Tether CEO Paolo Ardoino believes that Ripple‘s initiative to launch its own stablecoin could add more legitimacy to the stablecoin environment. Speaking exclusively during the Paris Blockchain Week event, Ardoino mentioned that the stablecoin ecosystem needs healthy competition among major players to further legitimize the use of fiat-backed tokens in the eyes of regulators.

Insightful Comments from Ardoino

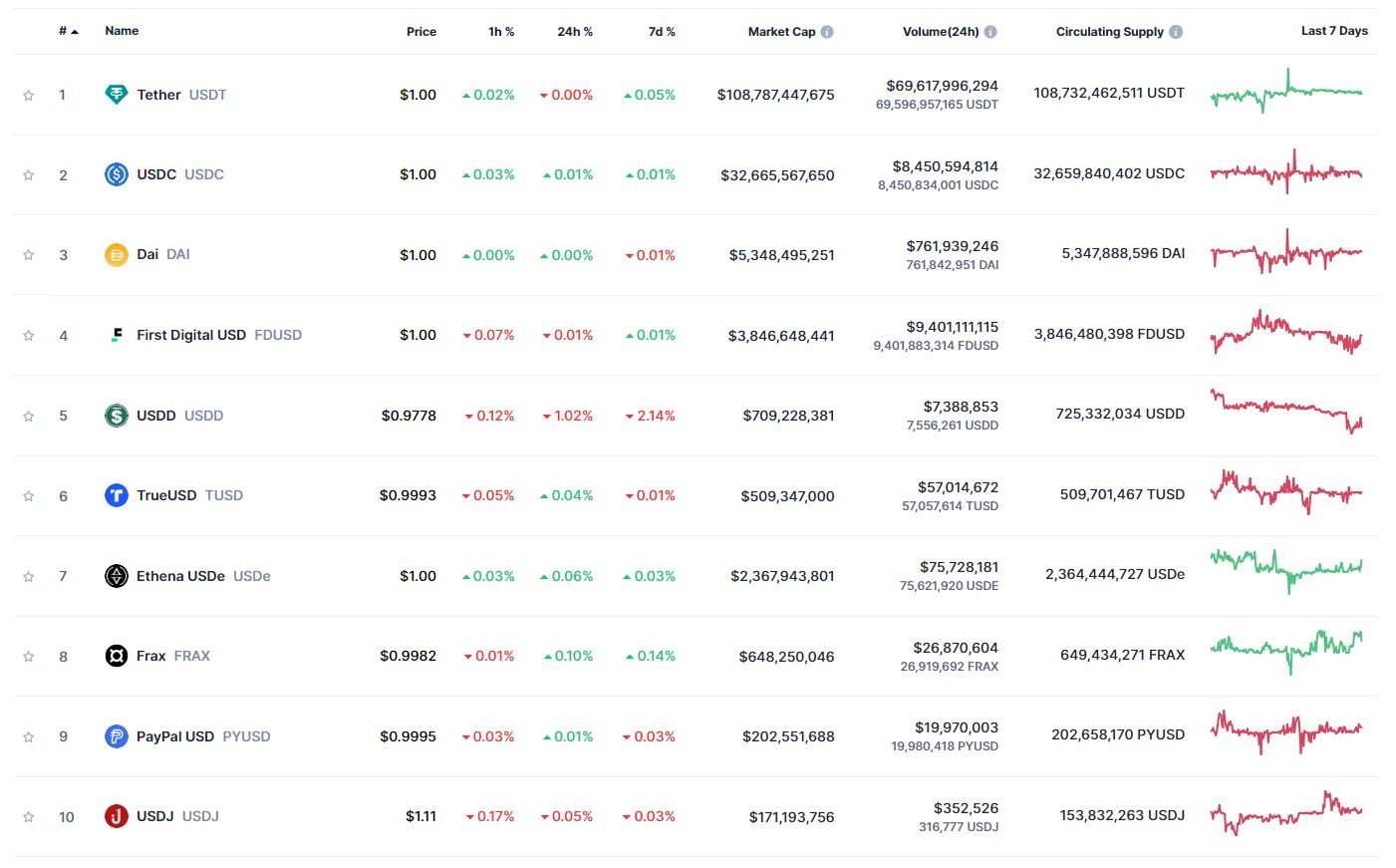

Stablecoin projects are increasingly becoming a crucial part of the broader cryptocurrency space. By April 2024, stablecoin projects with a total market value exceeding $130 billion are providing a wide range of benefits, from centralized exchanges to decentralized finance (DeFi) protocols.

Ardoino said that having multiple reliable players who can sustain and grow their stablecoin projects reflects the increasing importance of the sector, and he used the following words to elaborate on the issue:

“Being multi-player helps in discussions with regulators. If you are completely alone and have only one product, regulators will never take you seriously. If you have a group of great companies, then you become more effective.”

Ardoino also believes that Ripple’s intention to launch a stablecoin by the end of 2024 shows how much room there is for more players to offer legitimate fiat-backed tokens. Tether is the leading stablecoin with a market value of $108 billion as of April 17th. USD Coin follows with a market value of $32 billion, ranking second after USDT.

