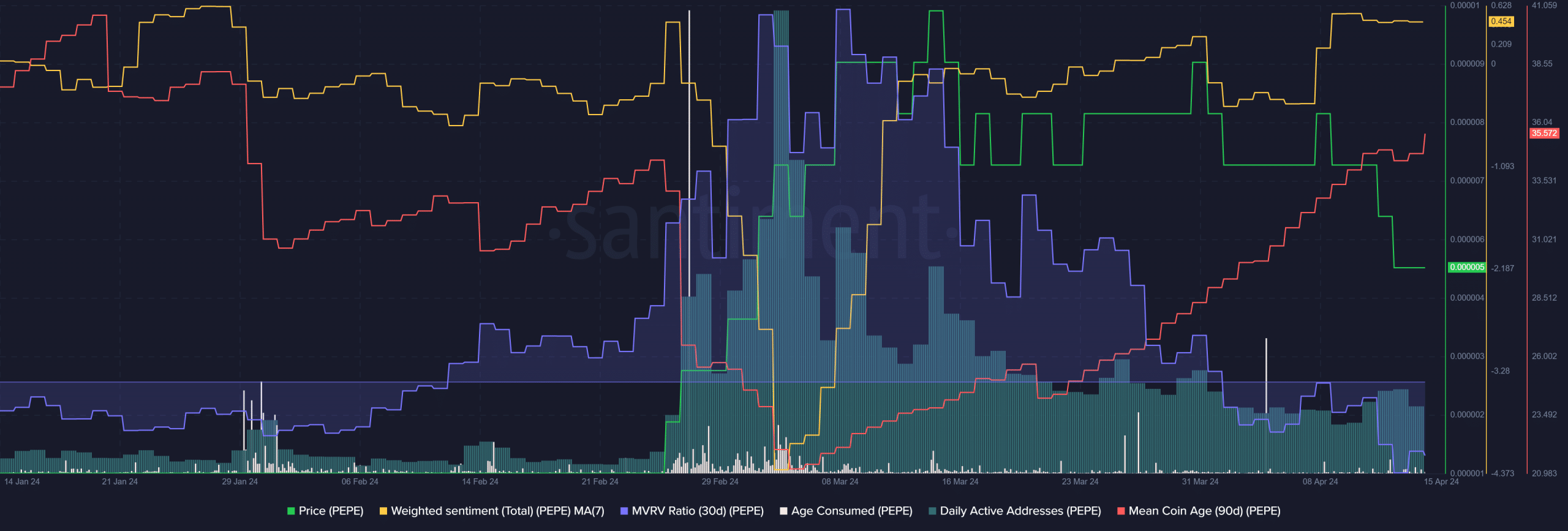

Since mid-March, the popular memecoin has been tracking the gains it made at the end of February. Despite the losses on the price chart, the average token age is trending upwards. This indicates that investors in the ecosystem are accumulating PEPE. This process is also supported by consumed age data. There was a significant rise on April 4, and two major increases on March 26 and 27. These developments are important in terms of investor support, but they were not as consistent as the movement we saw at the beginning of March.

This development means that while some asset holders are panic selling, many other investors continue to hold on despite the losses. The 30-day MVRV is negative, indicating increasing investor losses. However, the negative MVRV aligns with the average token price and is drawing attention as a buying signal. The seven-day weighted sentiment is positive, which is surprising after these recent developments. Technical analysis still suggests the possibility of a larger downturn.

