Fetch.ai (FET) price is shaking due to the recent corrections that wiped out significant gains in the cryptocurrency market. While there is a chance for recovery in the cryptocurrency unit, FET may not regain all profits as it heads for consolidation. Fetch.ai’s price has experienced a significant drop over the past few days, naturally causing investor concern.

The Effect of Crypto Decline on FET

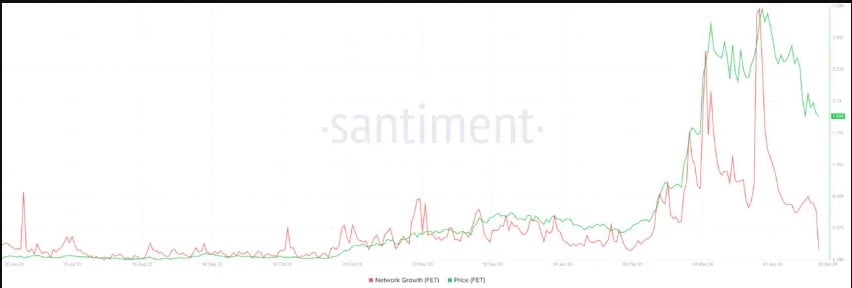

The overall market downturn has also deterred many potential investors. This can be seen in the decline in network growth. Following the corrections, the indicator fell to its lowest level in several months. Network growth is calculated by the formation of new addresses and participation in the network. A similar level of decline could indicate that Fetch.ai is losing its traction in the market and may create downward conditions.

Moreover, some investors in the network may not show resistance due to the market giving a sell signal. Based on the difference in daily active addresses (DAA), this signal only shines when price and participation move in opposite directions or both are in a downtrend. The situation in FET is the observation of old conditions that could potentially trigger sales among investors.

Uncertainty in FET

Fetch.ai’s price, trading just below the $2.00 level at $1.93, may witness consolidation due to mixed signals from the market. The upcoming halving event indicates an expected rise in Bitcoin prices, which will inevitably affect altcoins as well. However, the lack of investor support could create downward conditions.

Consequently, Fetch.ai’s price might move sideways instead of sticking to either scenario. This consolidation could be within the range of solid resistance and support levels of $2.26 and $1.71 respectively. Breaking these limits could lead to an upward or downward trend, invalidating the current neutral thesis. Fetch.ai (FET) price has been shaken by market corrections, entering a consolidation process and reducing the likelihood of regaining all profits. Falling prices and declining network growth are increasing investor anxiety. Specific levels of price consolidation are expected, but breaks in support and resistance could change the trend.