Crypto Market and Financial Sector

Ardoino; believes that the increasing adoption of stablecoin projects like USDT and USDC is a direct result of widespread inflation and the devaluation of national currencies worldwide:

“Consider Argentina, Turkey, Venezuela, Vietnam, or Brazil. All these countries are looking for alternatives to their national currency. Inflation is skyrocketing in these nations.”

The prominent figure added that over 2 billion people worldwide do not have a bank account and live on less than $300 a month. This results in many people being unbanked and unable to transact in traditional economies. The increasing accessibility of crypto wallets means that people can increasingly save in cryptocurrencies like USDT or USDC. As Ardoino said, the simplicity of these offerings reflects the grim reality of the global economic landscape:

“USDT’s crypto dollar is not fancy at all, it simply exists on a blockchain. The sad reality is that the success of stablecoin projects is also directly proportional to the macroeconomic issues occurring in the world.”

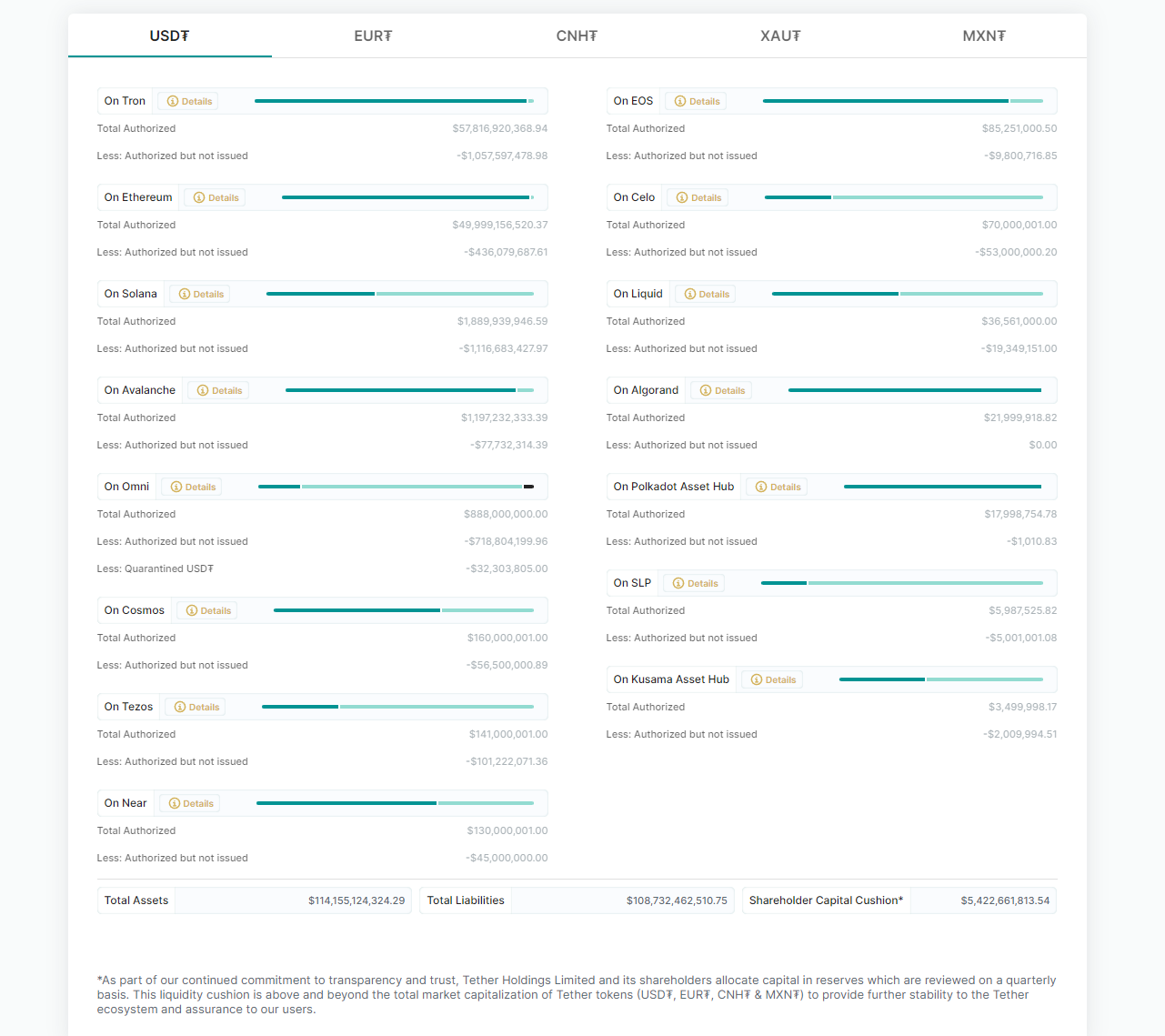

Ardoino argues that the circulating USDT is over-collateralized by 106%. Tether is also planning to move towards 100% reserve in U.S. Treasury bonds. Currently, it holds an estimated $90 billion in Treasury bonds.

Türkçe

Türkçe Español

Español