Noteworthy Data for PEPE

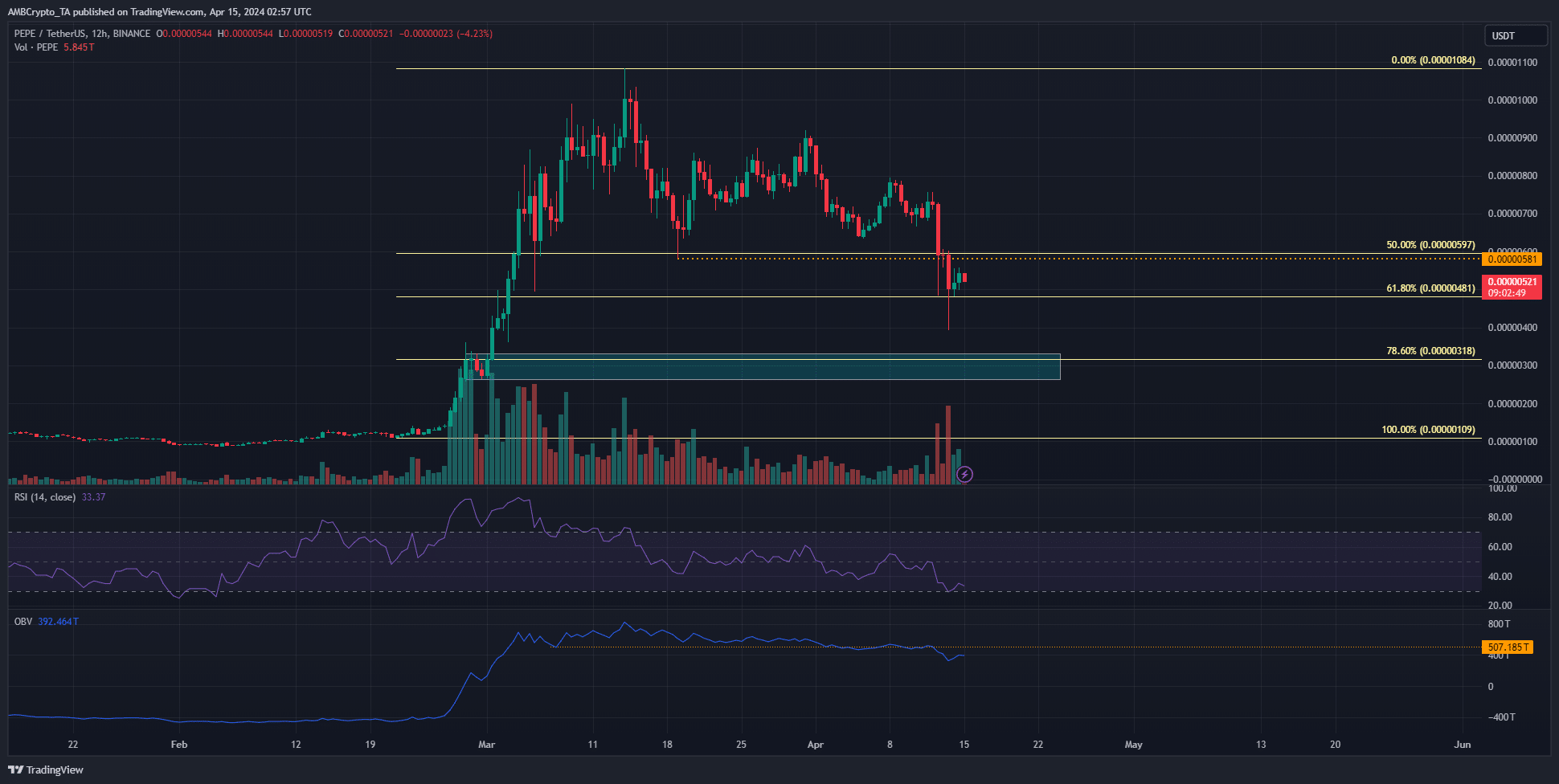

PEPE chart showed a new decline after retreating to $0.00000581 on March 19. The recent drop in PEPE indicates that the shorter-term trend and market structure are bearish. However, the 12-hour chart still shows an upward trend.

The RSI indicates that downward momentum is dominant, and an average RSI of 33 is noteworthy. Moreover, the OBV has fallen below a month-long support, suggesting further losses are expected in April. This shows that the popular memecoin has reached a 78.6% retracement level at $0.00000318.

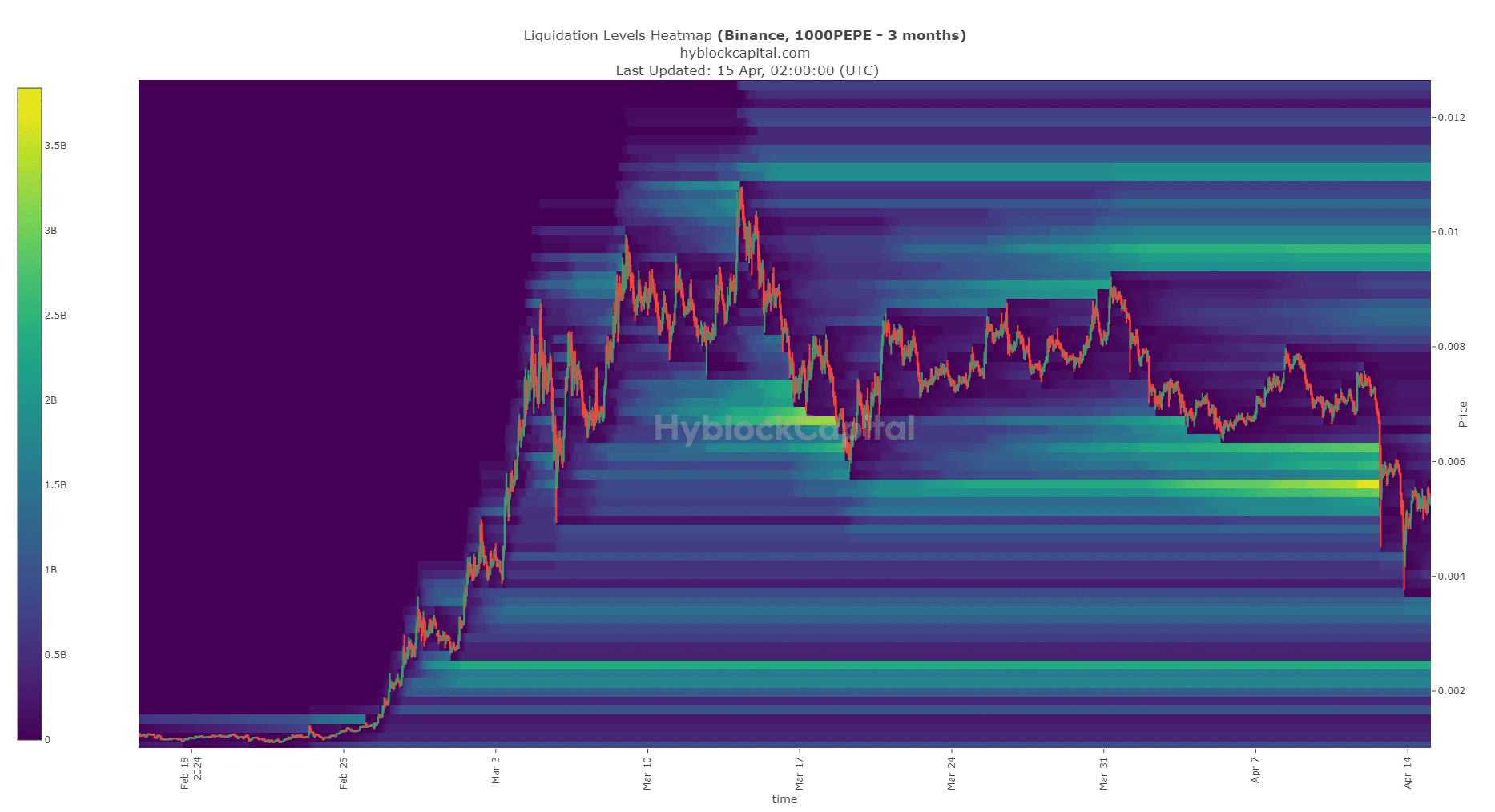

Liquidation data shows sparse liquidation levels above current market prices. The next magnetic zone for support levels is $0.00000245. However, if Bitcoin reaches a local bottom, PEPE could rise further. Therefore, the $0.00000955 area is also a magnetic zone in the short term, but being 85% higher than market prices is questionable considering market uncertainty. Overall, the data indicates this could be a good short-term buying opportunity for PEPE investors.

Türkçe

Türkçe Español

Español